The UK will likely need as much as £57 billion ($73 billion) in additional investment by 2030 to develop key industries that the incoming Labour government believes will help the country support green job growth and rely less on carbon.

The Labour party has already earmarked £7.3 billion of public funds to plow into a National Wealth Fund that will invest in industries like ports, green hydrogen and gigafactories that can produce electric vehicles and grid-scale batteries, according to a report by a taskforce that’s advising Prime Minister Keir Starmer’s new government on the creation of the fund.

Even after existing private capital flows are accounted for, though, that still leaves a funding gap of £35.9 billion to £56.9 billion between now and 2030, the report found.

“The challenge is clear,” the National Wealth Fund Taskforce, which is led by Green Finance Institute Chief Executive Officer Rhian-Mari Thomas, said in the report. “Even where clear policy direction is set, offering the certainty that investors require, there will still be projects going unfunded because levels of investment risk appetite sit beyond the thresholds of commercial investors.”

As part of the government’s plans, the UK Infrastructure Bank and the British Business Bank will be aligned under the new National Wealth Fund, the Treasury said in a separate statement. The government is planning to introduce new legislation that will make the wealth fund a permanent institution in the UK and will release further details about how it will work before an international investment summit later this year, the Treasury said.

“This new government is getting on with the job of delivering economic growth,” Chancellor of the Exchequer Rachel Reeves said in the statement. “We need to go further and faster if we are to fix the foundations of our economy to rebuild Britain and make every part of our country better off.”

Green energy investment

For years, lawmakers have batted around the merits of having the UK establish a sovereign wealth fund with politicians from both parties proposing different ideas for how to structure the fund. Barclays Plc Chief Executive Officer C.S. Venkatakrishnan and Mark Carney, the former governor of the Bank of England, have also been helping with the National Wealth Fund Taskforce in their personal capacity. Carney is the chair of Bloomberg Inc.’s board.

“We have to scale up,” Carney told the BBC on Wednesday in response to the reports’ findings, “and it starts with the initial allocation, which is significant.”

The taskforce recommended that the wealth fund be allowed to use a broad range of financial instruments, including equity, concessional debt, guarantees and price assurance products to pull off its mission. It should explicitly be excluded from issuing pure grants, the panel said, since that would unlikely deliver the expected return on investment.

“The NWF will reshape the way we approach public, private risk-sharing, providing private investors with the confidence needed to fund the technologies and infrastructure needed to drive growth and create new jobs across the UK,” Thomas said in a statement.

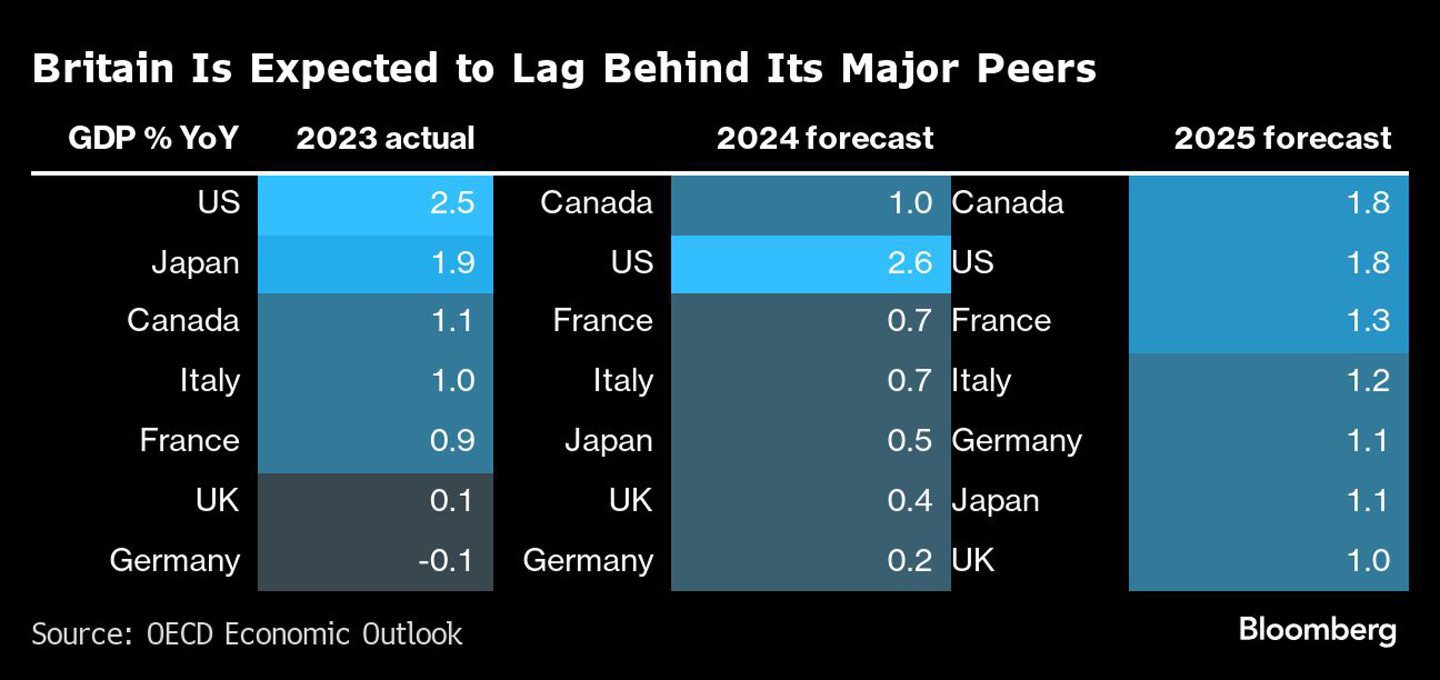

Reeves is hoping the NWF will help the UK bring in billions of pounds of private investment, which will, in turn, boost Britain’s sluggish economic growth rate. This week she announced a slew of planning reforms, including scrapping a ban on onshore wind farms and creating a task force to accelerate stalled housing projects.

Starmer has argued that a rapid return to growth would allow his party to avoid having to make painful decisions over whether to hike taxes or cut spending to balance the nation’s finances. However, economists doubt that growth will return fast enough to avoid such decisions, with Bloomberg Economics forecasting that Reeves is set to face a fiscal hole of about £20 billion at her first budget in the autumn.

Recommended for you

© Bloomberg

© Bloomberg © Supplied by Bloomberg

© Supplied by Bloomberg