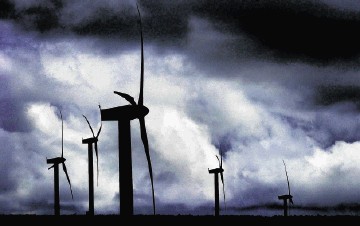

The cost to renewables firms from unpredictable weather is being offset by underwriter GCube’s new Weather Risk Transfer mechanism for the wind and hydroelectric energy sectors.

The insurance company’s new product provides the industry a means of guarding against the impact of volatile weather patterns that create issues for renewables companies.

In the first three months of 2015, many utilities and operators in the US wind market felt the performance impact of the lowest wind speeds since records began.

Long-term drought and low rainfall conditions in Uruguay and Brazil have hampered hydroelectric production and forced national governments to turn to costly spot market power.

Companies can look for a financial hedge, that offers compensation in the event of below par resource availability.

GCube uses historical weather data to create a suitable index and index trigger, which determines when payment to the buyer occurs – for example when wind speeds fall below 70% of the calculated long-term average.

“Weather risk exposure is simultaneously an issue for the wind and hydroelectric industries at large and a project-specific concern for individual operators,” said Charlie Richardson, senior underwriter at GCube.