Dundas Consultants has found that the contracts for difference (CfD) scheme has dished out more than £8 billion in renewables subsidies, with over 80% of projects yet to receive funds.

The CfD round acts as a financial support mechanism for renewable energy projects in the UK.

Low Carbon Contracts Company (LCCC), a government-owned, arms-length limited company, meanwhile administers subsidies to low-carbon electrical power generation projects that have successfully secured support through the UK’s Allocation Rounds (AR).

Of the 238 projects that have been successful in CfD bids since the scheme came into play in 2014, only 45 have received payment.

However, “the framework has been successful in its goal of encouraging private capital into renewable energy,” explained Richard Woodhouse, managing director of Dundas Consultants.

Woodhouse added: “Over 80% of projects are yet to receive payments – driven by both price levels and project maturity, i.e. many projects are not yet operational.

“As such the exposure to potential subsidy payments can be expected to grow substantially as more projects are finalised.

“Ultimately, future subsidy levels will depend on policy, technology and markets. The government will need to decide on allocation of subsidy schemes including CfD based on evolving energy policy.”

Renewable energy feels the winds of change

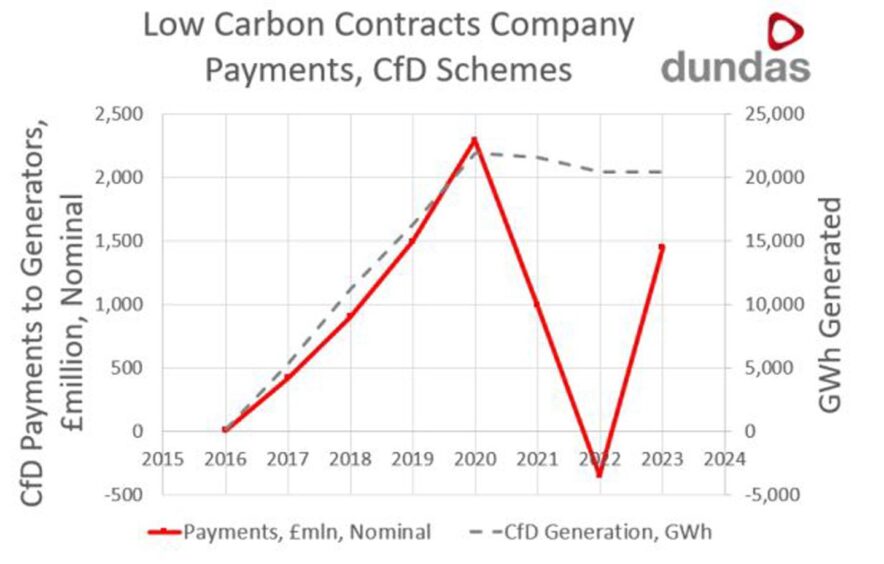

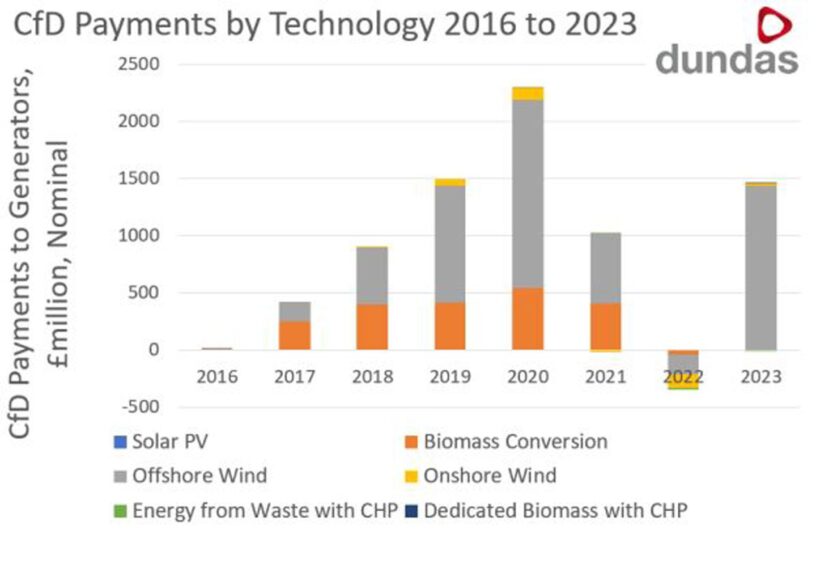

Since making its first CfD payments in 2016, the LCCC’s annual subsidy spend has grown rapidly, reaching a peak in 2020 when it got to around £2.3 billion in the 12-month timeframe.

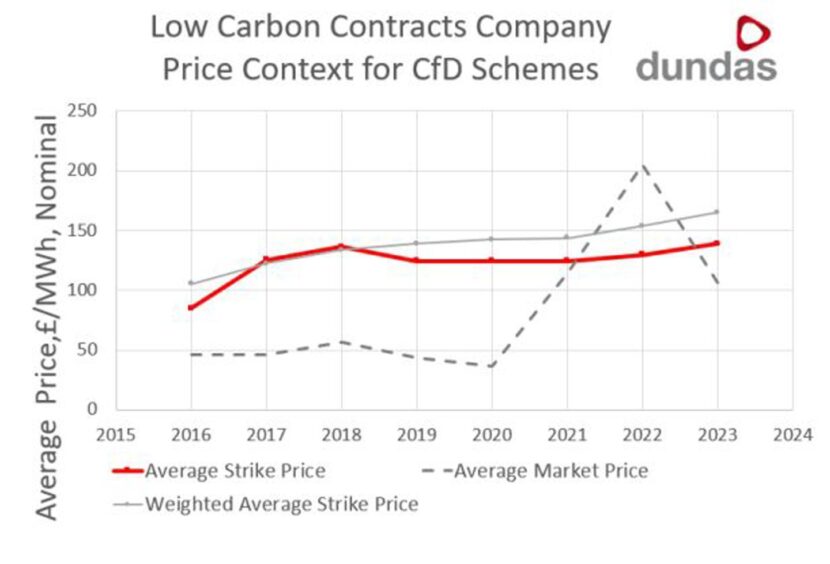

From 2016, the guaranteed power price paid to developers – or ‘strike price’ – was around 2.5 times higher than the market price until 2022.

Beyond 2022, the market price exceeded the strike price and developers had to pay back the revenue difference, according to the firm that provides training courses in renewable energy project economics.

Woodhouse added: “Technology developments have the potential to reduce the price per unit of power generated, for example with floating offshore wind.

“However, markets – regulated and otherwise – have the potential to have large and rapid impacts upon current and future CfD contracts.

“That may be due to electricity price changes and the costs associated with development projects – wind, in particular, having seen strong upward pressure on costs for hardware and construction services.

“Furthermore, the cost of capital for developers of all projects has increased dramatically over the timeframe of the CfD framework.”

Recovering from AR5 failure

Last year’s CfD awards saw no successful bids for offshore wind as the price was too low, forcing it to compete with cheaper technologies.

The offshore wind sector, like much of the economy, has been hit hard by inflation. This increases not only the cost of materials like steel and the services needed to complete projects, but also the cost of capital and finance to fund them.

This was just one of the reasons given industry for the lack of successful bids for offshore wind projects in AR5, the results of which were shared last September.

Since then, strike prices have been increased for some energy sources to make them more competitive and representative of market conditions.

The price jumped from £44/MWh to £73/MWh, and rose by 52% for floating offshore wind projects, from £116/MWh to £176/MWh ahead of AR6 later this year.

The total budget for AR6 will include just over £1 billion in funding from each financial year from 2027/28 to 2029/30, plus an additional £905 million in 2030/31, as things stand.

Last week, new prime minister Keir Starmer announced his party is considering increasing subsidies even further for offshore wind developers in the upcoming auction.

“Applications for AR6 are currently being assessed and the Secretary of State will then carefully consider whether to increase the budget,” a spokesperson for the Department for Energy Security and Net Zero wrote.

This is an attempt to scale up wind energy roll-out in order to meet the country’s lofty ambitions for the renewable power source.

Recommended for you

© Supplied by Dundas Consultants

© Supplied by Dundas Consultants © Supplied by Dundas Consultants

© Supplied by Dundas Consultants © Supplied by Dundas Consultants

© Supplied by Dundas Consultants © Supplied by -

© Supplied by -