The UK government has outlined what it sees as the obstacles the country faces within its carbon capture storage supply chain.

Equipment that is necessary for delivering CCS in the UK such as compressors, gas blowers and pumps were al outlined as stumbling blocks in the Department for Energy Security and Net Zero’s UK CCUS supply chain assessment.

This comes as the UK CCS sector is awaiting the announcement of the projects to be awarded funding through the government’s Track 2 funding round, a process in which the north-east of Scotland’s Acorn project is said to be a front runner.

What is limiting the supply chain?

In the government report, an assessment has been made on equipment components and how the UK supply chain is placed to handle the demand for this infrastructure.

The Department for Energy Security and Net Zero (DESNZ) has colour coded each component with how well-suited the supply chain is to deliver them, using a traffic light system.

In this section of the document, 12 components are listed and only three are green, while four are coloured red and the rest are amber.

One component that fell under red, or ‘low’, is pumps. The DESNZ explains that “it is hard for the UK to compete with well-established existing overseas supply chains,” in relation to this infrastructure.

The document explains that pumps do not typically claim a large share of the capital expenditure (CAPEX) of the CCS supply chain, however, it concedes that they are still “required throughout.”

Compressors were also listed among the components the UK supply chain is ill-equipped to deliver with the document outlining that “significant capital investment” is required to “enable a widespread connected CCS chain in the UK.”

If the UK does decide to step up its compressor manufacturing capabilities, new infrastructure would have to be purchased as there is “limited possibility to retrofit installed, operating infrastructure.”

In addition to the weak supply chain for this component, most expertise and products are being sourced abroad in relation to compressors.

The UK is not unique in its issue with this component, DESNZ explains that the international supply chain faces a “bottleneck” when it comes to delivering compressors for CCS as there is “competition with other industries.”

The report also outlines: “Given the UK’s limited expertise and lack of established manufacturing facilities, prioritising UK centrifugal compressions manufactures would be high-risk.”

A third red flag for the domestic supply chain was gas blowers, according to the report.

For these components, the UK has the capability to manufacture but according to the government, the domestic supply chain will struggle to compete with already well-established supply chains in Europe which already have manufacturing facilities.

The final component that the DESNZ outlined as a stumbling block for the domestic supply chain was liquid carbon dioxide storage tanks.

The report says the UK has the capability to produce tanks “but many are currently imported from overseas.”

Much like pumps, tanks are described as having “a relatively small expenditure across the CCS chain.”

The green and amber components

The remaining eight components that were colour-coded green and amber are as follows:

- Column Vessels – labelled a “significant opportunity for the UK” – Green

- Heat Exchangers – the UK has “a number of companies” offering turnkey solutions – Green

- Basic Process Control System – the work is described as “a critical opportunity area” – Green

- Column Internals – “There is an opportunity to develop this supply chain in the UK” – Amber

- Filters – The report finds that the UK is “well positioned” to manufacture filters – Amber

- Metering – Despite holding “relatively small CAPEX”, the report finds “potential for integration with control systems, and software-driven data collection and analysis from meter readings” – Amber

- Line Pipe – there is a reported ” large opportunity” for the supply chain, however, there is also a “high risk to develop CO2 pipeline production in the UK” – Amber

- Jackets – The report concedes that it would be “challenging” for the UK to compete with overseas firms, however, domestic yards have diversified for offshore wind in recent years – Amber

The UK’s ambitious CCS strategy

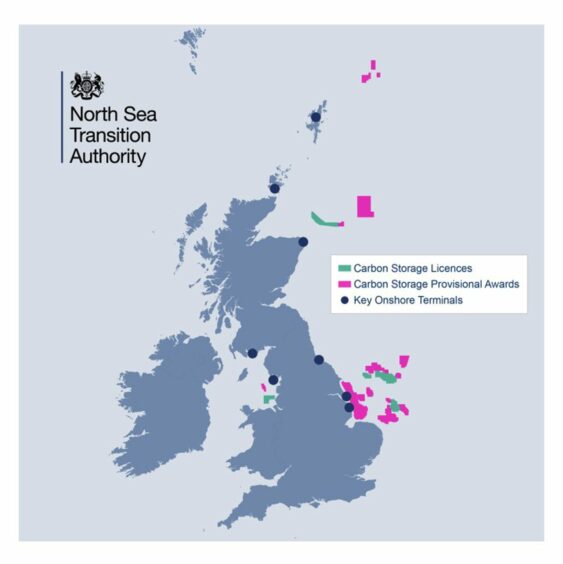

Recently, a survey conducted by The Crown Estate and Crown Estate Scotland found that the UK carbon capture utilisation and storage sector has ambitions to bring 37 projects online by 2035.

Respondents to the survey also outlined plans for a total of 62 projects to be up and running by 2050.

The industry displayed a want to bring CCS to all regions of the UK, with the Southern North Sea being “of particular interest.”

Currently, the UK government’s strategy is to store up to 30 million tonnes of carbon dioxide by 2030.

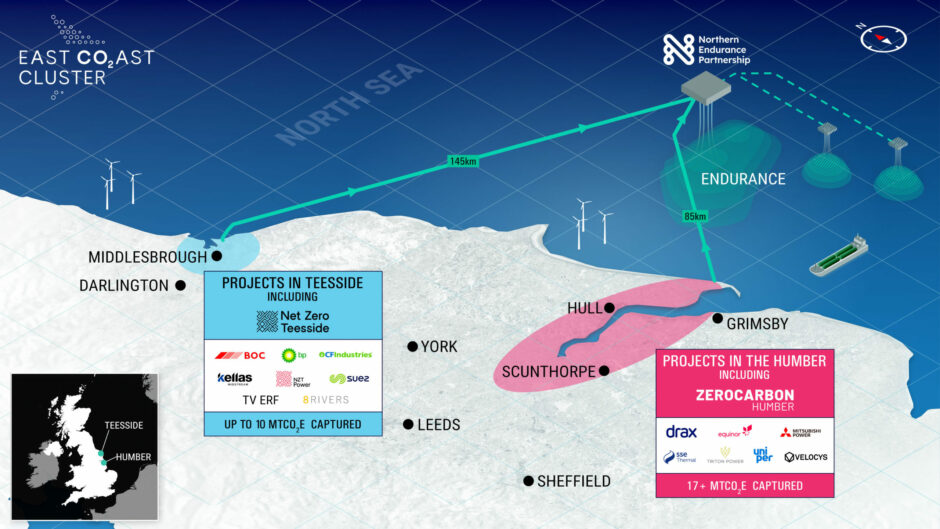

In 2021, the UK government split £1 billion between The East Coast Cluster and HyNet as it announced the two projects were the winners of its Track 1 funding round.

Both projects look to cut the country’s carbon emissions by the middle of the decade.

The East Coast Cluster looks to decarbonise industrial emissions around the Humber and Teesside and has the potential to transport and securely store nearly 50% of all UK industrial cluster CO2 emissions.

HyNet is a project backed by Italian operator Eni that aims to remove industrial emissions from north-west England and north Wales.

Recommended for you

© Supplied by NSTA

© Supplied by NSTA © Supplied by Storegga

© Supplied by Storegga © East Coast Cluster/ BP

© East Coast Cluster/ BP