The new US administration is keen to claim its role in new African markets, while also working on efforts to tackle climate change.

The idea that the US, and other developed economies, should prevent access to energy for African states is “borderline immoral and doesn’t make any sense”, the US International Development Finance Corp. (DFC) chief climate officer Jake Levine said.

Levine, speaking during an Energy Capital & Power webinar, said the US agency is trying to both provide more access to power and control carbon emissions.

“Are there ways to do that as well, or better, than the ways in which developed economies achieved their growth?” Levine asked. The official, DFC’s first climate officer, said there were now “as good, if not better, alternatives to fossil generation”.

The agency will support power generation transition to the most modern technologies where possible, he continued.

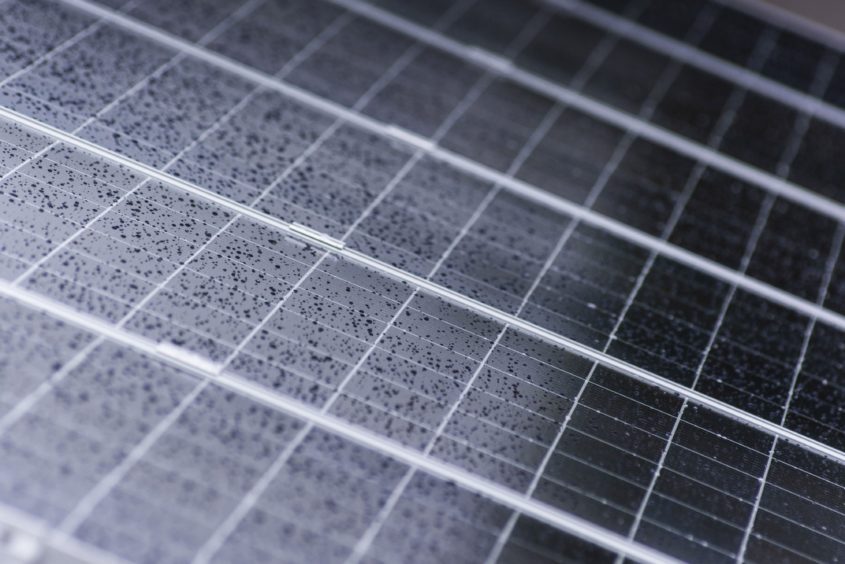

The DFC official gave the example of South Africa, where a combination solar power and storage facility would be able to compete with traditional thermal power. “This is not true of every technology and market.”

Levine gave the counter example of Sierra Leone. DFC has recently set out its support for an 87 MW gas-fired power plant in the country.

“In Sierra Leone we may not have the transmission and infrastructure to be able to provide the same baseload of electricity. It requires a little added nuance and complexity to recognise that nations will have a slightly different path. We want to try and put our thumb on the scale to push opportunities over into economic competitiveness,” he said.

Competition

Speaking during the same event, AlphaSierra Advisory leader C Derek Campbell called for the US to take action fast. “The US must do something about energy poverty. It needs to do it now. If we don’t, the Russians and the Chinese will address those needs. The US will lose in a market that is begging for our attention.”

The question of a competition for Africa as a market was also referenced by Export-Import (EXIM) Bank business development office Miguel Peñaloza.

Chinese financing is seen as “low cost”, Peñaloza said, but comes with “a lot of strings attached. In some cases, this involves losing sovereignty or ownership.”

The question of tackling Chinese influence played a part in the re-approval of EXIM Bank in 2019, he continued. The aim is that if buyers are considering “Chinese vs US goods, we’re hoping financing doesn’t drive the decision.”

Equatorial Guinea Minister of Mines and Hydrocarbons Gabriel Mbaga Obiang Lima said it was important to look at what Chinese lending got right. Speed is one such area, he noted.

“We don’t need a two-year study. Whoever can bring electricity now, I will sign a deal,” the minister said. He went on to praise China’s willingness to engage with local needs. “We should focus on what they’ve done right and improve it.”