Concern has been raised that there will not be enough green hydrogen to fill the Net Zero Technology Centre’s (NZTC) pipeline from Scotland to Europe.

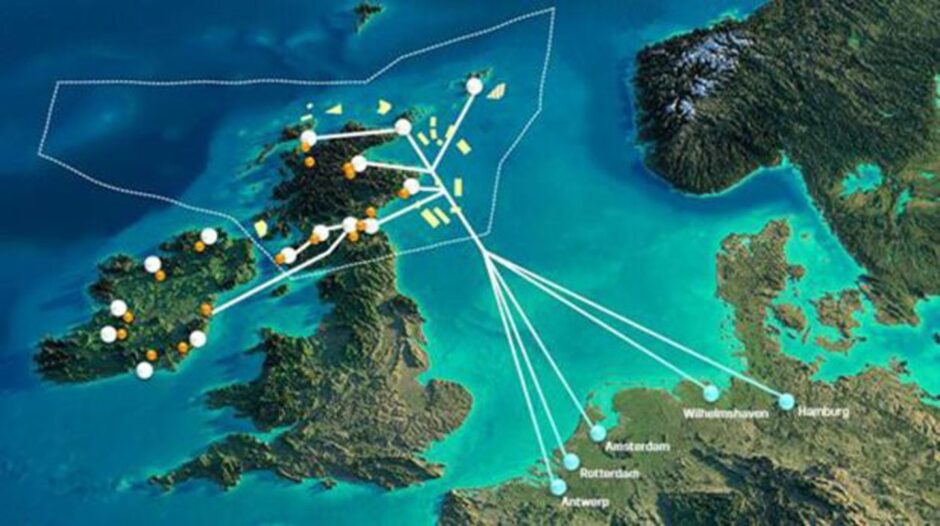

Aberdeen’s NZTC announced last year that it would be constructing a 10GW pipeline from Scotland to mainland Europe that would be exporting green hydrogen to the continent.

Despite recent reports that Scottish hydrogen exports could meet up to 100% of German import demand by 2045, programme manager for NZTC Darren Gee has raised concerns.

Mr Gee said: “If you look at the Scottish green economy scenario, we’re not going to fill the backbone unless we do something now that directly affects the probability of existing in the future.”

He pointed to work conducted by the Hydrogen Backbone Link’s (HBL) sister project, Energy Hubs, on the feasibility of large scale production of green hydrogen.

The programme manager continued: “It was on the back of some of the work that the Scottish Enterprise had done in terms of hydrogen production facilities and locations around the country, we identified 16 locations.

“Then we did some market segmentation on ‘what are the industrial uses for this?’… What that study positioned was that we’re asking the wrong question.

“The question we were asking was, what have we got and what do we do with it? And the question we needed to ask was what do we need? And how do we do it?

“Energy hubs in phase one had a look at where their industries are, a lot of the FIDs [Final Investment Decisions] for the likes of Kintore and Cromarty started coming through.”

Scotland’s hydrogen plans

The first stage of the HBL precedes the potential installation of hydrogen pipelines to export 35TWh of hydrogen from Scotland to Germany.

Meanwhile, the second phase looks at the period between 2030 and 2045, and involves the commissioning and ramping up of pipeline infrastructure to allow for up to 94TWh in hydrogen exports.

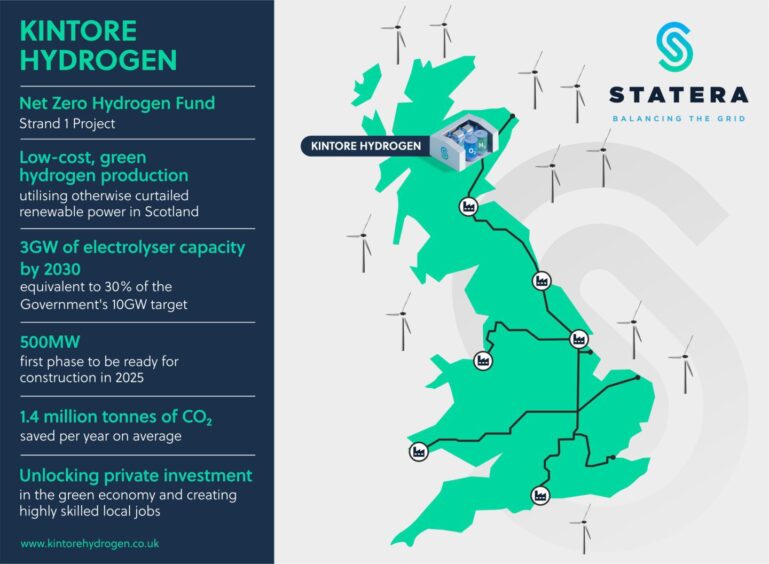

Recently, the firm behind Kintore hydrogen argued its 3GW project could rival Saudi Arabia’s Neom and the Port of Rotterdam.

In April Statera Energy hydrogen project director Don Harrold pointed to Shell’s 200MW green hydrogen project at the Port of Rotterdam and the 700MW H2 Green Steel in Sweden as some of the larger projects underway in Europe.

He said that Kintore is “up there more in terms of scale” pointing to the world’s largest utility scale, commercially based hydrogen facility in Saudi Arabia.

NZTC found that “there wasn’t an opportunity for decentralized production,” Darren Gee told Energy Voice.

He added that the Aberdeen-based organisation’s research found that “The Scottish view of hydrogen supply and demand was pretty mature.”

It was at the time of this research that the scale of the HBL was increased from 2GW to 10GW.

Mr Gee explained: “It went to 10 gigawatts based on the commercial economies of scale. At the same time, there was a sister projects within the program looking at alternative fuels for gas turbines, which quickly became reciprocating engines.

“What we realised is there’s a significant demand for alternative fuels, particularly within the North Sea where you can’t electrify things.

“There is a significant demand at a million tons of hydrogen that nobody is looking at.”

After discovering this perceived oversight, the NZTC’s Energy Hubs programme “pivoted” to start asking “how do we fill the backbone?”

The NZTC man continued: “Then we started having a look at large scale hydrogen production because transportation, as I said, is a is a major factor. If you look at the scale of the Staterra, that’s Kintore, I think they’re going to three gigawatts.

“The difficulty is how would they tie that in and where do they tie that in to? It’s much more aligned with their business case … about meeting national demand and not exporting and an awful lot of it.”

‘It’s just making the problem three times bigger’

Running into issues now surrounding the feasibility of filling the HBL lays out even more issues as Scotland presses forward with its hydrogen export plans.

“We believe that the size of the challenge in the 10 gigawatts is 1/3 of what the ultimate goal will be at the 30 gigawatts,” Darren Gee said.

“So, if you look at the Scottish green economy scenario, we’re not going to have enough to fill the backbone unless we do something now that directly affects the probability of existing in the future.

“When you times it by three, it’s just making the problem three times bigger.”

A recent report funded by the Scottish Government found Scottish hydrogen exports could potentially satisfy between 22% to 100% of Germany’s hydrogen import volume by 2045.

Overall, the report found ammonia emerges as the most feasible option for accelerating the establishment of hydrogen supply chains towards 2030, with its infrastructure and transportation capabilities already “well-planned and progressing”.

The report recommended subsidy mechanism for early projects, strengthening bilateral partnerships between Scotland and Germany, and investment in export infrastructure as among the key measures for developing a hydrogen supply chain.

The Scottish Government first announced plans for a £2.7 billion pipeline network connecting hydrogen hubs in Scotland to Germany last year.

The Hydrogen Backbone Link (HBL) could see an entirely new hydrogen pipeline linking the Flotta oil terminal in Orkney to the city of Emden in Germany.

It would also include a “backbone” connecting sites at Sullom Voe, the Cromarty Firth, and the St Fergus Gas Terminal in Aberdeenshire to the pipeline.

Working with supply chain

This is a major undertaking from an engineering and manufacturing standpoint and because of this, NZTC’s Darren Gee explained that he was already in conversation with key players in Scotland’s supply chain.

It is understood a north-east Scotland-based engineering services firm is already in talks to work on the HBL.

Mr Gee said that the project isn’t quite ready to offer up contracts, however, there will be work up for tender around 2027.

“We’re actively engaged with the supply chain now,” he said, explaining that work will “mostly” go to UK-based businesses.

The NZTC Programme manager added: “We’ve already got some of that suppliers here and some of them are them large valve manufacturers.

“We’ve engaged with some of the compressors we understand what types of compressors are more likely, but none of them make them at that scale.

“So, they want to assurance that if they invest in the scale and the and the size that we’re talking about, then they’ll get some refunds.

“We’re a little bit of a chicken and egg but we are actively having those conversations.”

© Supplied by NZTC

© Supplied by NZTC © Supplied by Statera

© Supplied by Statera © Supplied by NZTC

© Supplied by NZTC © Supplied by NZTC

© Supplied by NZTC