RWE is set to acquire the UK Norfolk Offshore Wind Zone portfolio, which represents a potential 4.2 gigawatt in production, from Vattenfall.

RWE explained the agreed purchase price “corresponds to an enterprise value of £963 million.”

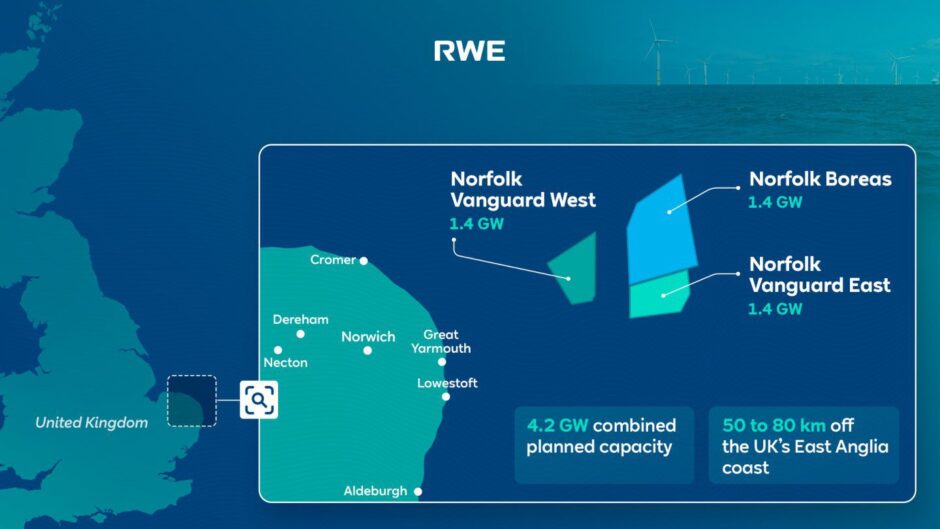

The portfolio comprises three offshore wind development projects off the east coast of England, these are, Norfolk Vanguard West, Norfolk Vanguard East and Norfolk Boreas.

Each with a planned capacity of 1.4 gigawatts, the three projects are located between 31 and 50 miles off the coast of Norfolk in East Anglia.

After 13 years of development, the three development projects have already secured seabed rights, grid connections, Development Consent Orders and all other key permits.

Norfolk Vanguard West and Norfolk Vanguard East are the two most advanced of the three projects, having secured the procurement of most key components.

Following the deal, RWE says its next goal for these two projects is to secure a Contract for Difference (CfD) in “one of the upcoming auction rounds. “

RWE also plans to resume the development of the Norfolk Boreas project, which was previously halted.

Earlier this year Vattenfall called off its development of the Norfolk Boreas project due to rising costs.

At the time, the firm said that Norfolk Boreas would have a SEK 5.5 billion impact on earnings, as costs increased “up to 40%.”

Yesterday Energy Voice reported that Vattenfall and Vestas had signed exclusivity agreements for the Norfolk Vanguard East and Norfolk Boreas projects.

These two will potentially feature up to 184 V236-15 MW turbines.

The contract also includes a preferred supplier agreement (PSA) for the 1,380 MW Norfolk Vanguard West project, comprising of 92 Vestas’ V236-15 MW offshore wind turbines.

Tom Glover, RWE’s UK Country Chair: “The UK has been one of our most important core markets for decades.

“We are delighted that we can now further contribute to achieving the UK’s ambitious build-out targets for offshore wind.

“The timely and efficient deployment of offshore wind is essential to ensure the UK’s domestic energy security, as well as achieving our net zero targets.

“We very much welcome the UK government’s recent decisions on future offshore wind auctions which provides us with the confidence to invest and represents a positive step in maximising the UK’s clean energy potential, ensuring sustained and lowest prices for consumers and creating good quality jobs.”

Recommended for you