American oilfield services firm SLB (NYSE:SLB) has finalised its acquisition of a majority stake in Norway’s Aker Carbon Capture (ACC).

SLB announced the $382m deal to purchase an 80% stake in ACC (OSL:ACC) and form a new joint venture company in March this year.

Under the deal, ACC will retain a 20% share in the new company, with conditions for board representation and other governance and minority protection rights included in the deal.

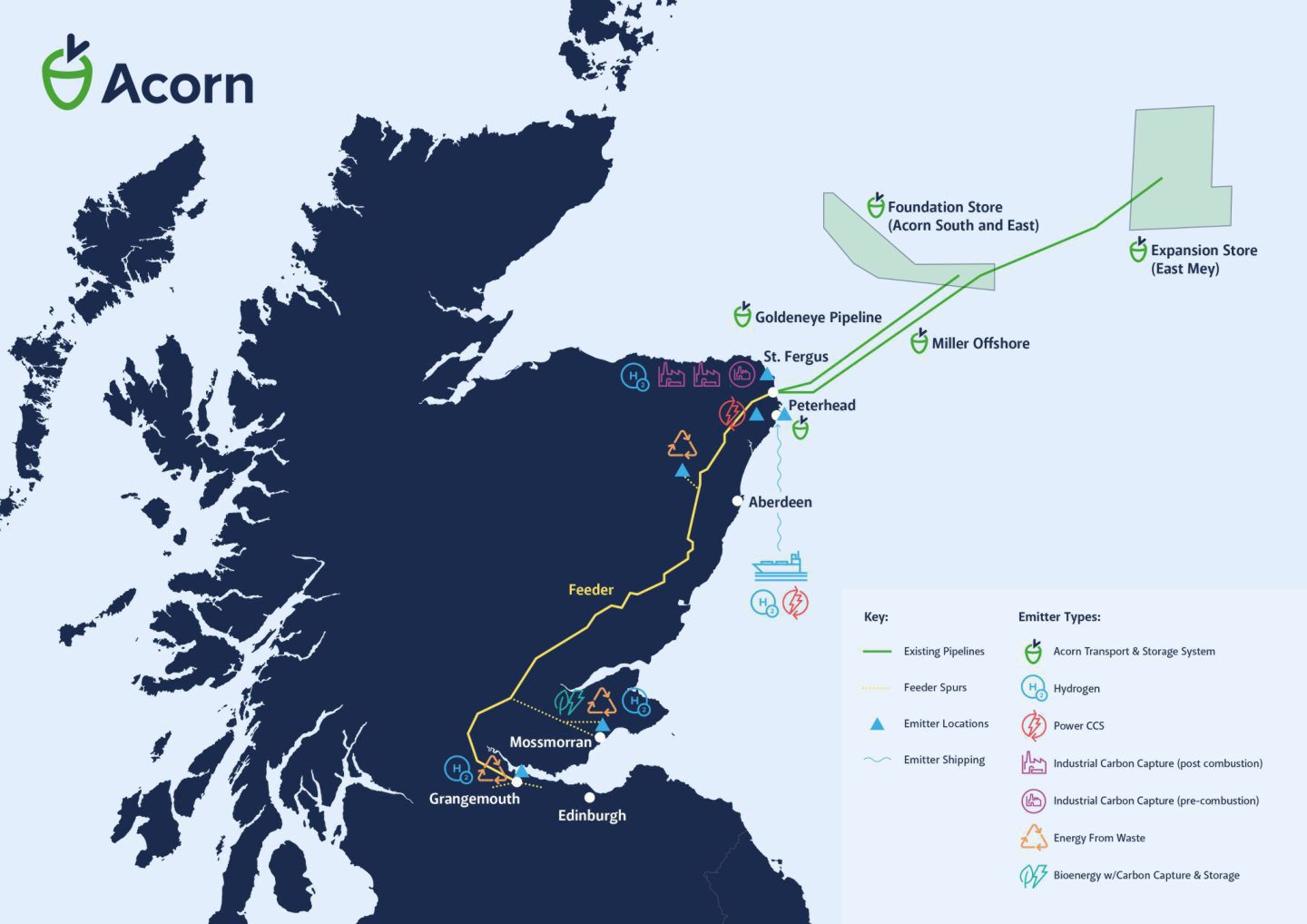

ACC is involved in several UK carbon capture, utlisation and storage (CCUS) projects, including the Acorn CCS project near Peterhead alongside Storegga.

The company is also involved in the Brevik CCS project in Norway, the Ørsted Kalundborg CCS project in Denmark, and the Twence CCU project in the Netherlands.

Announcing the closing of the deal, SLB said the new company will support “accelerated carbon capture adoption for industrial decarbonization at scale”.

SLB New Energy president Gavin Rennick said there is “no credible pathway” toward achieving net zero without deploying carbon capture and storage (CCS) at scale.

“In the next few decades, many industries that are crucial to our modern world must rapidly adopt CCS to decarbonize,” Mr Rennick said.

“Through the joint venture, we are excited to accelerate disruptive carbon capture technologies globally.”

SLB said the new, so far unnamed, company will be headquartered in Oslo.

SLB-Aker Carbon Capture joint venture

Separately, ACC announced changes to its executive team following the closing of the deal.

Current chief executive officer Egil Fargerland will step down from his role to take on the CEO position at the new joint venture.

Meanwhile, former ACC CEO Valborg Lundegaard, who held the position from 2020 to 2023, will return to the top job.

SLB said the new company will combine several of ACC’s modular and offshore carbon capture technologies with SLB’s portfolio of technology solutions.

SLB said the company currently has seven CCS installations in progress which will have the capacity to capture up to one million tonnes of CO2 emissions per year.

Mr Fagerland, said there is no “business as usual in the push toward net zero”.

“We will accelerate decarbonisation today and commercialize innovative technologies for the future,” Mr Fagerland said.

“We are proud of the carbon capture plants we are delivering across various industries, with each customer being an important front-runner in its segment.

“Successful project deliveries are paving the way for other emitters to follow.”

SLB’s acquisition of ACC in March came shortly before the firm announced a deal worth approximately $7.75 billion in stock to buy smaller rival ChampionX.

© Supplied by Storegga

© Supplied by Storegga