A new report on UK carbon capture and storage (CCS) progress finds its ample pipeline and sound ambition could yet be undermined by the risk of delays and cancellations.

The report from Westwood Global Energy Group shows that the UK can exceed its 2030 CCS targets if all projects maintain their proposed timelines, but cancellations or under-delivery pose a “significant risk.”

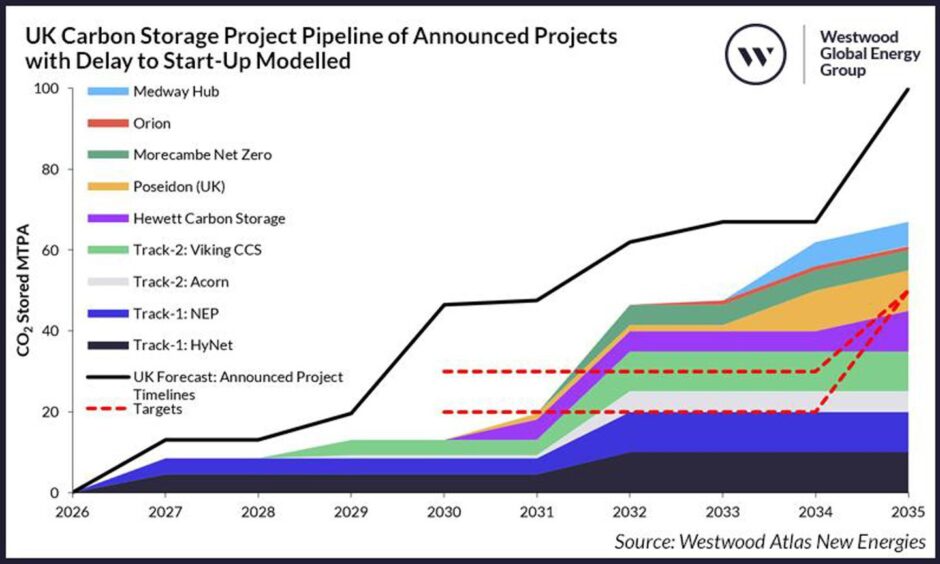

By 2030, there is potential for up to seven carbon storage sites with capacity for over 45 million tonnes per annum – double the lower end of its target for between 20-30m tonnes. Beyond that, it finds the UK is also well-placed for its 2035 ambitions and could even reach more than double its 50m tonne per annum target.

Currently eight projects are set to receive support across the two ‘cluster’ schemes – East Coast Cluster and HyNet – which secured backing under the 2021 “Track 1” sequencing process, with a further ten CCS elements in the two confirmed “Track 2” clusters, Acorn and Viking.

Yet timely delivery of this project pipeline is essential, with Westwood finding that “even minor delays” to later-stage schemes would mean missing the 2030 deadline.

The group’s new energies research manager Stuart Leitch noted: “While the forecast carries an optimistic outlook, project targets and reality can often differ.

“Delays and project under-delivery are not uncommon, and Westwood scenario analysis highlights the importance of the government’s support to ensure the prompt commissioning of projects to reach its own targets.”

It follows separate analysis by the Institute for Energy Economics & Financial Analysis which found that current Track 1 cluster capacity was unlikely to meet levels set out by the Climate Change Committee (CCC) in its Sixth Carbon Budget.

Supply chain and regulatory bottlenecks

The warning comes despite a successful inaugural Carbon Storage Licensing Round this year, in which additional acreage was secured for Acorn, Northern Endurance Partnership and Viking projects.

A further six licences associated with five storage projects outside of the cluster sequencing process won bids, also targeting ambitious timelines, including areas that would help unlock the Poseidon and Orion projects, the Medway Hub and CCS efforts around Sullom Voe, among others.

Westwood notes that few cluster projects are expected to take a final investment decision until funding has been awarded. “The UK Government risks becoming a bottleneck in project schedules as it progresses with the Track-1 and Track-2 clusters,” it said. Meanwhile the actual financial support mechanisms available for projects outside clusters are “currently unknown” – again precluding progress.

It also cautions that not all licences may proceed to a full storage permit application as firms deal with the reality of geological and commercial aspects of development while they appraise depleted fields.

Then there is the nature of the work programmes themselves notes that of the 21 licences awarded in the Round, there are “four firm wells and nine contingent wells, as well as four firm and five contingent 3D seismic data acquisition commitments,” – all of which will increase demand for seismic vessels and rigs.

Access to CO2 itself may also pose a challenge, with operators “unwilling to construct T&S systems that have the potential to remain idle for an extended period while awaiting a supply of CO2.”

“Some projects are likely to be considering importing CO2 from abroad and while bilateral agreements between countries can help circumvent the London Protocol, which prohibits the transfer of CO2 between countries for permanent storage, there is still uncertainty of how the UK Emissions Trading Scheme (ETS) and EU ETS will interact. For instance, whether a UK storage operator will be able to take on liabilities for allowances awarded to an EU ETS emitter,” the authors note.

Further hurdles lie in the challenges of co-locating CCS schemes with offshore wind farms and existing oil and gas fields. In the latter case, hopes to re-use crucial infrastructure will also depend on their suitability and integrity, with project schedules and economic viability potentially hampered if developers are forced to replace or install new equipment.

“Project delays are not the only risk to the storage targets. Some projects will under-deliver while others may even be cancelled,” Westwood notes.

“It is also worth noting the target is to ‘capture and store’, not to install the infrastructure to store. Any complications with the capture facilities, such as capture rates being less than anticipated, will also hamper the likelihood of targets being met.”

Senior analyst for northwest Europe Catherine Horseman-Wilson added: “The industry is grappling with a series of challenges, from funding delays and congested work programmes, to access to CO2 and co-location and infrastructure re-use difficulties, so the likelihood of delays can’t be ignored.

“The UK has a significant opportunity, with a strong capability to surpass its targets, but contingency planning will be a crucial element in securing its full potential, particularly in ensuring the strict adherence to schedules and maintaining a reliable CO2 supply.”

© Supplied by Westwood

© Supplied by Westwood