Energy service giant Wood will sell its nuclear business to US company Jacobs for £250 million.

Wood, headquartered in Aberdeen, expects the deal to go through before the end of the first quarter of 2020, subject to anti-trust clearance being obtained.

Jacobs will pay £7.5 million to Wood in certain circumstances where the transaction is not cleared by the Competition and Markets Authority.

Wood will use the proceeds to reduce debt and achieve its target leverage policy.

In 2017, the group completed the £2.2 billion takeover of Amec Foster Wheeler, whose portfolio included a large nuclear division.

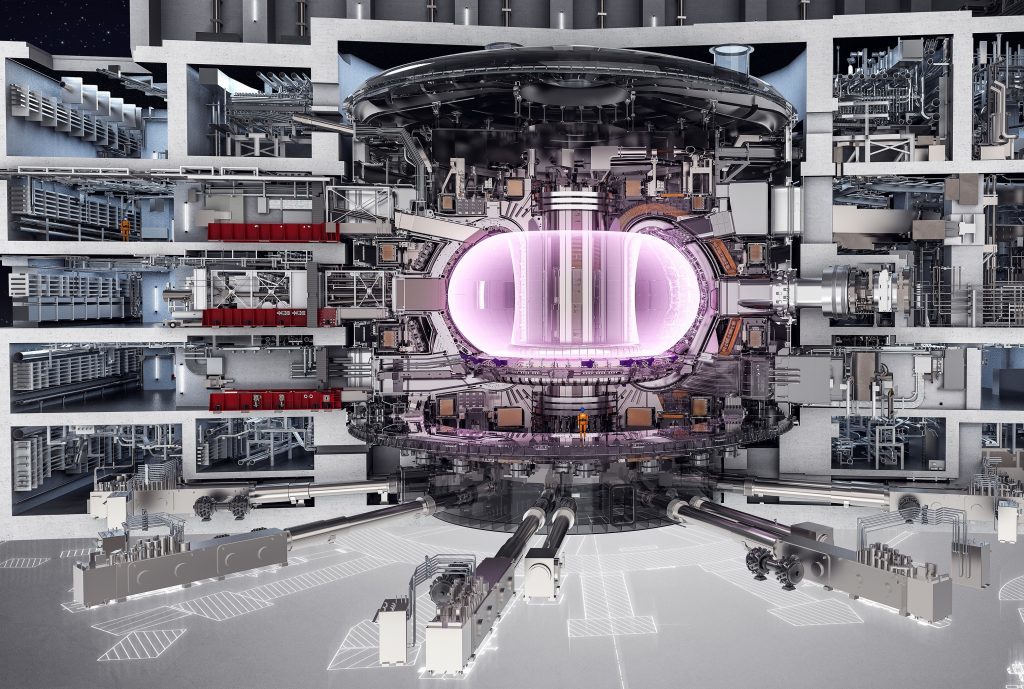

Wood’s nuclear branch designs, delivers and maintains strategic and complex nuclear assets for customers primarily in the UK.

Wood chief financial officer David Kemp said: “The sale of our nuclear business follows other recent divestments and marks a significant step towards achieving Wood’s target leverage policy.

“Although our nuclear business is a strong UK player and has performed well, we see better opportunities to develop clear global leadership positions across other parts of our business.”

Wood also reported an increase in first-half profits before tax and exceptional items to £81m from £68m, despite a 2.6% dip in revenues to £3.9bn.

Total profit for the period totalled £10.7m, a vast improvement on a deficit of £43m in the first half of 2018.

Chief executive Robin Watson said the increase in profits was driven by activities in energy markets in the eastern hemisphere, and Wood’s environment and infrastructure operations in North America, together with cost synergies.

Mr Watson said: “With 87% of 2019 revenues delivered or secured we remain confident in our full year outlook and guidance is unchanged.

“Looking further ahead, we remain well positioned for growth across the energy and built environment markets.”

Wood’s net debt at June 30 was £1.46bn, adversely impacted by two cash receipts totalling £107m anticipated in June but received in early July.

The group had an order book of £7.6bn at the end of June, down 2.3% year-on-year.

David Barclay, head of office at Brewin Dolphin Aberdeen, said: “Debt levels have been the main cause of concern about Wood – today’s announcement of the sale of its nuclear division will go some way towards assuaging those fears.

“Overall, it’s a positive set of results for the company after a choppy 2019 – Wood has swung back to profit and has good visibility of future earnings.

“Investors will have one eye on the slight fall in revenues and a marginally smaller order book, but the business remains in an encouraging position.”

Recommended for you