Technology developed by wave energy company Aquamarine Power has been put up for sale as its administrators try to recoup some of the £90 million invested in the business.

Graham Newton and James Stephen from accountancy firm BDO were appointed as administrators of the Edinburgh-based company in October.

They were asked by its directors to find a buyer or investors for the business, but a month later in November no offers were on the table and so the firm ceased trading, with the loss of 13 jobs in Edinburgh and one in Belfast.

At its peak, Aquamarine employed around 50 staff, but most had lost their jobs December last year as the company scaled-back its operations, despite £90m having been invested in the development of its technology.

Its slide into administration came despite winning a £2m contract in August from Wave Energy Scotland (WES) – the public body setup by Highlands & Islands Enterprise (HIE) and the Scottish Government to help the industry – and an €800,000 (£580,000) grant in September from the European Union.

Documents filed at Companies House last week revealed that Aquamarine had debts of more than £11m, with Scottish Enterprise owed £6.2m, Swiss engineering firm ABB Technology Ventures due £2.5m and Perth-based SSE Ventures £1.27m out-of-pocket.

The administrators estimated the “book value” of Aquamarine’s assets to stand at £2.5m – including £238,299 for “patents, trademarks, etc” – although they estimated that the sale of all the assets would only produce £612,181, with £25,000 pencilled in for the sale of the patents and trademarks.

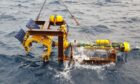

Aquamarine, which was founded in 2005, had tested its Oyster device – designed to convert wave energy into electricity – at the European Marine Energy Centre (EMEC) on Orkney and had worked with companies including Carnegie Wave Energy and Bosch Rexroth.

EMEC has a claim for £1.3m relating to the decommissioning of Oyster.

Nat Baldwin, head of corporate recovery at Metis Partners, the intellectual property (IP) consultancy that has been hired to conduct the sale, said: “Anyone who acquires these unique IP assets has the opportunity to capitalise substantially on a technology that will only become more critical as the years go by.

“We expect the sale to be of interest to companies active in the renewable energy, oil and gas, energy efficiency, engineering and desalination sectors as well as to patent aggregators.”

Metis – which has already handled the sale of assets from Proven Energy, Reaqua, Secure Electrans, and Swanturbines – has set a deadline for bids of noon on 21 January.

Dujon Goncalves-Collins, director of policy for technologies at trade body RenewableUK, said: “Aquamarine’s technology was repeatedly tested in British waters, so its IP assets should look attractive to any company wanting to gain from its experience and invest in the UK’s world-leading marine energy sector.

“The historic climate change agreement just reached in Paris shows that the world has an appetite to develop renewables at a faster pace than ever before.

“This will involve using a wide range of innovative technologies, such as wave energy, so now is the right time to be getting into that marketplace.”

The Aquamarine assets up for sale include: international patents; registered trademarks with international coverage; designs; test data; technical specifications; operational guides; branded domain names; website content; and goodwill from the brand and reputation.

Aquamarine was the second Scottish marine energy company to collapse in as many years after administrators from accountancy firm KPMG were called into Edinburgh-based Pelamis Wave Power in November 2014 and closed the business down the following month [December 2014] after no buyer was found.

A total of 56 people lost their jobs with the collapse of Pelamis, which had debts of more than £15m, including almost £13m to Scottish Enterprise, with its IP and other assets valued at just £836,000.

HIE bought some of Pelamis’s technology on behalf of the fledgling WES.

Recommended for you