Weeks after the North Sea Transition Authority (NSTA) finalised its first carbon storage licensing round, successful applicants are beginning to lock in industrial partners as the nascent sector takes shape.

Last month, the UK government outlined its first carbon capture, utilisation and storage (CCUS) vision, setting out the next steps towards developing a ‘self-sustaining’ market for the technology.

The 63-page document identified three phases of development for the CCUS sector: a ‘market creation’ phase until 2030; a transition phase between then and 2035; and ‘self-sustaining market’ from 2035 onwards.

With a recent report stating the UK’s CCS capacity is likely to fall short of 2030 targets, the pressure is on as the first NSTA licensed projects begin their journey towards a final investment decision (FID).

But as the wide range of offshore CCS projects move closer to starting up operations, where are they planning to source carbon dioxide from?

Peak Cluster & Morecambe Net Zero

One of the clearest visions so far outlined is a collaboration between North Sea operator Spirit Energy’s Morecambe Net Zero (MNZ) CCS project and a group of UK cement and lime producers known as the Peak Cluster.

Based in Derbyshire and Staffordshire, Peak Cluster members account for 40% of the cement and lime produced in the UK.

The two parties signed a memorandum of understanding in September to explore options to capture emissions from the industrial plants and store it in the MNZ site off the coast of Barrow-in-Furness.

The site has the potential to store up to one billion tonnes (1Gt) of CO2, making it one of the largest potential stores in Europe.

Cement and lime decarbonisation

Peak Cluster project director John Egan told Energy Voice the nature of the cement and lime manufacturing process means the only technology available to decarbonise the industry is carbon capture.

“For the majority of manufacturing industries, emissions typically come when a fuel is burned for heat,” Mr Egan said.

“With cement and lime production, there’s a fundamental difference in that the majority of the carbon dioxide emitted is actually coming from the raw material.

“There’s a lot of carbon locked up geologically in that raw material and when it’s processed to make cement and lime, CO2 is released.”

As a result, Mr Egan said approximately two thirds of the CO2 emissions from the Peak Cluster comes from the raw materials.

“The source of it matters, because that means we can’t fuel switch the problem away,” he said.

“We can’t electrify the problem away because the majority is actually there embedded in the raw material. So globally this is a really big challenge.”

Worldwide cement manufacturing accounts for approximately 7.5% of all CO2 emissions Mr Egan said, making CCS technology “vitally important” to reduce its climate impact.

Spirit Energy MNZ

That’s where Spirit Energy’s MNZ project, centred on the depleted Morecambe gas fields and Barrow Terminals, comes in.

Using direct air capture (DAC) technology, emissions from the Peak Cluster partners will be captured and transported via a proposed underground pipeline to Spirit Energy facilities near Barrow.

The company’s energy transition director Matt Browell-Hook told Energy Voice that “hard to abate” industries are a key focus for MNZ.

“The value proposition of the combination of Peak Cluster and MNZ is massive,” he said.

“On top of the Peak Cluster, we want to look at potential shipping solutions, potential rail solutions, for other hard to abate and hard to reach emitters and then develop an energy park as well around our Barrow site.

“Investing in the local area, creating green jobs and also capturing those emissions associated with that industrial activity and sequestering it offshore.”

Mr Browell-Hook said Spirit Energy will invest £10 million in 2024 to undertake seismic surveys at the Morecambe gas field site, with plans for the project to be fully operational by 2030.

When up and running, MNZ will have capacity to store 25 million tonnes of CO2 per annum (Mtpa), with up to 4Mtpa potentially coming from the Peak Cluster.

According to an economic impact report, the Peak Cluster project will create 1,500 new jobs and provide a £180 million boost to the region’s economy.

With the UK a net importer of cement, Mr Egan said policy measures like a carbon levy will help make projects like the Peak Cluster more financially feasible and help attract investment.

NSTA carbon storage licenses

In total, the NSTA awarded 21 offshore carbon storage licences to 14 companies in 2023.

In addition to Spirit Energy’s MNZ project, three other projects have the capacity to store approximately 1Gt of CO2.

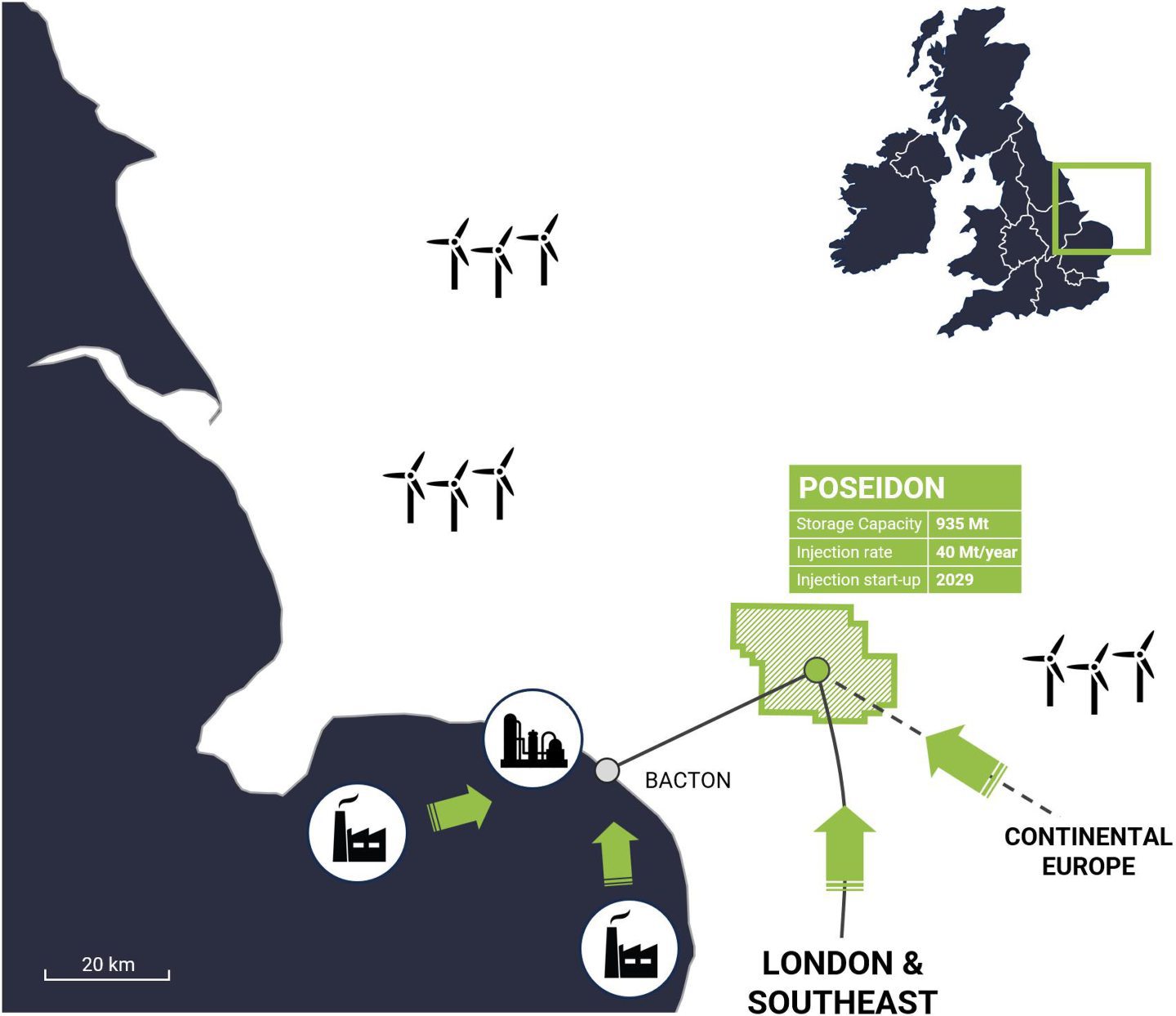

The Poseidon Project, centred on the Leman gas field offshore Great Yarmouth, is aiming to store 10Mtpa of CO2 using pipelines from the Bacton Energy Hub and the Thames Estuary.

The project, which developers Perenco UK and Carbon Catalyst say has the potential to significantly decarbonise East Anglia, Greater London and the Southeast of England, is due to come online by 2029.

A potential future pipeline to industrial sites in Belgium is also being considered, and the project could also facilitate hydrogen production in Bacton.

Northern Endurance Partnership

Meanwhile, BP and Equinor are collaborating on the 1GT Northern Endurance Partnership (NEP), which will capture emissions from East Coast Cluster (ECC) industrial sites.

The ECC was selected in 2021 to receive funding under the UK government’s ‘Track 1’ cluster process.

Encompassing “Britain’s historic engine room”, the ECC includes businesses associated with the Zero Carbon Humber and Net Zero Teesside initiatives.

The Humber region emits more CO2 than any other UK industrial cluster and the NEP, among several other CCS projects, aims to capture emissions across refining, petrochemicals, manufacturing and power generation operations.

Companies partnering with NEP from the Net Zero Teesside cluster include gas and fertiliser manufacturers, energy-from-waste plants and two bioenergy projects.

Following the release of the CCUS Vision, the UK government and NEP announced an agreement on the key commercial principles for the project.

NEP general manager Chris Daykin said the agreement was a “crucial step” in the decarbonisation of the region and FID is expected in 2024.

The final 1Gt CO2 storage project is EnQuest’s CCS project located East of Shetland.

Spread across four licences, EnQuest plans to utilise its Sullom Voe terminal on Shetland to enable direct CO2 imports via shuttle tankers.

The CO2 will then be transported via the existing East of Shetland pipeline for injection into the EnQuest operated Magnus and Thistle fields and non-operated Tern and Eider fields.

CCS projects taking shape

Other projects to receive an NSTA licence include the Bacton Thames Net Zero (BTNZ) initiative led by Italian oil and gas firm Eni.

The 330Mt capacity project will use a pipeline to transport CO2 from industrial emitters in the Thames Estuary to be stored in the depleted Hewett gas field off the coast of Bacton in Norfolk.

Eni says the BTNZ involves “more than 10 substantive entities”, including power and energy-from-waste companies in the Thames Estuary and London areas.

In addition, the consortium also involves hydrogen developers “seeking to produce and distribute zero-carbon and low-carbon fuels for industrial fuel switching, domestic heating and transportation”.

In addition to the NSTA licence covering the BTNZ initiative, Eni previously received an offshore CO2 carbon storage licence covering fields in the Irish Sea in 2020.

Connected to the separate HyNet North West project, the licence covered the Hamilton, Hamilton North and Lennox fields off the coast of Liverpool.

Industries set to make use of CO2 storage through HyNet North West include cement, construction materials, oil refining, recycling and waste management, low carbon hydrogen and waste-to-energy generation.

Eni expects to be able to store 10Mtpa of CO2 before the end of the decade.

Neptune Energy and Shell/Esso yet to outline plans

While developers have largely outlined plans for the remaining Acorn, Viking, Medway Hub and Orion CCS projects, the plans for the CCS licences awarded to Neptune Energy and Shell/Esso have yet to be publicly announced.

A spokesperson for Neptune Energy declined to comment on its future plans for its UK CCS licences other than confirming the three licences Neptune received cover areas with the potential to store around 350 million tonnes of CO2.

However, documents outlining the company’s “North Sea CCS Vision” propose “integrated energy hubs, using existing infrastructure to facilitate CO2 storage”.

Neptune Energy also recently announced progress on the L10CCS carbon storage scheme off the Netherlands, with FID now targeted in 2025.

Meanwhile, following the NSTA awarding three licences off the coast of Norfolk to Shell and Esso, Shell said the company “will now evaluate these areas and potentially develop them into sites where carbon captured and transported from industrial facilities can be safely and permanently stored, subject to future regulatory approvals and financial investment decisions”.

Within the UK, Shell is also part of the Acorn CCS project and proposals for a South Wales Industrial Cluster.

In total, globally the London-listed supermajor has three CCS projects in operation, 12 in development and another six in early stage studies.

© Supplied by Spirit Energy

© Supplied by Spirit Energy © Supplied by Spirit Energy

© Supplied by Spirit Energy © Supplied by CCL / Perenco

© Supplied by CCL / Perenco © Supplied by OMC

© Supplied by OMC