A new survey of the UK’s offshore wind supply chain finds a decline in confidence since last year, as inflation and a disappointing CfD round dent expectations.

The Offshore Renewable Energy (ORE) Catapult’s second annual Offshore Wind Supply Chain Confidence Survey found more organisations are expressing a less favourable outlook in the offshore wind sector, albeit tempered by longer-term optimism on growth.

ORE, a technology innovation and research centre, noted that while respondents are still generally positive as to growth in revenue and employment over the short, medium, and long term, respondents indicate that industry confidence has declined since last year’s survey, due to “tough market conditions.”

123 companies participated in the survey, taken during October and November 2023, representing every region of the UK – though with highest responses were seen in the Northeast of England and Scotland.

Over half of the respondents were from the renewables sector (51%), while over a quarter were from oil and gas, and the remainder split between the transport, construction, and chemical industries.

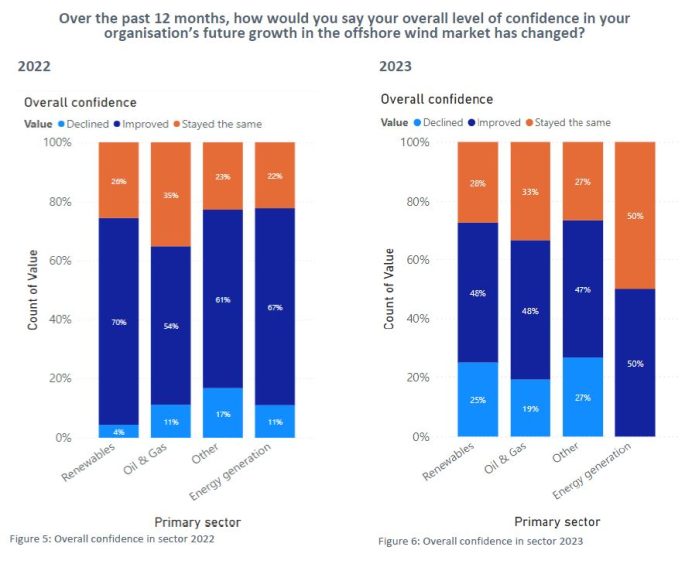

The biggest changes were seen amongst companies from within the renewables sector, where 25% of respondents said their optimism had declined since last year – up from 4% in 2022. That compares with electricity generators, who were split 50/50 on an unchanged or improved outlook.

ORE recorded a generally “more unfavourable view” of government policies and regulatory regimes since past year, though it notes the canvassing was conducted prior to the government’s updated Allocation Round 6 parameters, in which administrative strike prices were raised to account for broader economic challenges.

However it stressed that overall sentiment in the industry “remains high.”

Commenting on the survey results, ORE Catapult chief executive Andrew Jamieson said: “Ambitious national deployment targets and a large pipeline of projects support a high degree of confidence in continued growth within the UK’s offshore wind industry over the coming years. That’s fantastic news and will ensure that we maintain the UK’s standing as a frontrunner in global offshore wind.

“The UK Government’s recent AR6 announcement reflects its commitment to the sector and the pivotal role that offshore wind must play in achieving Net Zero.”

Skills crunch

Skills shortages and the visibility of the future pipeline of projects appeared as the greatest barriers to supply chain growth.

ORE said the survey identified challenges in attracting a skilled technical workforce, with “recruitment proving more of a challenge than retention” amongst most respondents.

Despite this, optimism around future employment growth has risen, with 63% of firms predicting an increase in employment over the next year, increasing to 89% over the period to 2030.

Pointing to similar skills crunches faced in adjacent sectors such as oil and gas, the survey report called for an expansion of targeted skills development initiatives, “aiming to address gaps in the most pressing area.”

Amongst other recommendations, the survey report advocates a significant increase to the existing industry target of 2.5% of employees being in apprenticeships, to substantially broaden the pipeline of talent flowing into the offshore wind sector.

Calls for national procurement portal

Further barriers mentioned in the survey included a lack of visibility of business and procurement opportunities in offshore wind, and information on global market requirements to enter the offshore wind sector.

ORE found that companies from oil and gas and the generation sectors in particularly suggested they have inadequate sight of future prospects in the industry.

In response, the survey report recommends a “single, national portal” populated by all project developers with visible procurement opportunities should be established “as soon as possible.”

Further investment in programmes to facilitate the transition into offshore wind from other sectors, such as technology transfer support, access to bespoke market intelligence, and supply chain readiness advice, is also recommended.

Commenting on the findings, RenewableUK chief executive Dan McGrail added: “The offshore wind industry is working closely with the Government to maximise the number of jobs we can deliver and the amount of private investment we can attract at a time of intense international competition.

“We’re focussing on growing new supply chains throughout the country in the Industrial Growth Plan which we’re developing with Ministers. This will enable us to serve projects here as well as exporting our cutting-edge technology worldwide.

“The industry estimates that the offshore wind supply chain could boost the UK’s economy by £92 billion by 2040, and the confidence demonstrated in the survey demonstrates we’re on the right track.”

Recommended for you

© ORE Catapult

© ORE Catapult