Siemens Energy is confident that hydrogen will assure a green future for its gas turbine technology – the question is whether there will be enough green fuel to go around.

In an energy market that is increasingly looking away from gas for heat and power generation – as much for economic reasons as climate concerns – is there a future for the stalwart gas turbine?

“It’s a big debate, and it’s also a matter of perspective and a matter of timeline,” muses Karim Amin, a member of Siemens Energy’s executive board and vice president for its generation business. He is however, confident there is.

It is perhaps unsurprising given Siemens Energy’s considerable stake in the turbine market, but in the medium term it’s clear that the technology isn’t going anywhere.

Citing IHS Markit data, Mr Amin said capacity forecasts have moved upward in the past two years, with average annual additions over the next decade expected to rise from 44GW/year in 2020 to 57GW/year in 2021. Forecasts in early 2022 now suggest this will rise north of 60GW/year.

“There is a lot of pressure on moving away from gas, pushing more towards renewables, which is true, but at least in the mid-future the thread is that we are adding more gas,” he continued.

Nevertheless, the German-headquartered energy giant is looking to future-proof its offering, building gas turbines capable of burning increasingly greater blends of hydrogen in with natural gas.

Round the blend

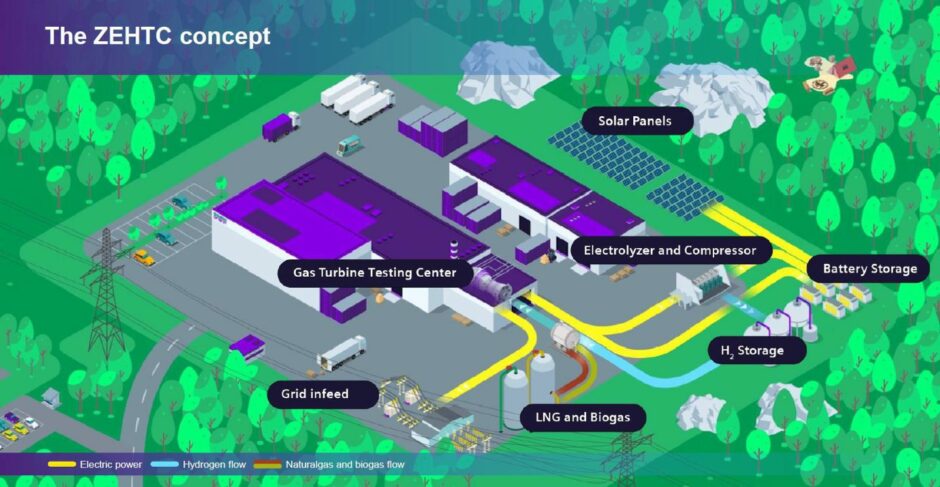

In support of this move, Siemens has added facilities at its manufacturing site in Finspång, Sweden, creating what it calls the Zero Emission Hydrogen Turbine Center (ZEHTC) and visited by Energy Voice as part of a press delegation in early September.

When new turbines are tested ahead of dispatch to clients, excess electricity is combined with output solar panels and used to produce hydrogen in an electrolyser. That hydrogen is then stored and can be used later as a fuel for further gas turbine testing.

The addition of batteries also creates a local microgrid for the plant, and a grid connection means it is even capable of exporting electricity, if and when required. Though it remains at a small-scale, the integration of various generation and storage methods mirrors the wider energy system of the future.

In many ways, qualifying units to accept green fuels is a sustainable approach to dealing with the huge volume of plant that will remain in operation throughout the decades-long energy transition.

“There are tens of thousands of gas turbines out there in the world. Not all of them will just die and disappear when we undergo an energy transition,” noted Hans Holmström, managing director of the company’s Swedish business.

“A lot of them will be transformed into step by step, burning more and more non-fossil fuels.”

That qualification is already underway, with the vast majority of the group’s heavy-duty gas turbines capable of “co-firing” with blends of up to 30% hydrogen.

Many other units for industrial applications can already accept higher blends ranging up to 75%, while an SGT-A35 model with a wet low emissions (WLE) system is capable of burning 100% hydrogen.

More than 55 units around the world have been tested for these high hydrogen blends, amassing millions of hours of operation since the 1960s, the company says.

The result is a reduction in CO2 emissions of anywhere from 11% to 100%, depending on the blend (though the carbon impact of hydrogen production itself must also factor into calculations).

By 2030, it intends to reach 100% hydrogen on the heavy duty, dry low emissions (DLE) systems, while future developments would see some units accept other fuels such as cracked ammonia, biodiesel and green methanol.

‘How much have you got?’

The market appears to be interested in the possibilities, Mr Amin suggested, but was quick to press that the viability of hydrogen adoption is less about technological capability and more about ensuring sufficient supply.

“When you engage in discussions and so on, you always have the question: how much hydrogen your gas device can burn?” he said. “I have a simple answer and say: How much have you got?”

“You give me what you have, we will burn it! But how much have you got?”

This again plays into the importance of integrated energy networks, he continued, adding that the discussion usually prompts many more follow-up questions around how to transport hydrogen from production sites to generation plants, the costs involved, and how much energy customers are willing to pay for their power and/or products as a result.

“It’s not really the question of how much can you burn, it’s really how much can you create the infrastructure around it with the order of magnitude that we need and at the [right] affordability level,” he explained.

Efficiency is also a concern. Why bother retaining gas-burning equipment at all in a net zero system, if the long-term goal is to reach 100% renewable energy?

Aside from its dispatchability, Mr Amin said the utility and scale of gas-fired rotating equipment in the electricity market means hydrogen is a viable bridge solution to deal with the intermittency of renewable power – not to mention the additional efficiency gains of other applications such as combined heat and power (CHP).

“If we just fast forward, let’s say X number of years from now; if the grid investment is done, if the interconnectivity works, if the inertia is there, then you don’t need to have gas-fired rotating equipment,” he said.

“But until you get there, how do you use this bridge in a way that is least impactful on the environment? [In this case] you lose efficiency… but on the other hand side, you reduce CO2 – and the question is, is the cost of CO2 more important than the efficiency you lose, or vice versa?”

It is a question faced by governments and power generators across the world. But hydrogen or no hydrogen, the gas turbine appears unlikely to disappear from our energy system any time soon.

Recommended for you

© Supplied by Siemens Energy

© Supplied by Siemens Energy © Supplied by Siemens Energy

© Supplied by Siemens Energy