Energy and climate change have been on the ballot around the world this year. Here’s a scorecard of what to expect on infrastructure, power and renewables in five countries.

United Kingdom

Keir Starmer’s Labour Party in July ended 14 years of Conservative rule. With the greatest majority since Prime Minister Tony Blair’s 1997 triumph, the new government wants to move quickly.

What could change: Labour aims to have a carbon-free power grid by 2030, a goal the industry says will be difficult to reach. The target requires a huge build-out of renewables, more than doubling wind and solar capacity. Labour has already taken action to unblock onshore wind development. Another flagship project: setting up a publicly owned energy company, Great British Energy, which would act as an investment body for renewables.

Winners: Developers of renewables are set to gain as the party seeks to reform the UK’s planning system, which has allowed local sway to delay projects in the past. The government also wants to upgrade the grid to establish faster connections for wind and solar farms. But Labour will have little money to support such endeavors after slashing annual spending on its green plan to £4.7 billion ($6.1 billion) from £28 billion.

Losers: Oil and gas companies will suffer if Labour follows through on a pledge to end new exploration licenses. Labour also plans to extend a windfall tax on them.

France

France is heading into an extended period of gridlock after a snap legislative election left no clear majority. President Emmanuel Macron’s centrist party trailed a left-wing coalition, while Marine Le Pen’s far-right nationalist party performed worse than expected but still gained ground.

What could change: A divided Parliament risks indefinite delays to large energy investment decisions. These decisions include Macron’s plan to begin the construction of at least six nuclear reactors, alongside solar and wind plants.

Winners: In the near term, households may benefit, as the lack of a clear parliamentary majority may favor measures to support the purchasing power of consumers, who’ve been hit hard by high energy costs.

Losers: A longer gridlock might undermine energy transition projects that require significant government subsidies, such as the production of electric-vehicle batteries and synthetic fuels as well as decarbonization plans for steelmakers and fertilizer producers.

South Africa

Frustrated by record power outages, voters in May handed the African National Congress its first electoral loss since Nelson Mandela came to power 30 years ago. This loss forced the party to form a coalition government with opposition groups and divided responsibility over key energy portfolios.

What could change: The energy transition could get unstuck. Under the previous administration, Mineral Resources and Energy Minister Gwede Mantashe celebrated the coal industry, raised conspiracy theories about environmental groups and delayed programs to build more solar and wind stations. Mantashe’s role has now been narrowed to mining and oil, with more control handed to the minister of electricity.

Winners: Private developers including Électricité de France, Enel and Scatec should be able to keep building commercial and industrial projects that deliver clean energy at prices that beat coal-fired power from state-owned Eskom. On the oil and gas side, the country’s shrinking refining capacity followed a dearth of investment. The state is unlikely to step in, resulting in opportunities for traders such as TotalEnergies SE and Vitol Group to import more fuel.

Losers: Many South Africans can’t afford their own rooftop solar panels and must rely on electricity from Eskom Holdings SOC Ltd. The utility regularly institutes above-inflation rate increases. And even though outages have decreased, the instability inherent in coalition governments may jeopardize the transition to clean energy.

Mexico

In June the coalition of Claudia Sheinbaum, a climate scientist with a doctorate in energy engineering, almost clinched a supermajority in congress and further strengthened the Morena party’s dominance of Mexico’s politics. Some worry the new president will have more power to cement state control over the energy sector in a continuation of her predecessor and political mentor’s policies. But Sheinbaum differs from Andrés Manuel López Obrador, or AMLO, in her strong focus on the green transition.

What could change: Sheinbaum has proposed spending $13.6 billion on new energy projects, including wind, solar and natural gas power plants. Investors are optimistic she’ll be pragmatic in opening the door to sorely needed private investment. She has proposed public-private partnerships to attract funds.

Winners: State-owned utility Comisión Federal de Electricidad will still have the edge on drawing in renewables investment as Sheinbaum limits private-sector involvement in power generation to 46%.

Losers: Private contractors will continue to face payment delays from state-owned driller Petróleos Mexicanos, the world’s most indebted oil company. Sheinbaum is under pressure to present a plan to solve its financial woes and will send a key signal to the market with her pick of who will head Pemex.

Looking ahead: US

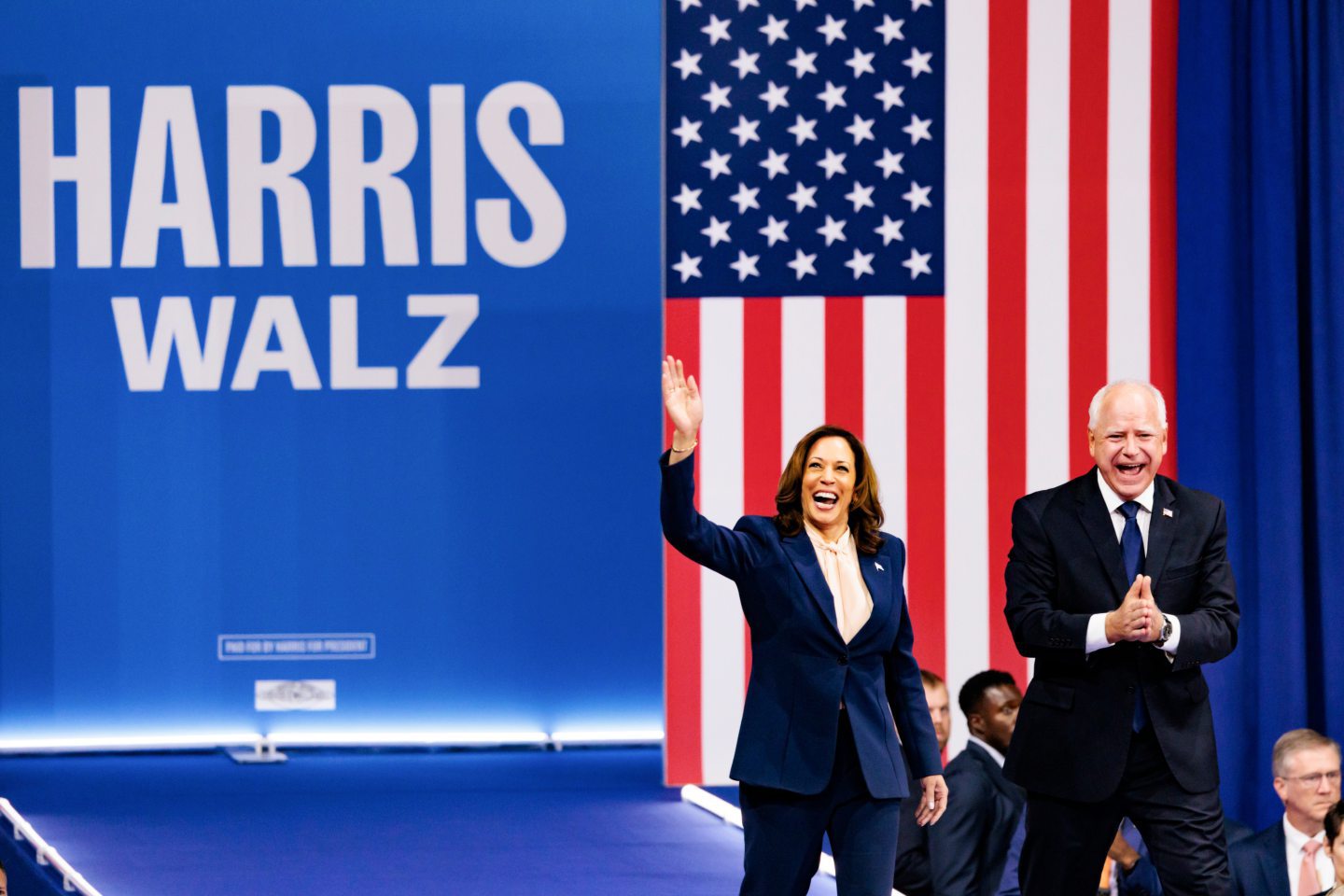

The Nov. 5 election will be a choice between two starkly different economic visions. It will also dictate which party controls Congress.

What could change: A Donald Trump victory, especially alongside Republican gains in Congress, would fuel a push to limit many tax incentives that are helping propel EV sales and new ventures to capture carbon dioxide, generate renewable power and manufacture clean energy technology. Trump would have wide latitude to rewrite Department of the Treasury rules that govern tax credit qualifications.

Winners: Oil and gas interests are likely to thrive under Trump, who’s vowed to “develop the liquid gold that is right under our feet,” remove barriers to production and offer more federal land for drilling. A Democratic victory would benefit renewables and other low-emission technology. Vice President Kamala Harris, the presumptive Democratic nominee as of late July, is expected to largely follow President Joe Biden’s lead on energy and climate change.

Losers: Trump has made no secret of his animus toward EVs and offshore wind. He wants to get rid of Biden-era policies supporting EV sales and has signaled he would throttle approvals of new turbines at sea. A Democrat would build on regulations that disadvantage fossil fuels, including through tough new curbs on pollution from gas-fired power plants. Harris has a history of tangling with oil companies and siding with communities hurt by environmental damage, suggesting she could be tougher on industry.

© Tayfun Salci/ZUMA Press Wire/Shu

© Tayfun Salci/ZUMA Press Wire/Shu © Bloomberg

© Bloomberg © Bloomberg

© Bloomberg © Bloomberg

© Bloomberg © Bloomberg

© Bloomberg