The biggest manufacturers of wind turbines and solar panels are facing their most serious financial challenges in years even as deployments of clean energy head for an annual record.

About 500 gigawatts of renewable generation capacity will be added this year, according to the International Energy Agency, and at least $1 billion a day is being spent on new solar additions alone.

Yet companies in the sector are being squeezed by volatile costs, snarled projects, high interest rates and — in the solar sector — a rush to add new capacity that’s overwhelmed demand.

Xinjiang Goldwind Science and Technology Co., the No. 1 wind turbine maker, just reported a 98% slump in third-quarter profits.

The head of Longi Green Energy Technology Co., the top solar manufacturer, said on Tuesday that panel prices were at “irrationally” low levels.

Even as installations rise, “wind and solar equipment companies are not a good exposure to this trend,” said Vicki Chi, a Hong Kong-based portfolio manager at Robeco, which managed about $197 billion globally as of June and invests in energy companies.

The wind and solar sectors are both highly competitive and there are “more attractive exposures” in electricity grid equipment and software, where demand should exceed expectations and entry barriers are much higher, she said.

The renewable industry’s travails are being reflected in a rapid drop in company share prices.

The S&P Global Clean Energy Index has fallen 30% this half, while the broader S&P 500 Energy Index has risen over the period.

At the moment, it’s the wind sector that’s faring worse than solar. After falling in 2022 for the first time in four years, wind installations are on pace to rebound this year, but they will barely surpass 2021 levels outside of China, according to BloombergNEF.

Projects from New York to the UK are at risk as developers ask for more money and tax breaks to ensure profitability amid rising costs.

European wind turbine makers, who account for as much as 300,000 direct and indirect jobs, have been particularly hard hit.

Orsted A/S, the world’s biggest builder of offshore wind farms, said it was ceasing the development of some projects as it announced a third-quarter net loss.

Siemens Energy AG has been forced to seek government guarantees due to ballooning problems with faulty turbines.

European wind companies are facing increased competition from Chinese firms, who are targeting overseas markets and offering discounts of about 20% to European and US producers, BNEF said.

In the solar sector, the main problem is overcapacity. Global demand for panels is on track to rise 55% this year, according to BNEF.

But the around 400 gigawatts of expected installations this year is dwarfed by nearly 1,000 gigawatts a year worth of module factories that are operating or being planned for construction.

While the surge in production has removed kinks in the supply chain that caused rising prices last year, it’s pushed panel prices down to record lows, squeezing margins and threatening a wave of bankruptcies and consolidation.

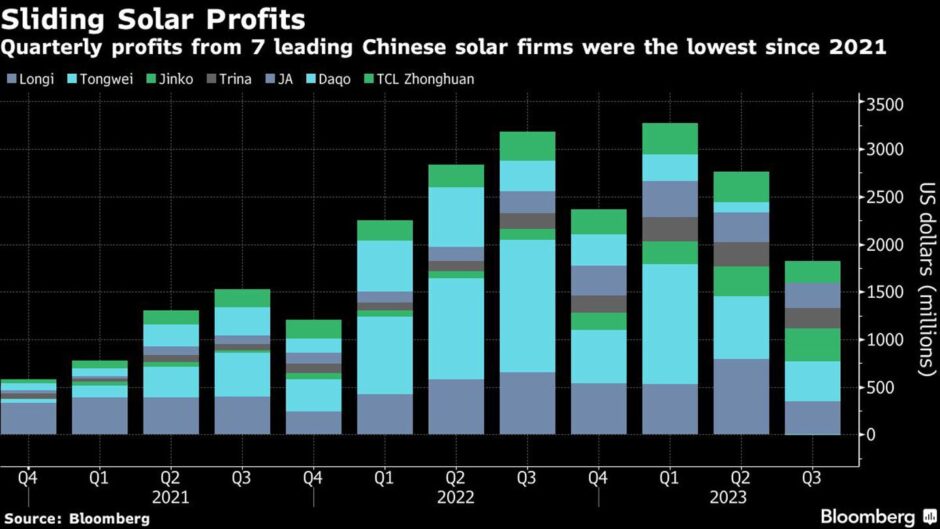

Combined third-quarter profits from seven major manufacturers in China, where more than 80% of global production is based, were at the lowest since the end of 2021.

Longi has warned that more than half of the firms in the sector could be forced out of business in the next two to three years.

Panel prices are likely to continue to drop through the end of 2023, making it difficult for even the best companies to make healthy profits, BNEF analyst Youru Tan said in a note.

Smaller, non-integrated firms will struggle to make any money at all, he said.

In the US, solar panel maker First Solar Inc. has been relatively resilient, as its outlook has been buoyed by the Biden Administration’s Inflation Reduction Act, which promises to pour billions of dollars into domestic clean tech manufacturing.

The firm’s third-quarter earnings expanded by almost 300% this year.

Still, rooftop solar in the US has been pressured by rising interest rates that make it more expensive for consumers to borrow for the up-front investment.

Inverter makers Enphase Energy Inc. and SolarEdge Technology Inc. posted disappointing third-quarter results, while SunPower Corp., which reports earnings Wednesday, has dropped by around three-quarters this year, making it the worst performer on the S&P clean energy gauge.

“Current prices make it very hard for anybody across the supply chain to make profit,” Longi President Li Zhenguo said on an earnings call on Tuesday.

Some companies may soon start abandoning plans to build new solar plants, he said.

© Getty Images

© Getty Images © Supplied by Bloomberg

© Supplied by Bloomberg © Supplied by Bloomberg

© Supplied by Bloomberg