Energy giant Shell has become the latest major firm to join an innovative wave power subsea project off Orkney.

The oil major follows several other key players including TotalEnergies, Harbour Energy and Baker Hughes in joining the £2m “Renewables for Subsea Power” (RSP) scheme.

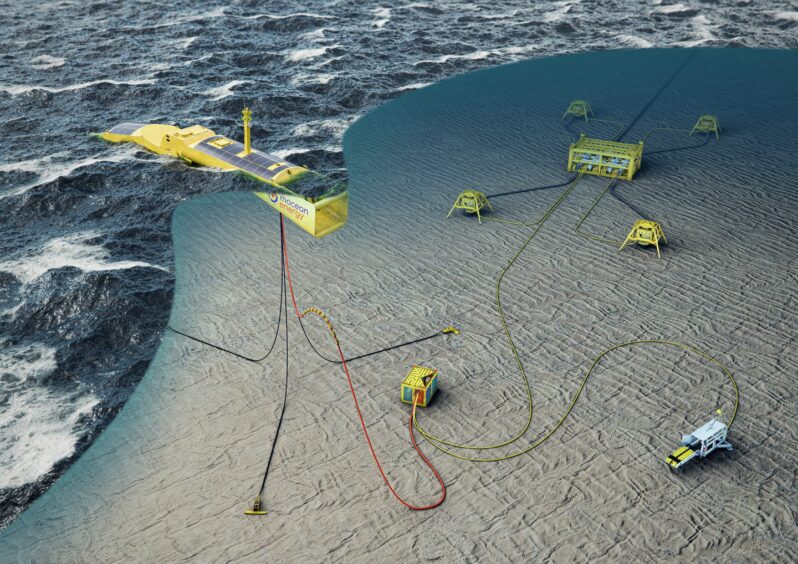

Now close to the finish line of a 12-month test programme, RSP aims to power underwater projects – like subsea oil and gas tie-backs, or carbon capture and storage developments – using wave power, without the need for costly and carbon-intensive umbilical cables.

To do that, Edinburgh-based Mocean Energy’s “Blue X” wave energy converter is linked up with Aberdeen-based Verlume’s “Halo” underwater battery storage system.

Mocean commercial director Ian Crossland said: “Joining RSP offers Shell access to all data and results from the current test programme, alongside a feasibility assessment of the use of RSP technology at a location of their choice.”

Verlume’s Andy Martin said he is “proud of what has been achieved both technically and commercially to date, alongside the calibre of the industry partners that are involved”.

We want to be ‘default’ system for sector – Verlume CEO

Richard Knox, CEO of Verlume, hopes that the Halo and RSP system will become the “default” for parts of the offshore energy sector where it will be most critical, removing the need for tens – or even hundreds – of kilometres of cables.

The “criticality” of the RSP system varies, says Knox and some applications will take time to filter through to being used at scale.

“For example, doing carbon capture and project at the minute you could be laying a cable for 100 kilometres, and if anything were to happen that cable, you’ve got a single point of failure. So that’s quite fundamental.

“I think some of the really high critical ones (are) looking at potentially using the system as a backup. Our aspiration is in the future, once they get comfortable and have used it for 5-10 years then almost, just become the default, ‘why did we lay the cable in the first place?’.”

Other lower-risk, such as monitoring a decommissioned well, may start moving to “commercial-type applications” soon.

Moving to RSP has clear environmental benefits, including removing the need for fossil fuels-based power generation, and cut down on the environmental footprint and cost of vessel time.

“This way, everything is produced locally via a renewable source.

“You get rid of all the emissions in terms of operating whatever it is you’re operating on the seabed, and also the embedded emissions from installation.

“Laying a hundreds of km cable takes a lot of vessel time, whereas we can in a day or so drop something in the seabed and off it goes.”

What next for Renewables for Subsea Power?

As the £2m demonstrator project nears the end of its 12-month test run off Orkney, the options are now being weighed up for its next phase.

The team are looking for a window to take the equipment back and carry out an assessment.

The partners will next look at budget and the next phase, which may include taking the kit to a candidate site picked by the operators involved.

Next steps for Verlume

Aberdeen-headquartered Verlume is ramping up production of battery storage products, manufactured locally, with the aim of having a rental “fleet” towards year-end.

Verlume expects to increase its headcount of around 30 up to 40 by the end of the year and, depending on deployment of renewables projects, has projected increasing headcount to near a hundred in years to come.

The company, which is supported by the Scottish National Investment Bank, has built a strong order book for the next year, and is already in the process of planning out three-quarters of them.

Aside from that, it is working towards other projects including a docking site for autonomous underwater vehicles launched from Aberdeen South harbour to inspect offshore wind farms.

Established in 2013, and formerly known as EC-OG, the firm is shifting from prototype to commercial scale, and Knox recognises the importance of the SNIB in getting the firm there and the challenges for the energy supply chain to secure finance.

“It’s difficult I think. We’re fortunate in terms of what we want to do as a business lines up very well with the missions and aims of Scottish Enterprise and Scottish National Investment Bank.”

He adds that, to go from prototype to commercial, there’s a gap in financing as venture capital in Scotland comes in at around £5m, while private equity is coming in at £10m-north.

“That gap between £5m and £10m is where the SNIB are coming in – that area is the sums of money you need to go from prototype to commercial and there are not many places you can go to secure that funding.”

Recommended for you

© Supplied by Kami Thomson/ DCT

© Supplied by Kami Thomson/ DCT