EnergyPathways CEO Ben Clube is looking on the bright side of Labour’s windfall tax changes as he feels the winds of change blowing in the North Sea.

Last week the gas firm insisted recent changes to the energy profits levy (EPL) are a “positive indication of the new Labour government’s commitment to support investment in energy transition projects”.

Despite worry around skills leaving the UK as a result of falling investment, Clube insisted his firm has not been affected by a “departure of service capability” despite dire warnings from other North Sea firms that the levy would “kill” the supply chain.

He told Energy Voice that his firm is seeing “good interest” from the services sector on the firm’s Marram Energy Storage Hub (MESH) project in the Irish Sea, which will also come under the new tax policies being brought in by the Labour government.

“We are continuing to monitor that situation, but as yet we’ve not been affected in a negative sense by a departure of service capability.”

Oil and gas ‘not being encouraged’

Clube argues that Labour is setting out a mission statement on how the North Sea will operate going forward.

He explained: “There were adverse changes, with the increase in the levy rate, the sunset clause being pushed back, and the arrangements around capital allowances and the investment allowance structure.

“We take that as a sort of confirmation of the signal that was previously made that conventional oil and gas investment is, let’s say not being encouraged.

“However, investments and projects which are bringing forward solutions for energy transition are still being encouraged with the retention of the decarbonization allowance in the energy profits levy.”

‘A signal of the sort of project that is being supported’

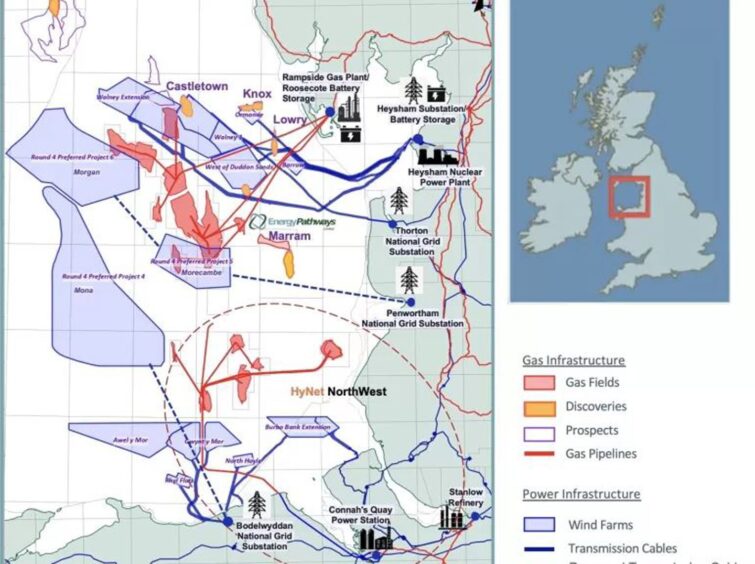

EnergyPathways’ MESH project is a gas and hydrogen storage facility which is set to come from the Marram gas field.

Plans are for the project to provide long term clean energy supply and storage and will be completely powered with UK renewable energy.

It also stands to benefit from the decarbonisation investment allowance, which is set at 80% and will remain in place in order to incentivise firms in the UK’s energy sector to slash emissions.

“I’m not saying we want to be the exemplar,” he said.

“What we’re trying to do is develop a project that is meeting the expectations and the requirements of what UK Government is seeking to advance for the benefit of the UK economy.

“We take the retention of the 80% decarbonization of that as a signal of the sort of project that is being supported and we’ve sought to design and develop our project in a manner that we think is meeting the expectations of the UK Government’s plans for energy transition.”

‘There’s still some uncertainty around the fiscal regime’

When asked about industry reaction to the announced changes as the backlash Labour has felt industry, Clube said he was speaking from an “energy transition project perspective.”

Mitch Flegg recently argued that uncertainty is what “kills” projects, as he explained that some development will be “cancelled or at best delayed.”

Last week Serica’s chairman David Latin said the industry was in a “nosedive” heading for a “herd of elephants” – a reference to the liabilities facing government if North Sea firms are forced to decommission assets early.

To this, Clube said that this is a “variable in the broader energy transition space” how late life assets continue and the decisions operators make around decommissioning.

Clube acknowledged the “uncertainty” facing some of his peers as he explained his firm also has a “need to monitor” fiscal policy changes.

“We do need to take all future announcements and changes into consideration,” he said.

Clube explained that EnergyPathways will be “monitoring” how the capital allowances scheme under the EPL is affected in Labour’s budget at the end of October.

“Furthermore, we’re going through our regulatory approval processes for the project and that includes the progression of a field development plan as well and we are making a submission for the storage license for the project shortly.”

Tax changes serve as ‘confirmation of the landscape’

This month the Labour government announced plans to up the rate oil firms pay under the energy profits levy and the move to abolish investment allowances under the fiscal policy.

The headline rate of tax imposed on oil firms will now be 78%.

However, the Decarbonisation Investment Allowance remains, covering electrification, powering production facilities with renewable energy, green hydrogen production and reducing greenhouse gas emissions.

Clube said Labour’s decision to implement the rise and extension of the EPL should not have come as a surprise.

“Our view was that the changes announced just over a week ago were not unexpected and we’re aligned with previous commentary from the Labour Party prior to the election.

“We really saw it as a sort of confirmation of the landscape that they foresaw for the UK.”

© Supplied by EnergyPathways

© Supplied by EnergyPathways © Supplied by EnergyPathways

© Supplied by EnergyPathways © Supplied by Wullie Marr / DC Tho

© Supplied by Wullie Marr / DC Tho