Six UK tidal stream projects have secured funding as part of the sixth Allocation Round (AR6) renewables auction in an “important step forward” for the sector.

The latest Contracts for Difference (CfD) funding round will see 28 MW of tidal stream capacity delivered across five sites in Scotland and one in Wales.

Tidal stream projects received £15 million in ringfenced funding in AR6 after Labour increased the budget for the renewables auction shortly after taking office.

Delivered at £172 per MWh, the UK Marine Energy Council (MEC) said this represents a 34% saving against the administrative strike price cap.

It is also the lowest cost that tidal stream projects have been contracted at since the introduction of the ringfence in 2022, the MEC said.

Tidal capacity drops in AR6

However, the 28 MW contracted through AR6 result is the lowest for the tidal sector since the ringfence, following the delivery of 40 MW in AR4 and 53 MW in AR5.

The MEC said AR6 gives the UK an “unrivalled deployment pipeline”, with the country now on track to have 130 MW of tidal stream capacity deployed in its waters by 2029.

Scotland now has 83 MW of contracted tidal stream capacity, cementing its position as a leading developer of marine energy globally.

Wales meanwhile has 38 MW of contracted capacity, while there remains no successful tidal project contracted in England.

MEC policy director Richard Arnold said the AR6 results are an important step forward for the UK tidal stream sector.

“These projects will provide entirely predictable renewable energy and a critical service to the UK energy system,” Arnold said.

“The tidal stream ringfence has provided a clear route to market, supporting the industry to grow, create jobs and secure investment into UK supply chains.

“Maintaining and increasing the size of the ringfence in future rounds will ensure the UK continues to lead in developing, deploying, and exporting tidal stream technology and expertise around the world.”

The MEC said it is continuing to work with the UK government to “ensure the tidal stream opportunity is shared across Great Britain”.

The industry body is calling on the UK to “demonstrate international leadership” by maintaining the tidal ringfence and increasing it to £30m.

The MEC also wants to see a 1 GW target set for 2035, as well as more support for wave energy projects.

Tidal project pipeline ‘confidently growing’

London School of Economics (LSE) Grantham Research Institute policy fellow Esin Serin told Energy Voice that with the UK tidal sector in its infancy, there are “opportunities up for grabs”.

Serin said seeing developers that secured contracts in AR5 and AR4 return to win contracts in AR6 “signals a project pipeline that is confidently growing”.

To continue that growth, Serin said the UK government should consider ways of providing longer-term certainty for the sector so it can attract investment.

This would also give the associated supply chains the confidence to scale up, maximising the economic benefits and jobs for the UK, Serin added.

“The ringfence in the CfD has changed the game for the tidal stream sector and cemented the UK’s leadership position in this exciting technology,” Serin said.

“But the availability of the ringfence only gets confirmed in the year prior to the auction, which is too short notice to guide investment decisions with long-term returns.

“It leaves the sector in doubt about the availability and size of support in future years.”

While the new Labour government faces fiscal challenges ahead of its October budget, Serin said setting an explicit deployment target “could serve as a second best” option.

Serin also said it was “no coincidence” that Sir Keir Starmer launched Labour’s green strategy launch at Scottish tidal firm Nova Innovation last year.

Nova Innovation has delivered past projects with up to 80% UK content, but Serin said a strong domestic supply chain is needed to ensure this continues, requiring investment in manufacturing capacity and skills.

‘A real boost’ for Scottish tidal energy

Meanwhile, Scottish Renewables policy manager for new technologies Maggie Olson said the AR6 results were a “real boost” to the tidal energy sector.

“Scotland’s vast tidal stream energy resource is set to play an important role as part of our net zero energy mix and it is a real boost for the sector that five Scottish projects with 18 MW of capacity have been successful in this year’s Contracts for Difference,” Olson said.

“These projects represent nearly double the current 10 MW of operational capacity in Scotland.

“As the CfD shows, tidal stream projects now have a reliable route to market and will support significant growth in an emerging sector backed by a supply chain which is 80% UK based.”

AR6 tidal stream winners

Tidal stream developers which secured funding in AR6 for projects in Scotland include SAE Renewables, Nova Innovation and Magallanes Renovables.

Meanwhile, HydroWing secured funding for a 10 MW project in Wales.

The five Scottish projects are all based off the coast of the Orkney Islands, while the HydroWing project is part of the wider Morlais tidal development near Anglesey.

AR6 funding will see SAE Renewables increase the size of the second phase of its MeyGen project in the Pentland Firth by 9 MW.

SAE, formerly known as SIMEC Atlantis Energy, previously secured contracts for 50 MW of capacity for MeyGen in AR4 and AR5.

The firm already has 6 MW of capacity operational at the site.

Commenting on the AR6 result, SAE chief executive Graham Reid said: “The scale and opportunity that MeyGen represents for the industry the supply chain, our stakeholders and the wider United Kingdom, is significant and we will work with all involved to ensure its success.”

SAE is developing the MeyGen project across multiple stages, and it could one day reach up to 398 MW in capacity.

Nova Innovation

Meanwhile, Edinburgh-based Nova Innovation secured three AR6 contracts across its SEASTAR and Oceanstar Tidal projects totalling 6 MW.

The 4 MW SEASTAR project aims to build on the success of Nova’s world-first Shetland tidal array, which has been providing power to the Shetland grid since 2016.

The project will see 16 tidal turbines deployed at the EMEC Fall of Warness site in Orkney, the largest number deployed in a single location globally.

The Nova-led consortium behind SEASTAR secured €20m (£16.8m) in funding from the EU for the project last year.

Nova also secured 2 MW of capacity for the first phases of its Oceanstar project in Orkney.

Oceanstar will see up to 19 of the company’s next generation M-series turbines deployed, with Nova targeting an eventual capacity of 10 MW at the Fall of Warness site.

The first phase will see the installation of a single Oceanstar turbine in the second half of 2025, with the remaining turbines installed in phase two from 2027 onwards.

Nova Innovation chief executive Simon Forrest said the company secured success in its first venture into the CfD process.

“Winning the CfDs enables us to deliver our world-leading tidal energy technology in the UK and enables us to scale up rapidly – designed in Britain, built in Britain, delivered globally,” Forrest said.

Nova said adopting the “right industrial strategy” and a 1 GW target would “enable the UK to become a green energy superpower in tidal energy”.

In addition, a spokesperson for Nova told Energy Voice that the company hopes to see floating solar included in future CfD rounds.

Nova recently launched floating solar joint venture AquaGen365 with engineering firm RSK, and the company has installed a demonstrator project at the Port of Leith.

Magallanes Renovables and HydroWing

The final Scottish tidal project to receive funding in AR6 is being developed by Spanish firm Magallanes Renovables.

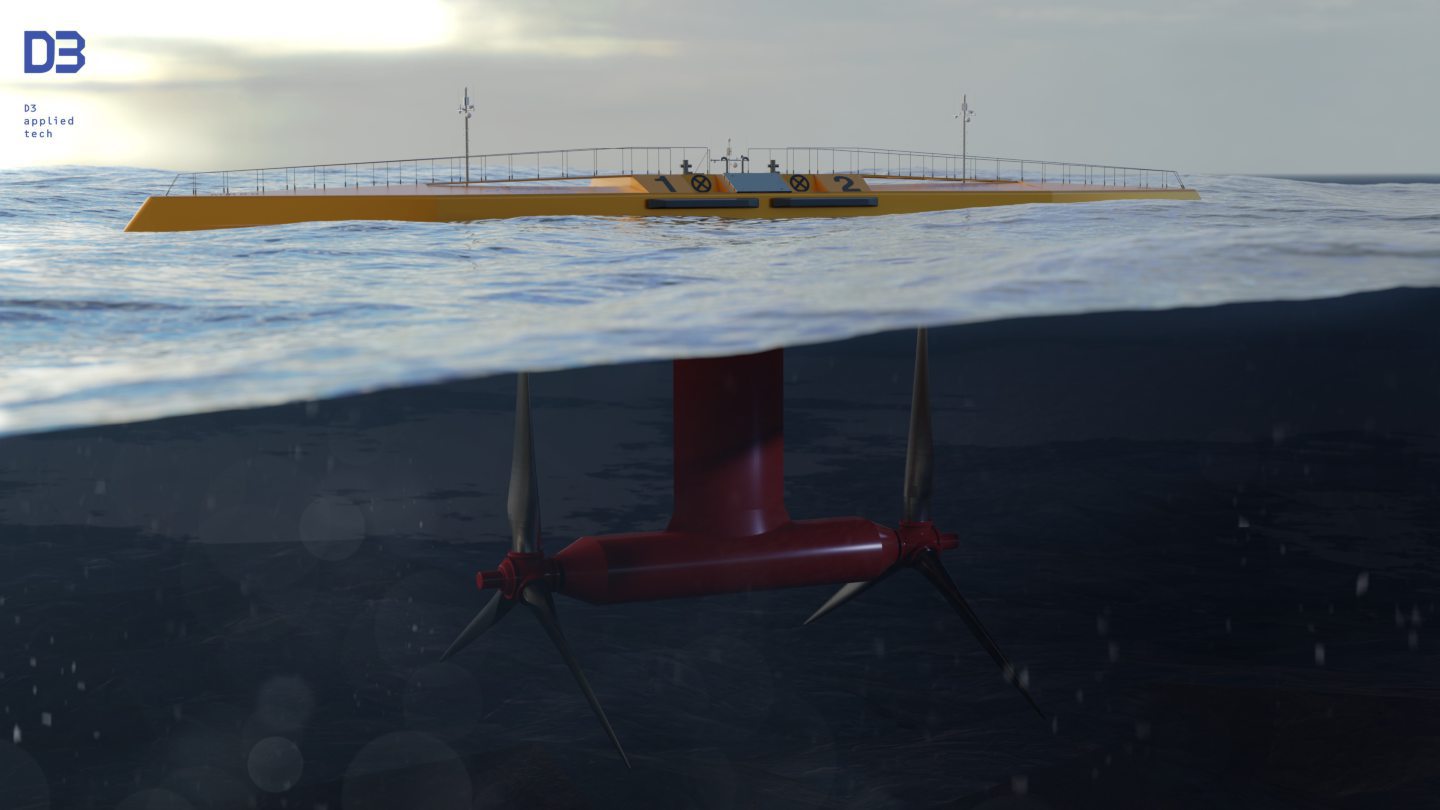

After successfully tested a prototype of its ATIR device at EMEC, Magallanes plans to deploy two additional platforms for up to 25 years from 2029.

A spokesperson for Magallanes told Energy Voice the AR6 results were “great news” for the company, which has secured CfD contracts for the third year in a row.

“We are very proud of being a key factor in the compromise of the UK government to reduce the dependency on fossil fuels and we’re very honoured to help Scotland maintain its leadership in tidal development overall,” the spokesperson said.

Magallanes also said the UK government “ought to have full confidence” in the tidal sector, and called for the streamlining of the consenting process to speed up development.

Finally, HydroWing will deploy its Quad Hull Barge technology as part of the Ynni’r Lleuad 2 project, located off the west coast of Holy Island in the Irish Sea.

The project forms part of the wider Morlais tidal energy project, which could produce up to 240 MW of capacity.

© SImec Atlantis

© SImec Atlantis © Supplied by Orbital Marine Power

© Supplied by Orbital Marine Power © Supplied by SAE Renewables

© Supplied by SAE Renewables © Supplied by Nova Innovation

© Supplied by Nova Innovation © Supplied by Magallanes Renovable

© Supplied by Magallanes Renovable