The UK’s offshore trade body said that the government’s energy transition ambitions do not match up with the ‘unpredictable’ fiscal policies surrounding oil and gas.

In a briefing marking the beginning of the UK’s first ‘Hydrogen Week’, Offshore Energies UK (OEUK) energy policy manager Will Webster said the low-carbon fuel could help underpin the country’s future energy system, but predictable regulations and taxation, as well as a steady flow of gas production licenses, would be essential to meeting targets.

Industry has plans to invest around £9 billion in up to 10 gigawatts (GW) of hydrogen infrastructure by 2030, but Mr Webster suggested many of the trade body’s members would be reluctant to commit cash without a stable framework from the UK Treasury.

It comes amid discontent around the effects of windfall taxes on the sector’s ability to invest in energy transition projects.

“We see a massive disconnect between the kind of detailed policy development government is doing across the whole range of topics – whether it’s renewables, wind, hydrogen etc. – where they are going into a lot of effort in developing incentive mechanisms, but at the same time we have a fiscal mechanism that is pretty unpredictable, we don’t really understand where it’s going, and it’s very unsupportive of investment,” he said.

“Across the energy sector there’s a huge disconnect there and that’s definitely something we’re talking to government and Treasury about – going back to something that’s a bit more long-term and will promote investment across the board.”

OEUK sustainability director Mike Tholen said that the main concern amongst investors in these projects was long-term certainty.

“People have to be confident that what they start today will still work two or three years’ down the road, never mind five or ten years,” he said.

“The current political dynamic coupled with the yo-yoing on fiscal [policy] makes it really hard to see our way through.”

Eyes on Spring Budget

It comes as many in the oil and gas sector have warned the UK Government’s Energy Profits Levy (EPL) has sent North Sea investor confidence to “an all-time low”, prompting job cuts and a reduction in planned capital expenditure.

Mr Tholen said many in the sector had been also “blindsided” by the scale of the Biden administration’s Inflation Reduction Act (IRA) in the US, with the UK now on the back foot as many multinational firms look to deploy capital elsewhere.

He pointed to some recent bright spots in the form of an investment decision on Shell’s Jackdaw project last year and a play-opening discovery at Pensacola in the southern North Sea last week. However, he also acknowledged that some companies such as Harbour Energy were facing severe challenges as to how they respond to the environment.

“There is a focus on some new developments longer term but a number of companies – not just the Harbours of this world – are scratching their heads on the nature of the basin and the nature of confidence.”

He also reiterated the sector’s call for a price floor mechanism to be built into the EPL, especially as commodity prices rebalance in 2023.

“As we look to the Budget we’ve been very clear we’d like to have some signals that as windfalls fall away the tax falls away with a price trigger,” he said.

“We’re cautious on picking a particular number… but what we will see if gas prices continue to ease and oil prices stay where they are is that profits will start to deflate as we get through this next year. Even a signal that there’s a conversation to be had will be very important to help set expectations.”

‘Rapid’ work needed on Acorn

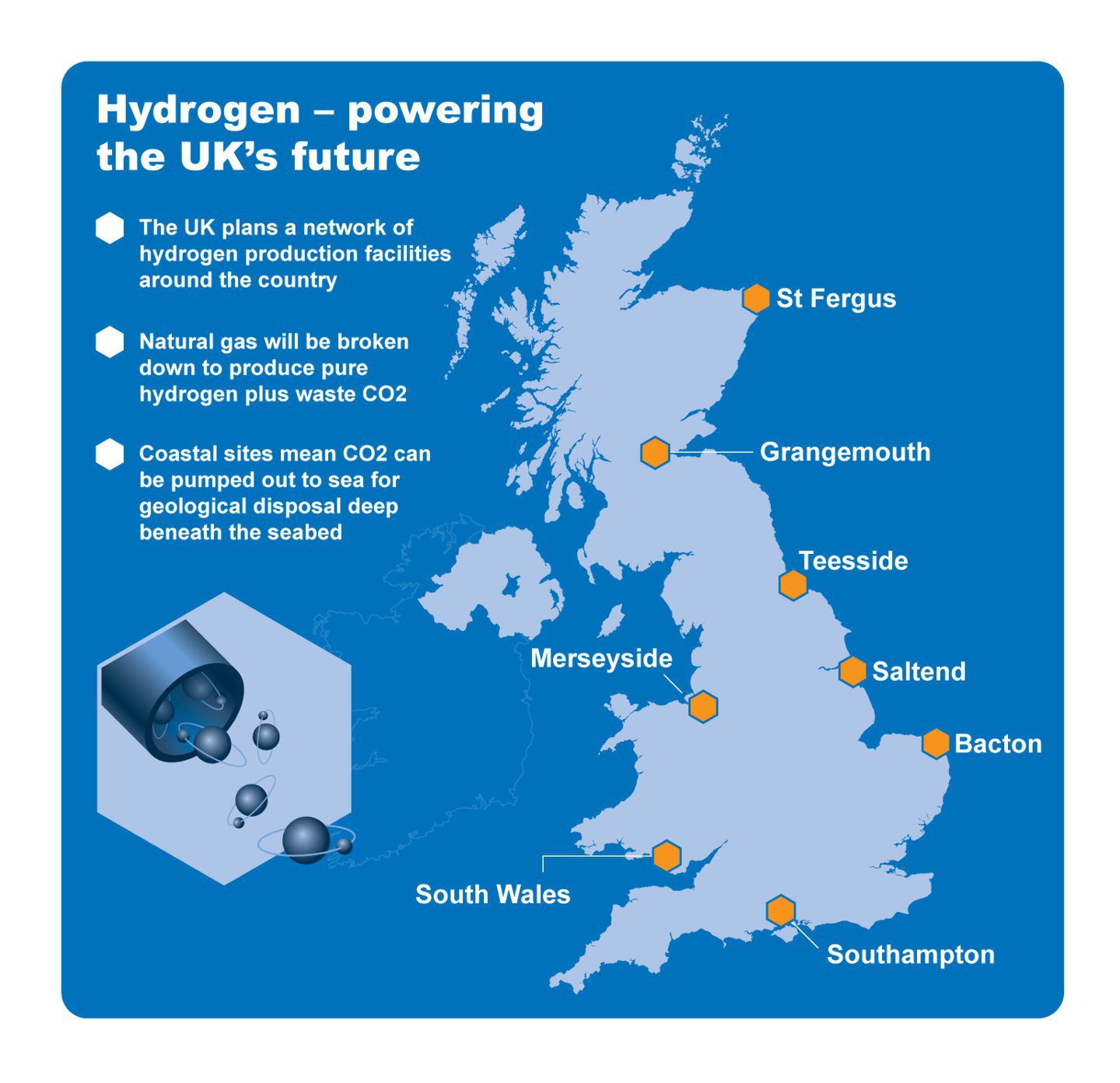

Under current targets the UK intends to establish up to 10GW of hydrogen production capacity by 2030, at least half of which should come from renewably powered electrolytic “green” hydrogen. The Scottish Energy Strategy meanwhile aims to produce 25GW in Scotland alone by 2045.

In the short term though, many supplies will come from methane with CO2 process emissions captured and stored (blue hydrogen).

Large industrial cluster projects will be central to both supply and demand, including the likes of the Acorn CCS project in north east Scotland.

With regards to Acorn and the wider Scottish Cluster, Mr Webster said that progress “needs to be more rapid”.

“It’s quite a well-developed project and we’d have liked to have seen it in Track 1, either in a bigger Track 1 or a more rapid follow-on in Track 2.”

“We’ve written to various secretaries of state on this topic a number of times and it’s one we see as very important for the story in Scotland around industry and the development of hydrogen as an alternative for business and domestic heating source.”

An update on the scheme is expected this spring, though both industry and the Scottish Government have put pressure on Westminster to provide more details to enable investment to proceed on schedule.

Mr Tholen said the scale of Acorn and its ability to accept seaborne CO2 from other regions and markets “really puts us into a different game”.

“The Northern Lights project in Norway already moving fast. We’ll be playing tail-end Charlie if we’re not careful and that would be a big pity.”

Recommended for you

© Supplied by OEUK

© Supplied by OEUK