The world is shifting too slowly from fossil fuels to avoid severe climate change, increasing the risks that the eventual transition to clean energy will be “disorderly,” BP Plc warned.

Fossil fuel consumption broke records last year, led by climbing oil demand, the company said in its annual Energy Outlook on Wednesday. Countries remain in an “energy addition” phase — increasing their consumption of both low-carbon energy and fossil fuels — and need to pivot to a “substitution” phase, it said.

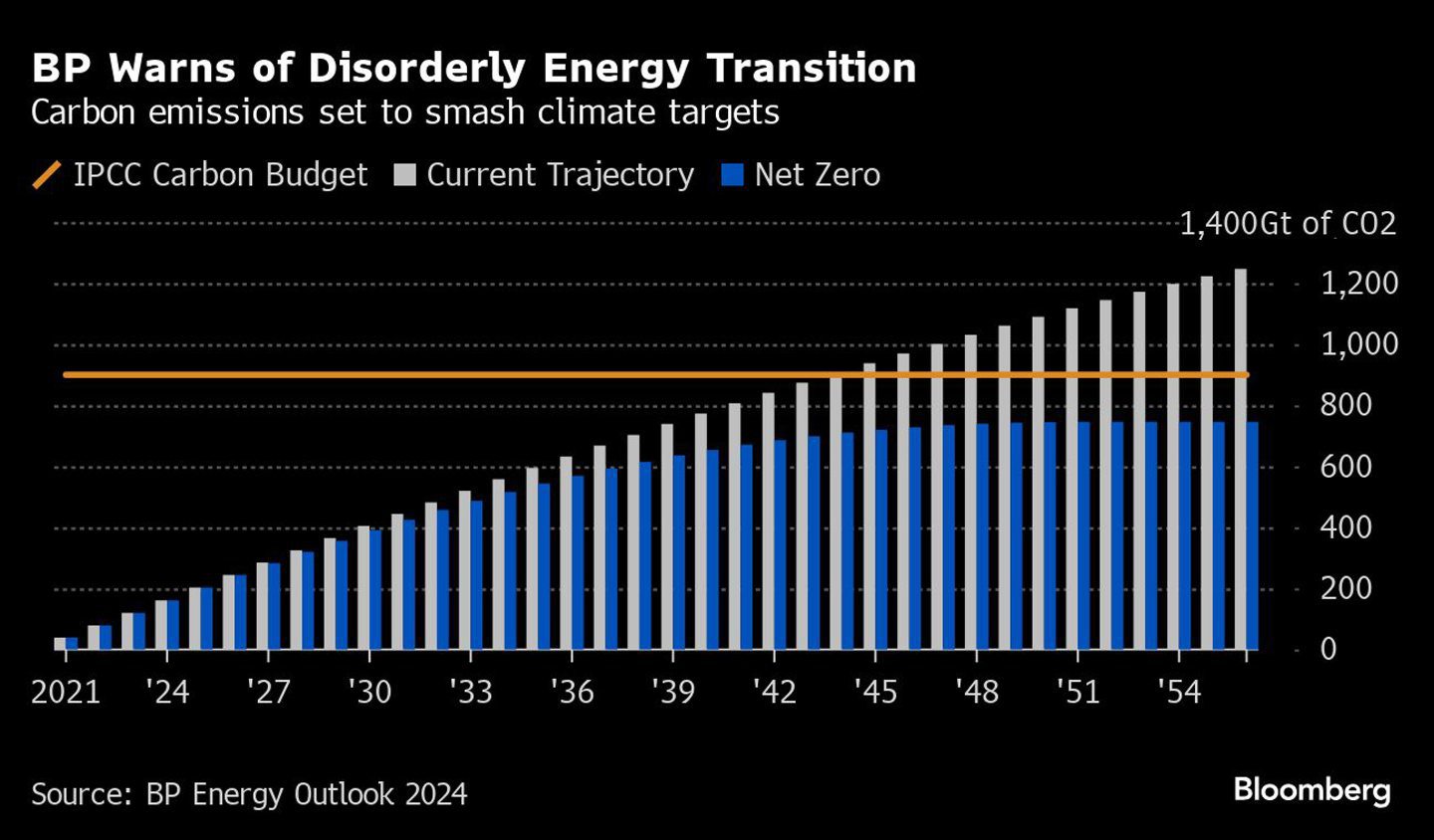

If this trend continues to the early 2040s, the world may have exhausted the so-called “carbon budget” that would limit temperature increases to 2C above pre-industrial levels, BP (LON:BP) cautioned.

“The longer it takes for the world to move to a rapid and sustained energy transition, the greater the risk of a costly and disorderly adjustment,” said Spencer Dale, the company’s chief economist. This pathway could have outsized economic and social costs, according to the report.

BP itself refocused on its traditional oil and gas business last year, an adjustment of its previous plan to shift rapidly into renewables under former Chief Executive Officer Bernard Looney. That strategy was impeded by opposition from some activist shareholders, and an energy squeeze precipitated by Russia’s invasion of Ukraine.

Investment in low-carbon energy has soared 50% since 2019 to reach roughly $1.9 trillion last year, helping power generation using wind and solar energy to almost double during the period, according to the report. Yet this progress hasn’t been sufficient to cover rising energy demand, even as the rate of growth has cooled.

Improvements in efficiency have been “disappointing,” with the amount of energy used per unit of economic activity diminishing by barely 1% over the past four years. Global oil demand is on track to keep growing until the end of the decade, and then go into decline, according to the report.

Global oil demand reached unprecedented levels of more than 100 million barrels a day in 2023, as travel and transport continued to recover from their slump during the Covid pandemic and emerging economies increased their intake of petrochemical feedstocks.

On the current trajectory, consumption will remain near this level until 2035, then start declining thanks to the adoption of electric vehicles and improving fuel efficiency, eventually reaching 75 million a day in 2050.

In order to reach the global climate goal of net zero carbon emissions, oil use would have to plunge 70% by 2050 to around 30 million barrels a day, BP projected.

Recommended for you

© Bloomberg

© Bloomberg