No aspect of the energy transition is simple, but decarbonising the UK heat sector poses one of the country’s most significant challenges.

Heating, including space heating, hot water, cooking and industrial processes, accounts for an estimated 37% of the UK’s total carbon emissions.

In 2019, approximately 17% of UK heat emissions came from homes, about equal to the emissions from all petrol and diesel cars on UK roads.

Around 85% of UK homes use natural gas for heating, but changing the fuel source used is only one part of the challenge.

A study from Imperial College London found the UK’s 28.6 million homes are “among the least energy efficient in Europe and lose heat up to three times faster than on the continent”.

When the challenge of decarbonising commercial and industrial heating processes is factored in, the scale of the task is huge.

But within that challenge, many companies also see significant opportunities.

Decarbonising heat

The northern Italian region of Lombardy is home to much of the country’s heavy industries.

In the city of Brescia, halfway between Milan and Verona, Japanese firm Mitsubishi Heavy Industries saw an opportunity to capitalise on the growing demand for industrial scale large heat pumps.

Brescia has been a pioneer in decarbonising home heating since the 1970s, when the city’s district heating network became the first in Italy to be powered by a waste-to-energy plant in 1972.

Now, the city is looking at other large scale industrial processes to further decarbonise its heating network by capturing waste heat and converting it for use in homes.

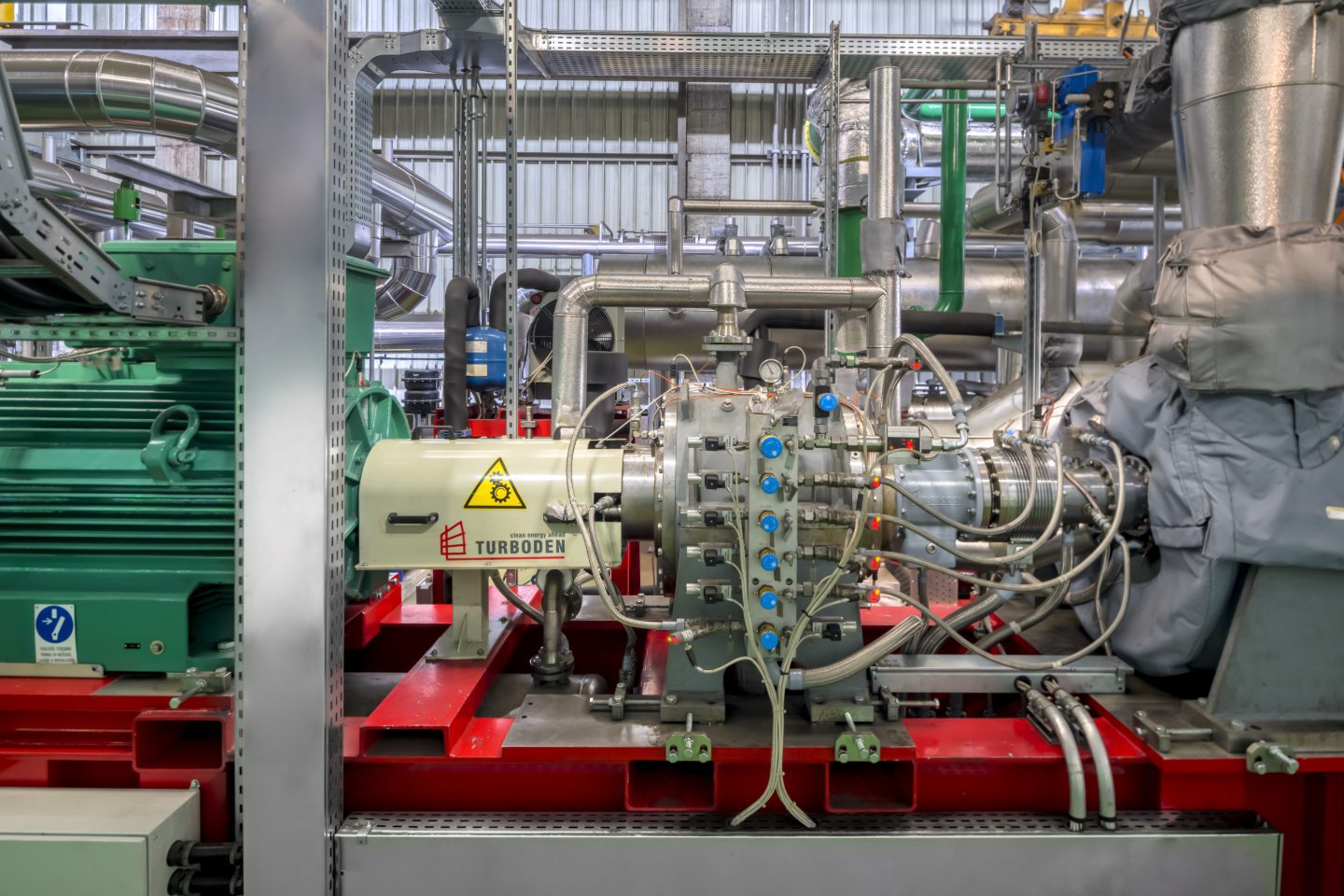

Brescia-headquartered turbine manufacturer Turboden has been involved in capturing waste heat since it was founded 1980 by Italian professor Maria Gaia.

Turboden started out producing Organic Rankine Cycle (ORC) systems, developed from the work of Scottish inventor William Rankine.

ORC systems capture excess heat at low temperatures and convert it into electricity which can be fed back into industrial processes.

Large heat pumps

Seeing an opportunity to move further into the decarbonisation space, Turboden built on its experience in ORC systems to create large heat pumps (LHPs).

LHPs can be used to convert low temperature waste heat from industrial processes into a higher temperature, which can be used to heat water for district heating. The technology is also a key component of geothermal energy projects.

With funding from the European Union, Turboden installed a LHP at ORI Martin’s electric arc steel furnace in Brescia, alongside a previously installed ORC system.

The LHP installed at the ORI Martin plant provides heating for approximately 3,500 homes in the city during the winter, but the steelmaker also sees a benefit to its business.

Steel decarbonisation

ORI Martin sustainability manager Carolina de Miranda said 90% of the steel produced by the firm is used in the automotive industry.

“[Car manufacturers] have strict targets, they want to see year by year what emissions you’re able to reduce,” she said.

Ms de Miranda said while installing the Turboden systems represented a significant investment, the company saw it as essential for its business and the local community.

“Even if you are not ready to do it, you have to do it. It’s something you do now or you are completely out of the market,” she said.

Steelmaking isn’t the only sector where the technology can be incorporated, with Turboden involved with a similar project at a pulp and paper mill in Finland.

There the waste heat is converted into steam which is fed back into the paper making process, reducing carbon intensity and the company’s exposure to turbulent gas prices.

Turboden expansion after MHI acquisition

Since MHI acquired Turboden in 2013, the company now exports to more than 50 countries with its eye on further expansion into larger LHP and geothermal projects.

Turboden CEO and managing director Paolo Bertuzzi said the company expects to see significant growth in demand, with the market for LHP expected to grow from an estimated $5bn in 2022 to approximately $40bn by 2030.

“It’s a key moment for us because we have the right product in the right moment,” Mr Bertuzzi said.

Turboden institutional affairs and marketing director Marco Baresi said the firm had benefited from the European Union’s industrial support through the Net Zero Industry Act, which lists heat pumps and geothermal as key strategic technologies.

“We need more clean technologies, we need more affordable power, but still we need to maintain jobs and to create new jobs,” Mr Baresi said.

Mr Baresi said most of the components for Turboden’s turbines are manufactured by the local supply chain in Lombardy, with assembly done at its Brescia base.

Carbon capture applications

As the company seeks to capitalise on the growing market for LHP, Turboden is also investing in larger ORC turbines which can generate up to 70MW for the US market.

Meanwhile, MHI also sees potential for Turboden’s technology to complement its existing other decarbonisation work in the carbon capture, utilisation and storage sector.

Using the ORC systems Turboden produces, electricity generated from waste heat from industrial processes can be used to reduce the electricity needed to power carbon capture.

Turboden heat generation general manager Andrea Magalini said this can reduce the costs of CO2 capture by up to 15%.

MHI is involved in a range of UK CCUS projects, including a hydrogen plant within the HyNet cluster and the Peterhead power station.

With many hard to abate industrial sectors looking to incorporate CCUS, particularly the cement sector, Turboden’s technology could play a role in making the process more cost effective.

MHI isn’t the only company making acquisitions in the UK focused on geothermal energy.

Earlier this year, Norfolk-based geothermal developer CeraPhi Energy acquired a former fracking company with plans to repurpose the existing gas wells into clean energy centres.

CeraPhi is also exploring the potential for its geothermal technology to power a proposed CCS hub centred on EnQuest’s Magnus platform in the North Sea.

Decarbonising heat in Scotland

While many UK industrial firms could look to incorporate ORC systems to reduce electricity usage and costs, the lack of district heating networks in the country presents a barrier to widescale adoption of LHPs.

Only 1.5% of Scotland’s heat demand is delivered by district heating network, while the UK wide figure is approximately 3%.

However, the Scottish Government has set an ambitious target to provide 6TWh through heat networks by 2030, the equivalent of connecting around 650,000 homes.

Pilot projects utilising LHPs have already been rolled out at housing developments in three cities, including a project in Glasgow delivered by Scottish firm Star Refrigeration.

Last year, Glasgow City Council outlined a strategy which could see more than half the city’s homes powered by district heating, adding to the eight district systems already operating in the city.

Rolling out heat networks across Scotland could provide more than just environmental benefits, according to Euroheat & Power market intelligence director Eloi Piel.

Mr Piel said while household energy bills skyrocketed in many European countries following Russia’s invasion of Ukraine, district heating companies in Denmark were able to keep prices largely stable.

While the Scottish Government has ambitions to massively scale up the decarbonisation of heating through district heat networks, skills shortages, and political uncertainty remain key challenges to the rollout of large heat pumps.

© DC Thomson

© DC Thomson © Image: Turboden

© Image: Turboden © Supplied by ORI Martin

© Supplied by ORI Martin © Mathew Perry/DCT Media

© Mathew Perry/DCT Media © Image: ORI Martin

© Image: ORI Martin © Supplied by Turboden

© Supplied by Turboden © SYSTEM

© SYSTEM