UK firms Costain Group (LON:COST) and Wood (LON:WG) have hailed the “monumental” projects starting after two landmark carbon capture and storage (CCS) projects in the North East of England got support to go ahead Tuesday.

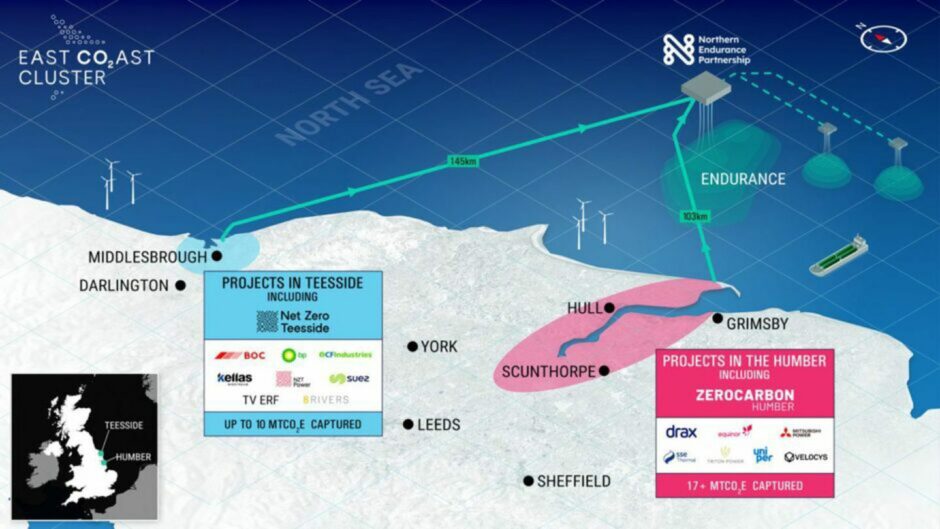

Planned CCS works for the East Coast Cluster got the green light from regulators which has enabled developers to commit to final investment decisions (FID), delivering a boost to contractors.

Costain and Wood did not confirm the value of the contracts on offer from Northern Endurance Partnership (NEP), which include the likes of BP (LON:BP), TotalEnergies (PAR:TTE) and Equinor (OSLO:EQNR). However overall the CCS projects are expected to require investment of £4 billion and employ 4,000 people.

Trade body offshore Energies UK (OEUK) said construction work will start in the middle of next year and will directly support around 2,000 jobs in the North East of England, as well as protecting thousands of jobs at existing industrial sites that are only able to transition to net zero by the capture and storage of their carbon emissions.

Start-up of the project, expected in 2028, will see hundreds of millions of tonnes of carbon dioxide pumped into subsea aquifers off the coast of the region.

The permit, confirmed by the North Sea Transition Authority (NSTA), enables the NEP to inject up to four million tonnes of CO2 a year for 25 years into Endurance, a saline aquifer 4,265 ft (1,300m) deep located some 47 miles (75km) east of Flamborough Head, off the Yorkshire coast.

The carbon will be pumped via a 90mile pipeline to vertical CO2 injection wells.

Costain said it will deliver and manage the engineering, procurement and construction (EPCm) of the Northern Endurance Partnership’s (NEP) onshore CO2 gathering system on Teesside, and associated utilities for the 860MW Net Zero Teesside Power (NZT Power) gas plant.

Wood said will be responsible for providing specialist support services including project and construction management, engineering and technical assurance, information management and digital systems integration across all the nine contractors involved. It added 100 Wood employees will be hands on at project peak.

NZT Power is now on track to be the world’s first gas-fired power station with carbon capture and storage, the partners claim. NEP will provide the CO2 transportation and storage infrastructure for three Teesside-based carbon capture projects including the gas plant as well as two further projects led by energy giant BP, H2Teesside and Teesside Hydrogen CO2 Capture.

The confirmation to proceed follows Costain’s completion of the front-end engineering design (FEED) for the carbon capture network, and its appointment to deliver the FEED for the cluster’s hydrogen network.

Sam White, managing director, natural resources at Costain, said: “This announcement is a significant step towards UK decarbonisation.

“We’re working with Net Zero Teesside Power and the Northern Endurance Partnership, their partners and the supply chain to deliver a world-class CO2 gathering network, utilising our first-class capabilities in consultancy, engineering and construction.”

Wood has been involved with the project since 2019, providing concept, pre-front end engineering design (pre-FEED) and front-end engineering design (FEED) packages.

Craig Shanaghey, executive president of projects at Wood, said: “As a UK headquartered company, continuing to support a world-leading decarbonisation project in our own backyard is monumental.

“Our integrated team working closely with Net Zero Teesside Power and Northern Endurance Partnership is leading the energy transition by designing and advancing the energy ecosystem. We are proud to be a strategic ally through the full lifecycle of this project from inception to operation.”

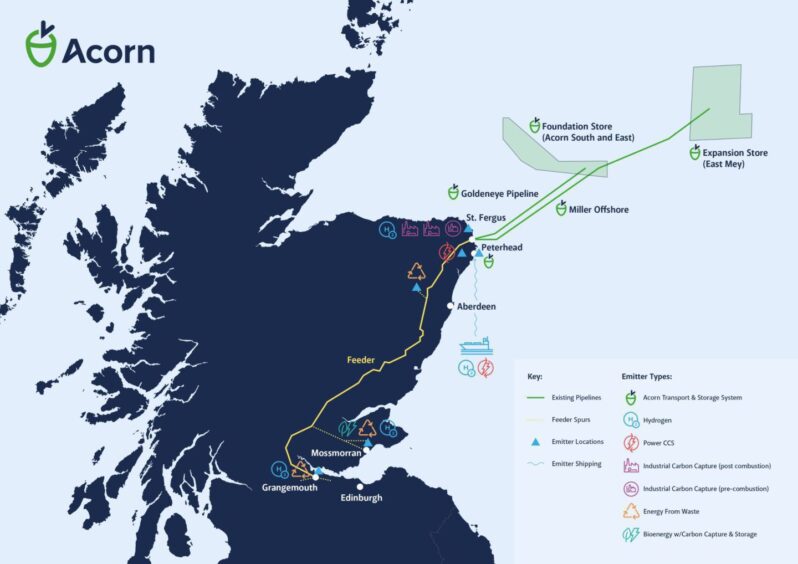

OEUK said some of its member companies were involved with the projects, but that government needed to press on with further CCS projects including the Acorn project in Aberdeenshire.

Both the Teesside CCS projects and HyNet in the North West of England – so called “track 1” schemes – were backed with £21.7bn of UK government support in October, but others such as the “track 2” proposal at Peterhead and another on Humberside have been left in limbo.

OEUK chief executive David Whitehouse said: “We must keep the momentum going if we are to achieve our net zero targets. Track 2 carbon storage clusters for the Acorn project in Scotland and Viking on Humberside will require clarity on funding timelines to move forward.

“Clusters that are maturing outside of the cluster sequencing process also need a clear route to market.

“We need government support to deploy initial CCUS infrastructure, but we must find ways to transition to a market-based model as soon as possible.

“OEUK will deliver a report in early 2025 outlining how the UK’s CCS sector can transition from the current subsidy-based regime to achieve this.”

CCS still “risky”

Richard Power, partner and energy industry disputes lawyer at global law firm Clyde and Co, said the final investment decision for the projects was a “major step” albeit it was also likely to be “controversial and technologically, legally and economically risky”.

He said: “Critics of CCUS argue it is a fig leaf – it is an excuse to prolong the use of fossil fuels rather than phase them out as quickly as possible. But the counter-argument is that renewables cannot provide a complete substitute for hydrocarbons, and for hard to abate industries, CCUS offers a relative immediate, practical solution to greenhouse gas emissions.

“Technologically, the challenge is to build and operate the CO2 capture, transmission and storage equipment and infrastructure which operates efficiently and safely, at scale.

“Legally, the challenge is to develop a legal and regulatory framework that creates a CCUS economy, incentivising private investment be creating a market for the capture and storage/use of CO2.

“The UK Government has done this via a regulated market for licenced operators, with a contracts for difference (CfD)-style contractual mechanism that provides market entrants with a guaranteed level of income to remove some of the pricing risks of this nascent market.

“CfDs worked to stimulate the UK’s offshore wind market, but the question is whether the same model will work effectively to support a different technology with potentially different market dynamics.

“Furthermore, as with most energy projects, and especially those involving hydrocarbon-based energy, it remains to be seen whether legal challenges will be launched by environmental groups, which could hold up development even if ultimately unsuccessful.”

Recommended for you

© Supplied by Equinor

© Supplied by Equinor © SYSTEM

© SYSTEM © Supplied by Storegga

© Supplied by Storegga