Delays in offshore wind construction and the cancellation of key projects will see the UK fall short of its 2030 deployment targets, according to analysts Cornwall Insight.

In its quarterly GB Benchmark Power Curve report, the firm forecasts that UK offshore wind capacity will increase from 12.5GW at present to just over 47GW in 2030 – narrowly missing the government’s goal of 50GW by the end of the decade.

Cornwall attributed the shortfall to delays in deployment, mainly as a result of rising costs. It comes after last month’s washout Contracts for Difference (CfD) auction, which lacked a single bid from the flagship generation source.

Worse still, even projects which had secured CfD support in previous auction rounds are under threat, with Vattenfall abandoning plans for its 1.4GW Norfolk Boreas scheme saying it no longer made financial sense in the current environment.

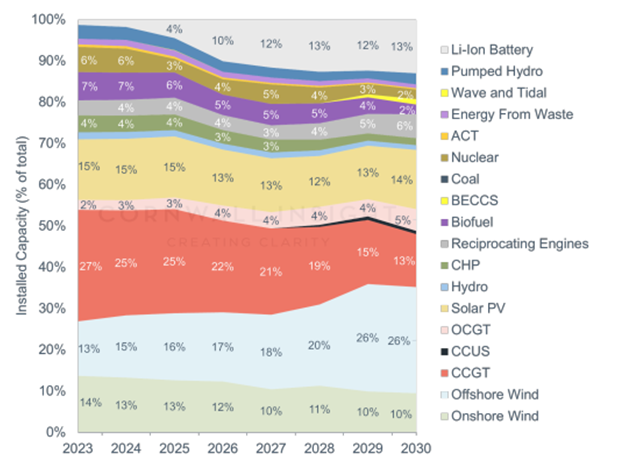

Despite the concerns, the analysts still see offshore wind become the largest source of electricity in terms of installed capacity by 2028, and making up 26% of UK generation by the end of the decade.

Senior modeller Tom Edwards noted that: “Offshore wind delays, spurred on by cost worries and project setbacks, pose a roadblock to reaching net zero.

“We can see the country is travelling in the right direction towards a renewables-based electricity system, however, our estimates continue to show it is simply not fast enough to deliver on government targets.

“Time is of the essence, and it is critical that the government reassess its commitment to accelerating renewable energy adoption, which includes being more flexible when setting auction parameters to reach the UK’s offshore wind goals.”

Higher for longer

Looking to the power market, Cornwall Insight sees power prices remaining comparatively high over the medium term.

Prices are likely to stay “at least 60% above pre-2021 averages” until 2030 and “likely beyond,” with a peak of nearly £130 per MWh in 2024, before falling to a low of just over £80 per MWh by 2030.

While this does mark a large decrease, it remains “substantially higher” than the pre-energy crisis levels of less than £50 per MWh.

While a greater share of low marginal cost renewables like wind and solar will help drive prices down when in operation, this is likely to be met by demand growth from wider electrification efforts in heating, industry and transport as well as increasing production of green hydrogen – “resulting in a levelling of prices above pre-pandemic levels” analysts said.

However, the authors warned that slowing the transition is likely to prove even more costly.

“Rolling back our net-zero ambitions and slowing our transition away from fossil fuels is likely to be a costly delay that will not only see us fall further behind in decarbonising the country but will leave consumers shouldering the prolonged burden of high prices,” Mr Edwards said.

“Without a resolute commitment to a greener and more sustainable future, achieving net zero emissions and pre-crisis energy bills becomes an increasingly elusive goal.”

© Cornwall Insight

© Cornwall Insight