Analysis by Rystad Energy finds that demand for the steel towers that comprise wind turbines will outstrip manufacturing capacity before the end of the decade.

Analysts from the Oslo-based energy consultancy warned that “time is running out” for European suppliers to address the issue and ramp up production capabilities.

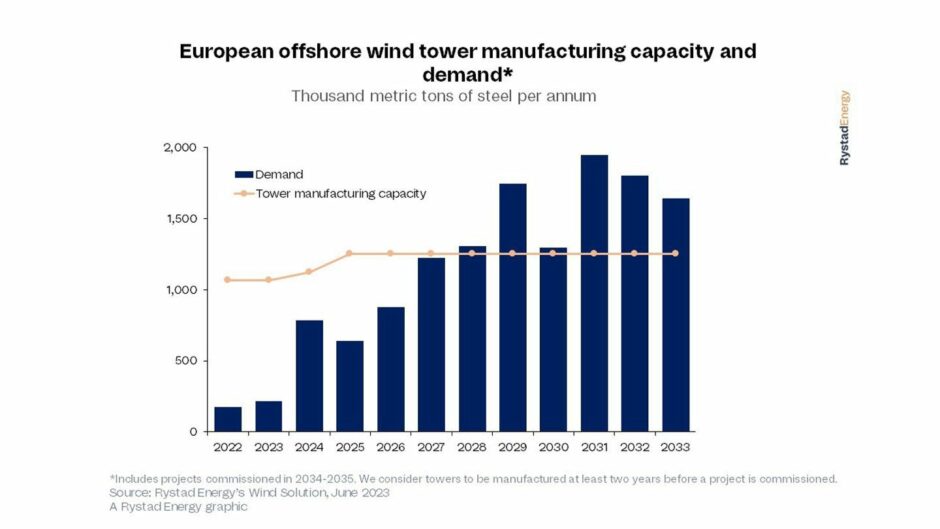

Rystad’s offshore wind capacity outlook suggests manufacturing capacity for steel towers will keep pace and exceed demand prior to 2028. However, by 2029 demand will surpass Europe’s manufacturing capacity by “a significant margin.”

Current and planned manufacturing capacity stretches to a maximum of around 1.3 million tonnes per year yet demand for towers is forecast to total more than 1.7 million tonnes by 2029, meeting only 70% of demand.

Rystad said manufacturers must begin expansion plans now if this crunch is to be avoided, since it takes between two and three years to build new facilities.

Moreover, these forecasts assume no major steel shortage, allowing manufacturers to work at full capacity. If a shortage were to emerge, Europe could face supply issues earlier than expected.

“Turbine sizes keep growing as the importance of offshore wind to the global power grid accelerates, and tower demand is projected to surge accordingly,” noted Alexander Fløtre, vice president at Rystad Energy.

“This is a golden opportunity for manufacturers to capitalize on increased demand, but new capacity needs to be added imminently if Europe is going to avoid a supply headache.”

Encouragingly, raw capacity remains the largest barrier – Rystad says there no additional complexities or specialized machinery required for the sector’s scale-up.

Much of the demand growth will come from the sheer size of towers required.

Rystad estimates that half of the turbines installed between 2029 and 2035 will be bigger than 14 MW, with some projects forecasting to build 20-MW at the beginning of 2030 – compared with an average of 10MW at present.

A tower’s weight varies with the hub height, which is required to be more than half of the rotor diameter – excluding the clearance to the water surface – and which fluctuates from country to country.

In addition, as rotor dimensions grow, turbine sizes increase and larger towers are required. This growth is more prominent in Europe, where offshore wind developers have requested turbines of 12 MW or larger for their projects.

Spain and Denmark lead European offshore wind tower supply, accounting for about 90% of the estimated 1.1 million tonnes of the continent’s supply.

Yet manufacturing capacity is not the only issue the sector much grapple with. Analysts have also warned of a looming shortage of vessels to construct and install offshore turbines – a crunch that is set to worsen as larger turbines require larger lifting capacity to move them around.

Recommended for you

© Supplied by Rystad Energy

© Supplied by Rystad Energy