China’s wind turbine manufacturers dominated global supply last year, riding the nation’s renewables installation boom as a contraction in the US and meager growth in Europe dented overseas competitors.

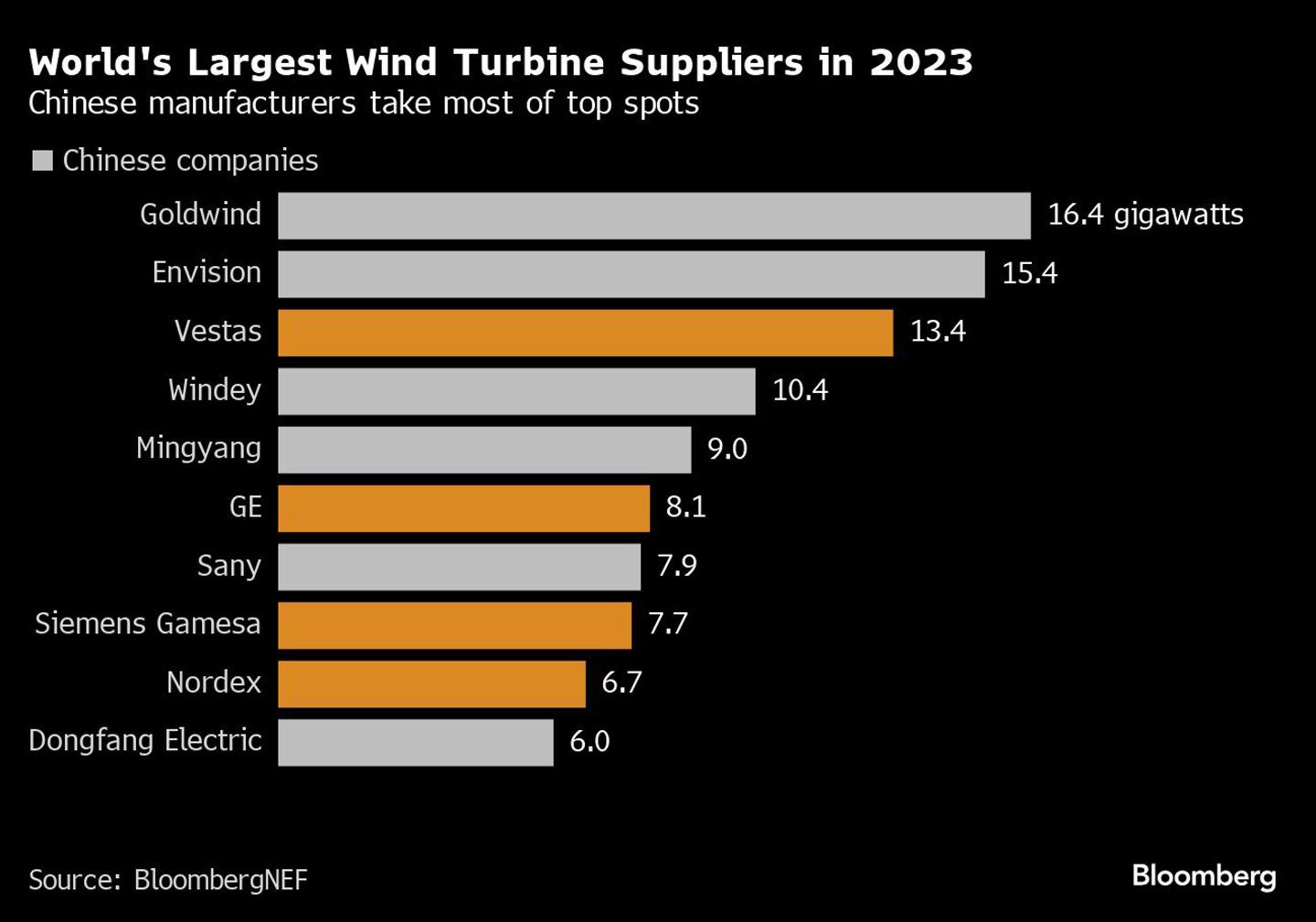

Four of the five biggest producers in 2023 were China-based companies, up from just two in the prior year, according to a BloombergNEF report released Wednesday. Goldwind Science & Technology Co. retained the top spot, while Envision Energy Co. took second place from Vestas Wind Systems A/S. General Electric Co. and Siemens Gamesa were pushed out of the top five.

China accounted for about two-thirds of global additions of onshore and offshore wind last year, and while the nation’s manufacturers lifted sales overseas they continued to rely on their home market for about 98% of deployments, according to the report. Wind installations in the US fell to the lowest since 2017.

“The boom in China last year hides a worrying trend, as new additions elsewhere were just 8% higher,” said Oliver Metcalfe, head of wind research at BNEF. Recent project approvals in Europe and a surge in turbine orders in the US offer “signs that growth will accelerate,” he said.

China has the largest and most fragmented wind market, with more than 12 domestic manufacturers, and fierce price competition has damped profit margins and seen many expand abroad. The price of Chinese-made turbines delivered outside the nation is about a fifth below those of US and European peers, according to BNEF.

Recommended for you

© Supplied by Bloomberg

© Supplied by Bloomberg