The emerging European hydrogen sector is one of Scotland’s “greatest industrial opportunities since oil and gas”, according to the Scottish energy minister.

Acting Cabinet Secretary for Net Zero and Energy Gillian Martin made the comments as the Scottish government unveiled its hydrogen sector export plan.

The report outlines the “significant” international trade opportunities for Scotland in renewable and low-carbon hydrogen, and the steps required to turn Scotland’s “global ambition into an economic reality”.

It follows the release of the government’s green industrial strategy in September and its hydrogen action plan in 2021.

During a visit to the Glasgow offices of Scottish firm Hydrasun, Martin said the plan will provide industry and investors with greater clarity on the future of Scotland’s hydrogen sector.

“Hydrogen is one of Scotland’s greatest industrial opportunities since oil and gas was discovered and we have the environment, skills, knowledge, and experience to become a driving force behind the growth of the hydrogen sector in Europe and beyond,” Martin said.

“Although the full economic potential of hydrogen is yet to be realised, Hydrasun is a great example of how Scottish businesses are already leading the way in the hydrogen sector.”

The export plan outlines opportunities to support domestic supply chain capacity and skills, alongside the build out of hydrogen storage and transport infrastructure.

It also identifies key enablers for the growth of green hydrogen production in Scotland, including planning and consenting, the UK regulatory environment and low-carbon certification standards.

But Scottish energy expert Dick Winchester has called for a greater focus on building domestic manufacturing capacity in the hydrogen sector.

Aberdeen ‘leading the way’ on hydrogen

Speaking to Energy Voice, Martin said Scotland’s growing offshore wind sector means it will one day produce “far more electricity than we feasibly can get on the grid”.

“One of the advantages of that is that [renewable electricity] is a feedstock for hydrogen production as well,” she said.

Aberdeen is “already leading the way”, Martin said, with North Sea operator BP investing in a project to produce green hydrogen for the Granite City’s bus fleet.

Elsewhere, two Scottish projects were included in the UK government’s first green hydrogen production support scheme, with up to 19 bidding in round two.

But Martin said even with more firms switching to use hydrogen domestically, Scotland still has significant opportunities for export.

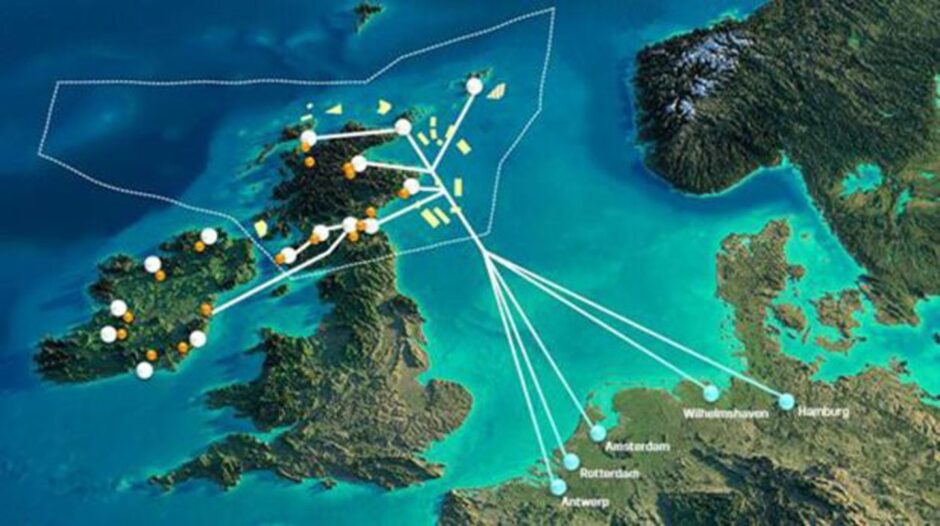

“We’re still going to have much more to export to other countries, particularly Germany, the Netherlands and Belgium, where we can decarbonise their industrial processes as well,” she said.

“We’ve set out our stall, this is what we can produce… Scotland is where you can get your hydrogen.”

Electricity costs key to hydrogen dream

Altogether, the low-carbon hydrogen sector could provide an estimated £7 billion opportunity for the UK.

But delivering progress on Scottish offshore wind projects will be key to ensuring the excess renewable energy is available to produce green hydrogen at an affordable cost.

The UK government is considering introducing zonal electricity prices in the country as part of a suite of reforms designed to decarbonise the grid.

If the plans get the go ahead, Scotland could see the lowest electricity prices in Europe, delivering a competitive advantage for green hydrogen producers.

Hydrasun hydrogen director Dr Stuart Mitchell said the introduction of zonal pricing would “absolutely” make Scottish hydrogen production more attractive for investors.

Alongside its involvement in the Aberdeen Hydrogen Hub, Mitchell said Hydrasun is already gaining experience delivering hydrogen systems across northern Europe.

“Our expanding footprint demonstrates the growing demand for Scottish hydrogen expertise overseas,” he said.

“Scotland’s proximity to key markets like Germany and the Netherlands provides the opportunity to be at the forefront of hydrogen exports.”

A Scottish government spokesperson said it is working closely with the UK government on electricity market reforms.

“We are aware that the introduction of zonal pricing could have significant impacts for all market participants, from renewable generators and hydrogen producers to suppliers and consumers,” the spokesperson said.

“Any market reform must help reduce electricity costs for industrial and domestic consumers and ensure that levels of investment in renewables, flexibility and networks are protected and enhanced.

“The UK Government must urgently provide a public signal on the timetable and direction of travel for key reforms – as this is crucial to maintaining investor confidence.”

Hydrogen Sector Export Plan

According to the report, European demand for renewable and low-carbon hydrogen is set to increase “substantially” by 2050.

Germany in particular is investing heavily in hydrogen as it looks to quickly replace the Russian gas that has fuelled its economy for decades.

With a huge buildout of offshore wind farms set to take place in the UK North Sea over the next decade, Scotland is looking to harness its excess renewable electricity to create green hydrogen for export.

The European Commission is targeting 330 TWh of imported hydrogen by 2030, with the Germany expecting to import between 50% and 70% of its demand by then.

The report said this represents a “clear policy intent” from the EU, with Belgium, the Netherlands and Italy also targeting hydrogen imports.

The Scottish government is progressing long-term plans to build a 10GW hydrogen pipeline network from Scotland to mainland Europe.

There are also plans to establish hydrogen hubs across Scotland and to explore potential shipping options in the interim.

Supply chain constraints

But there are concerns that Scotland will not produce enough green hydrogen to fill any potential pipeline amid project delays and policy hurdles.

A lack of supply chain capacity in Scotland is another barrier, with skills, manufacturing capacity and delays to renewable energy projects key challenges.

More broadly, the hydrogen sector continues to face challenges around high costs, lack of demand from offtakers and concerns around future storage capacity.

Another criticism of the Scottish government’s hydrogen strategy is its lack of focus on boosting domestic manufacturing capacity.

Energy Voice columnist Dick Winchester said there is a risk Scotland’s hydrogen sector will be “dominated by large overseas or non-Scottish companies”.

“The one glaring problem with this plan is that Scotland simply doesn’t have the manufacturing supply chain that all other advanced northern European nations, including England, have to be able to support this otherwise noble ambition,” he said.

“No electrolysers, no compressors, no storage tech, no ability to cool and compress in order to liquify hydrogen.

“All this hardware will have to be sourced outside Scotland which means the industrial benefit will be extremely limited.”

Winchester said another risk is that Europe may “simply do it all themselves”.

“They have the technology and they are already developing big H2 production projects, including offshore production and beginning to build hydrogen pipeline networks in Germany, Denmark and the Netherlands,” he said.

He wants to see Aberdeen’s Net Zero Technology Centre, which is jointly funded by the UK and Scottish governments, place a greater emphasis on building Scotland’s manufacturing supply chain.

Scottish electrolyser manufacturing

But Martin told Energy Voice that securing electrolyser manufacturing is a key focus for government agencies Scottish Enterprise and Scottish Development International.

“There’s quite a lot of work in terms of looking at electrolyser sites in the central belt of Scotland in particular, not just Scottish companies, but actually attracting inward investment as well,” Martin said.

“We’ve already seen approaches come from all over the world who want to base themselves in terms of electrolyser manufacturing in Scotland as well.”

Martin said the Scottish National Investment Bank is also looking at ways it could secure electrolyser manufacturing.

Securing the delivery of ScotWind, which has already attracted wind turbine manufacturers Vestas and Mingyang to the country, would be crucial to attracting electrolyser production, Martin added.

“It’s going to be the supply of green electricity that is going to be the absolute key aspect of this,” she said.

Recommended for you

© Mathew Perry/DCT Media

© Mathew Perry/DCT Media © Supplied by BP

© Supplied by BP © Mathew Perry/DCT Media

© Mathew Perry/DCT Media © Supplied by Eneco

© Supplied by Eneco