Spain’s Iberdrola announced on August 2 that it had agreed to acquire 88% of the UK’s Electricity North West (ENW) for an equity value of €2.5b (£2.1b).

The deal puts ENW’s total value, including debt, at roughly €5b (£4.2b).

Iberdrola noted that the deal was in line with its strategy of investing in electricity networks in countries with a strong credit rating – in the UK’s case it is AA.

The company already owns ScottishPower, which it says is the only 100% green integrated utility in the UK.

Since it completed its acquisition of ScottishPower in 2007, Iberdrola has invested around €36b (£30b) in the country.

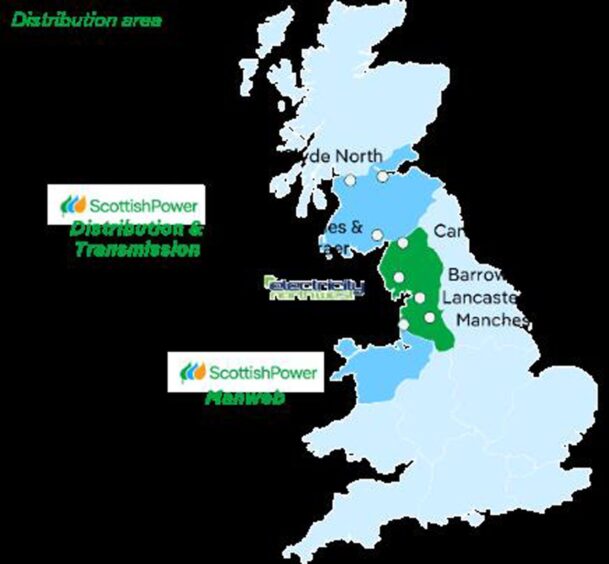

ENW distributes electricity to almost 5m people in the Northwest of England and owns roughly 60,000 km of electricity distribution networks. The acquisition is expected to help Iberdrola connect areas it already serves, as geographically, ENW is located between the two existing ScottishPower networks licence areas, in central and southern Scotland and Merseyside and North Wales.

Once the acquisition of ENW is also complete, the UK will become Iberdrola’s leading market by regulated asset base, with a value of roughly €14b (£11.9b), overtaking the US market, valued at around €13.3b (£11.1b).

Iberdrola will also become the second largest electricity network operator in the UK, distributing electricity to roughly 12m people in the country, across a network spanning more than 170,000 km.

The company therefore also sees the deal as aligning with its goal to grow its electricity networks business.

“This transaction reinforces our commitment to investing significantly in electricity networks, which are a critical component for supporting the electrification and decarbonisation of the economy,” stated Iberdrola’s executive chairman, Ignacio Galan.

“The agreement is also consistent with our strategy to invest in countries that have ambitious investment plans and stable and predictable regulations. As a result of this acquisition, our regulated networks asset base in the UK is now valued at €14b. When combined with the US, these two markets now represent two-thirds of our total global regulated asset base.”

New ownership

Iberdrola said in its acquisition announcement that a consortium of investors from Japan, led by Kansai, would retain 12% of ENW’s capital, having signed a shareholders’ agreement with the Spanish company to collaborate on a long-term basis.

This refers to Osaka-based Kansai Electric Power Co., also known as KEPCO or Kanden, which bought into ENW in 2019, marking its first investment into European electricity distribution networks.

When Kansai acquired its ENW stake, it also established an investment company in the UK, together with Daiwa Energy & Infrastructure Co. and MHC Infrastructure UK, known as KDM Power.

According to ENW’s latest annual report, published in July 2024, KDM Power owned a 40% interest in North West Electricity Networks (Jersey), or NWEN (Jersey), its ultimate parent company, as of March 31, 2024.

Units of infrastructure investor Equitix also owned 40% in NWEN (Jersey), with Swingford Holdings owning 20.0%.

Iberdrola did not elaborate on the breakdown in ownership of the stake changing hands as a result of the transaction.