When GlassPoint succumbed to bankruptcy in 2020 the vision of solar-powered steam production seemed to have come to a close.

While GlassPoint offers many features that would seem attractive in a world where decarbonisation is a real trend, the company was a victim of circumstances. Backed by oil companies, including Shell, and with a focus on enhanced oil recovery (EOR), GlassPoint seemed out of step with a world where – for a moment – it seemed the era of fossil fuels may come to an end.

Now, though, GlassPoint has come out with a new plan, to focus on decarbonising industry first and foremost.

“Industry is the largest segment of the largest energy market,” GlassPoint CEO Rod Macgregor told Energy Voice. “Pretty much everything is heat driven and that is a hard piece to decarbonise.”

As markets take more and more notice of carbon, and the associated carbon of imported products, manufacturers must take steps to get ahead of this.

GlassPoint’s technology remains similar to its previous existence. The company provides concentrated solar, heating water in pipes through parabolic troughs.

While concentrated solar power (CSP), to generate electricity, has lost the battle to solar photovoltaic (PV), GlassPoint’s focus on steam appears an attractive proposition.

MacGregor said the technology had efficiency of 55%, in turning sunlight into steam.

Saudi steps

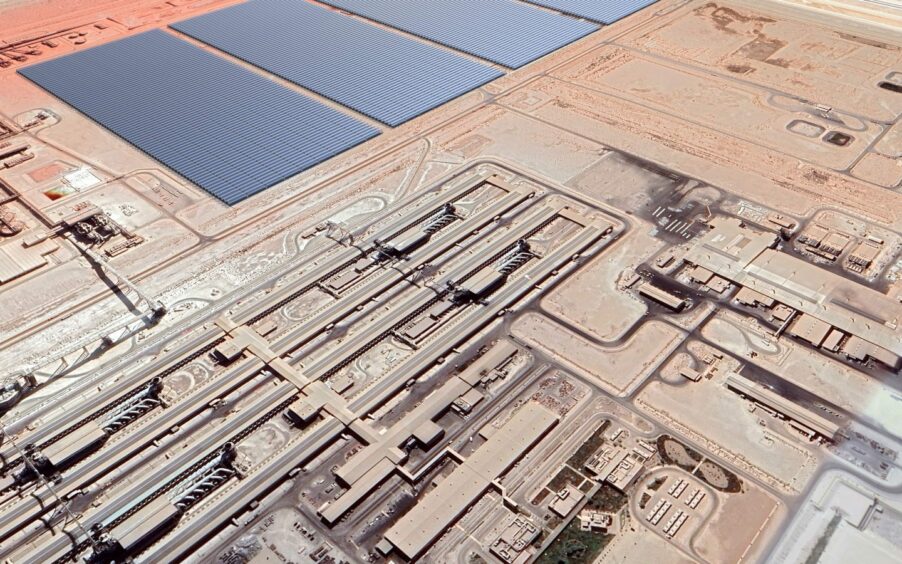

One company interested in GlassPoint’s pitch is Saudi Arabia’s Ma’aden. The Saudi company signed a memorandum of understanding (MoU) with the solar steam company in early June, for a 1,500 MW facility to supply its alumina refinery.

Should the deal go ahead, the Ma’aden Solar 1 plant would reduce emissions at the facility by 50%. Steam from the GlassPoint project would refine bauxite ore into alumina.

The deal represents GlassPoint’s new direction, with a focus on companies with a decarbonisation imperative.

Saudi’s Vision 2030 aims to cut emissions and the country has also made a net zero commitment by 2060. “They’re on a mission to decarbonise. There’s a good macro environment,” MacGregor said.

The company plans to seal a steam purchase agreement with Ma’aden. With design work under way, GlassPoint may be ready to seal a concrete agreement in around 12 months.

Where GlassPoint previously built and transferred projects, now it plans to own the facilities and sell the steam.

“It’s a much more robust business model,” MacGregor said. “It’s a recurring revenue stream. It spreads the money out over 20 years.”

Customers gain from reducing their carbon footprint, but also from removing price volatility. Buying a similar service from a fossil fuel plant exposes companies to fluctuations in energy prices that MacGregor said solar skips.

“At today’s prices, we’re cheaper than gas. But we also help customers avoid the volatility. If you’re buying gas the price is all over the place, so you need to hedge. Solar locks in that price,” he said. “As the energy transition accelerates, we’re going to see more fossil fuel volatility as supply and demand shift.”

Proven points

While GlassPoint’s corporate history has been turbulent, the technology is proven. The company completed projects in California and Oman, giving years of field data.

MacGregor retired in 2018 but came back when offered the chance to restart GlassPoint. The company was able to hold on to the intellectual property and copyrights, but was reduced to “zero employees and infrastructure”.

The first step, the executive said, had been to secure funding. Blackrock came in as GlassPoint’s largest investor.

“Customers really liked the technology. Some of [the collapse] was just around timing. 10 years ago when we were getting started, industry would look at us blankly with no recognition around why they might want to decarbonise. Now, it’s completely different,” MacGregor said.

“Before we were pushing, now customers want to decarbonise. Electricity is easy, heat is much more of a challenge.”

Scaling up and out

GlassPoint can scale, he continued. The model of owning the assets and selling the service is an attractive one for investors looking for renewable energy projects.

The company would contract out the engineering, procurement and construction (EPC) aspects of the work to local builders. Speculating that Australia would be a likely next step for GlassPoint, MacGregor said the company would simply contract another EPC provider to do the work.

“There’s a few components we manufacture. That’s fairly capital light, so we can scale quickly. I think we can start multiple projects per year for the next two to three years,” he said. “We’re not resource constrained yet.”

The company will need funding to accomplish its growth plans, particularly given its new model of retaining ownership of assets. The CEO said the company was considering all options in how it sought the needed funds.

GlassPoint requires a number of factors, MacGregor continued. Installations need good solar coverage, land availability and with heavy industry. The Middle East is a natural home, while Australia and Chile also offer options, as do California and Arizona.

Given the deal with Ma’aden, GlassPoint would be well prepared to work with other bauxite refiners. That said, MacGregor did not rule out a return to the company’s EOR projects.

© Supplied by GlassPoint

© Supplied by GlassPoint