Fresh from putting shovels in the ground on a £350 million cable factory in Scotland, Japanese conglomerate Sumitomo has backed plans to develop hydrogen storage capacity with UK Oil & Gas in Dorset and Yorkshire.

UK Oil & Gas (AIM: UKOG) said the Japanese giant had provided a “letter of support” for its planned hydrogen storage schemes.

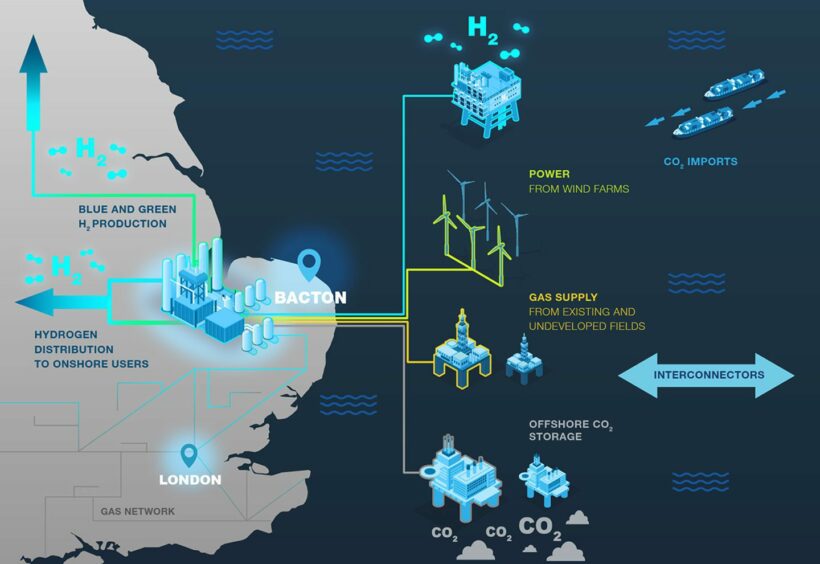

Sumitomo owns Summit Energy Evolution Ltd (SEEL), which is leading on the development of a 590MW CCS-enabled hydrogen production facility in Norfolk near the Bacton gas terminals, called the Bacton Hydrogen Hub (bH2).

Letter of support key to government funding

UKOG said the letter of support (LoS) meant Sumitomo would co-operate with the firm “with a view” in investing in its future hydrogen storage projects.

It also promises the potential that the projects could provide “keystone storage” of hydrogen for SEEL’s Bacton scheme.

Further, the letter is an “important step” in UKOG seeking government funding for its storage projects.

UKOG added it plans to apply for support in the UK’s first hydrogen storage allocation round. This is due to commence in the second-half of the year, after the summer general election.

Department of Energy Security and Net Zero (DESNZ) has stipulated applicants to the allocation round “will be required to furnish such LOS from identified hydrogen storage users and financial backers in order to be successful”.

UKOG is known for its oil and gas assets in the Weald Basin in southern England.

Through its subsidiary, UK Energy Storage (UKEn), it struck an agreement in 2022 to lease two sites at the former Royal Navy port in Dorset with Portland Port. It plans to develop an energy hub centred around a 1 billion cubic metre hydrogen-ready salt cavern gas storage facility.

SEEL was established after Sumitomo sold its Summit Exploration North Sea upstream assets to Ithaca in a deal worth $224 million in 2022.

UKOG CEO Stephen Sanderson said that “SEEL, the UK based energy transition subsidiary of one of Japan’s most significant global trading houses, Sumitomo Corporation, has recognised the strategic significance and potential material future value of our planned hydrogen storage projects”.

He added: “Their LOS will help ensure we meet the application criteria in DESNZ’s forthcoming Hydrogen Storage Revenue Support Allocation Round, a key step towards delivering our projects. We look forward to continued and fruitful cooperation with SEEL/Sumitomo and to securing further LOS from other potential storage users and investors”.

Markets welcomed the news with shares in the AIM-listed firm rising spiking 21.28% to 0.03p.