South Africa will bail out Eskom with a commitment to providing 254 billion rand ($13.97bn) over the next three years, as power outages reach unprecedented levels.

Finance Minister Enoch Godongwana set out the 2023 budget today, in Cape Town. Eskom has 423bn rand ($23.25bn) in debt.

Godongwana said the government would provide 168bn rand ($9.23bn) in capital, with another 86bn rand ($4.73bn) for interest.

The Treasury has said it is impossible to disentangle Eskom’s power problems from its debt load. An Eskom official put load shedding at 7,045 MW yesterday – which would suggest technically Stage 7. On February 19, the company reported that 21,243 MW of power generation was unavailable because of breakdowns.

Bailing out

The government has provided 263.4bn rand ($14.47bn) since 2008 in bailouts to Eskom.

There are government guarantees for 350bn rand ($19.23bn) of Eskom’s debt. This creates “a contingent liability that raises South Africa’s risk premium and borrowing costs”, Treasury said. This guarantee ends on March 31.

In the annex explaining its plans, the budget said “the provision of large-scale debt relief to Eskom will result in a significant increase in gross borrowing, but prudent fiscal policy and debt management will ensure that this arrangement does not put the fiscal framework at risk”.

South Africa’s gross borrowing requirement will increase to 555bn rand ($30.4bn) in 2025-26, reaching 73.6% of GDP. “Eskom debt relief is the main driver of the increase in the debt levels and the delayed stabilisation date.” Last year, the government predicted debt would stabilise in 2024-25. It has now pushed that back a year.

The annex said that as government settles Eskom debt, its contingent liability exposure will fall. As such, the debt relief plan will reduce governmental liability, it said.

Government will split the debt relief out over the next three years and, in 2025-26, it will take ownership of 70bn rand ($3.85bn). The statement said government had reached this positon after consultations with Eskom and stakeholders.

“Its success rests on the implementation of key reforms that address the inadequacies of the transmission network and performance of existing power stations,” said the Budget Review.

The missing link

The government has said it is keen to establish – with Eskom, Treasury and the Department of Public Enterprises – a means to build new transmission infrastructure. This would allow more private sector participation in transmission, it said.

The sixth bid window of the Renewable Energy Independent Power Producer Programme (REIPPP) seeks to secure 4,200 MW. The aim is to reach commercial close by the end of May this year, and be operational by May 2025.

The government has noted that a lack of transmission prevented plans for any wind projects moving forwards under this bid window.

South Africa will open the seventh bid window in the first half of the 2023-24 year, it said, although noting this was “subject to grid availability”.

Treasury has also commissioned a review of Eskom’s coal-fired power fleet. This will conclude by mid-2023. This aims to work out which plants can be “resuscitated to original equipment manufacturers’ standards”, it said.

Powering up renewables

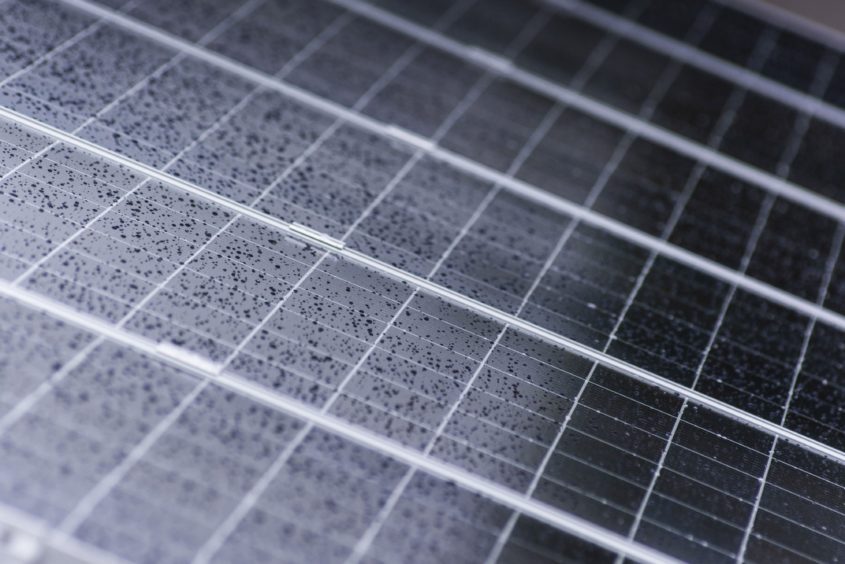

Godongwana also said there would be a rebate of 25% for solar panel installations from March 1. This would be worth up to 15,000 rand ($823).

The rooftop rebate only applies for one year, though. It will end February 29, 2024. It only applies to panels, not inverters or batteries.

The tax cut will cost government 4bn rand ($218mn). It is also extending a renewable energy incentive for businesses, while declining to increase fuel taxes.

The incentive for businesses offers a 125% reduction for renewable energy projects. This applies to projects brought into use for the first time between March 1, 2023, and February 28, 2025.

The government aims to guarantee solar loans for small and medium sized companies.