Record electricity prices are damaging Europe’s attempts to build its solar and battery sectors, as manufacturers face mounting costs, warns Rystad Energy.

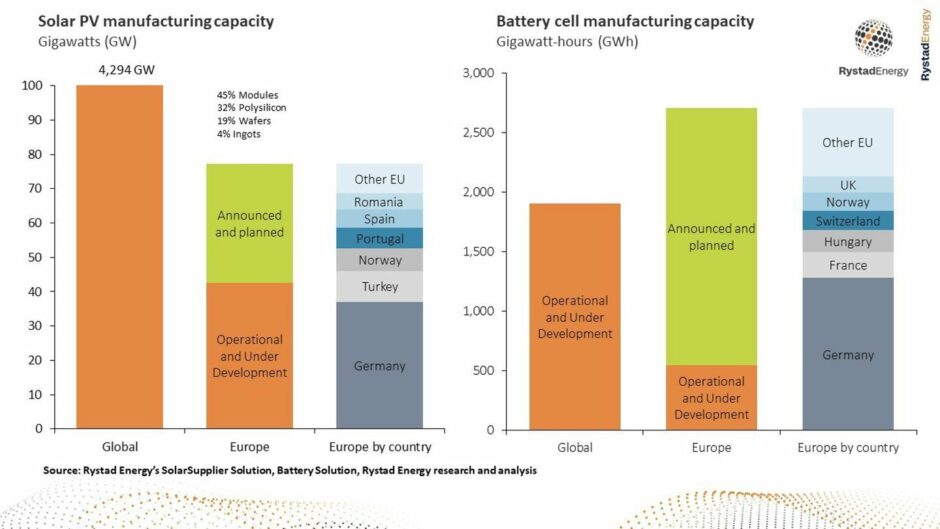

The Oslo-based analysts report that 35 gigawatts (GW) of solar PV manufacturing and more than 2,000 gigawatt-hours (GWh) of battery cell manufacturing capacity could be shuttered unless power prices recede.

As in many energy-intensive sectors of the economy, the high cost of power is forcing some manufacturers to temporarily close or abandon production facilities, with analysts warning the bloc’s plans to reduce its reliance on imported fuels could be “derailed” unless these costs come down.

Daily average spot power prices in Germany – the European leader in solar and battery cell manufacturing capacity – have surpassed €600 per megawatt-hour (MWh), while rates in France have risen above €700 per MWh.

At times prices have spiked as high as €1,500 per MWh, and although average rates have fallen significantly, they remain in the €300 to €400 range “many multiples” above pre-2022 norms where stable power prices of €50 per MWh could be relied upon.

“High power prices not only pose a significant threat to European decarbonization efforts but could also result in increased reliance on overseas manufacturing, something governments are eager to avoid,” noted Rystad Energy’s head of energy service research Audun Martinsen.

“Building a reliable domestic low-carbon supply chain is essential if the continent is going to stick to its goals, including the REPowerEU plan, but as things stand, that is in serious jeopardy.”

Meanwhile, manufacturers in other regions such as Asia, enjoy lower electricity tariffs, meaning European producers are becoming “increasingly uncompetitive” by comparison, they warned.

Europe’s solar manufacturing capacity accounts for only 2% of global capacity but any shutdowns would have significant long-term consequences for the local market.

It also puts the EU’s target to establish 20 GW of production capacity by 2025 increasingly at risk.

At the same time, battery cell manufacturing needed for both electric vehicles and energy storage supply chains is even more energy intensive.

The EU currently holds around 550 GWh of capability, around 27% of global operational capacity.

Projects under development would push this to 2.7TWh, positioning the EU as a global leader – yet again high power prices put these plans at serious risk.

Britishvolt’s signature 30GWh factory in Blyth in the UK has already been delayed to mid-2025 due to rising energy costs and the need for additional fundraising – a trend that could continue across the continent.

“Depending on how long elevated power prices continue, a slowdown in EV adoption in Europe could follow,” Rystad noted.

© Supplied by Rystad Energy

© Supplied by Rystad Energy