One-half of the joint venture partnership behind the 560MW Green Volt floating offshore wind farm said the project will start signing contracts with suppliers and work with the supply chain to standardise design and accelerate rollout for the sector.

And while floating offshore wind will deliver benefits for the supply chain in the UK, Vargronn chief executive Stephen Bull said the sector will need to look overseas for turbine manufacturing, particularly China, in order to deliver on the government’s 5GW by 2030 target.

Speaking to Energy Voice while at the Floating Offshore Wind conference, Bull said: “Our approach here is we would like to get the best ideas from the supply chain.

“Rather than us dictating all of the terms and all of the conditions and the engineering around that, actually, to go into a dialogue with the supply chain to find ways that we can standardise a lot more and reduce wait and reduce costs, that’s what we’re in to here.”

He explained that this is Vårgrønn and project partner Flotation Energy’s “philosophy” around the Green Volt project, which will be Europe’s largest floating wind farm when it is built.

“We want to work differently with suppliers, sometimes others dictate the terms or use certain specs or standards that maybe aren’t right for the offshore wind industry, maybe they’ve come from oil and gas,” Bull added.

The approach Green Volt is taking is “getting really good feedback” from suppliers, the Vårgrønn boss said.

‘All hands on deck’ for Green Volt

Last month Green Volt was announced as the only floating wind project to secure a successful bid in the government’s Allocation Round 6.

Bull said: “It’s like all hands on deck now to build on the project team and really get established and moving.”

Green Volt is set to double the size of Europe’s total currently installed floating offshore wind capacity when it comes online in 2029.

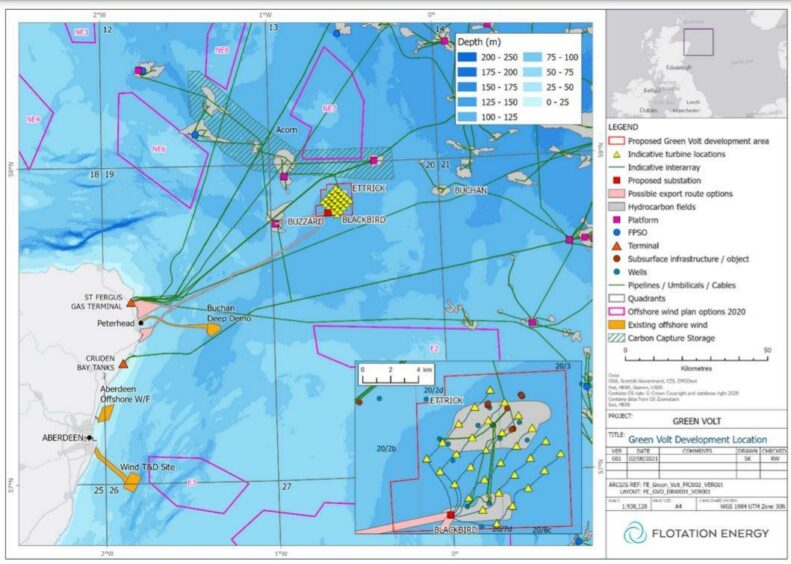

The floating wind project will be stationed off Aberdeenshire’s east coast near Peterhead and will have up to 35 turbines at a power estimated to be up to 560 MW.

Following the announcement and their engagement with the supply chain, the firms behind Green Volt are set to start dishing out contracts relating to the project.

This week saw the project announce its headquarters will be located in Aberdeen. This move is set to create 40 jobs in the region, however, it is unclear where in the city the base will be located.

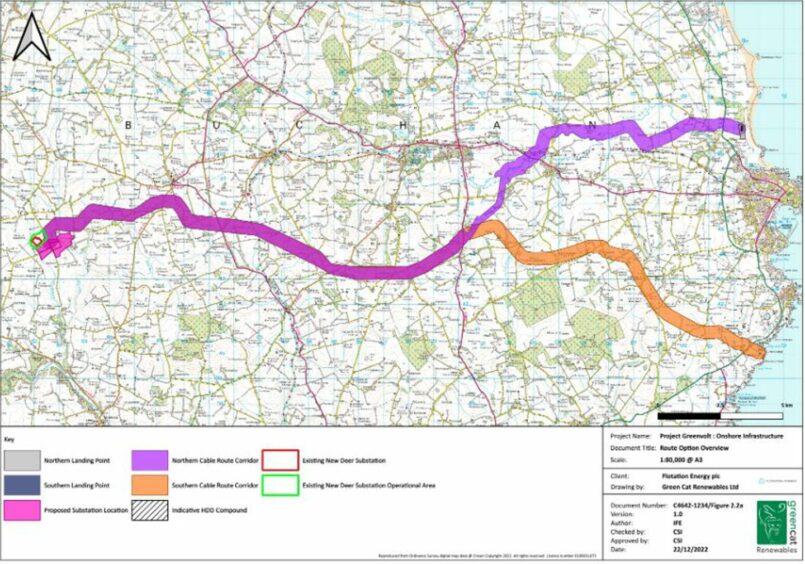

He added: “We’re working with all the long lead items at the moment, that one being the onshore transmission. So yeah, we do have some pre-FEED [front-end engineering design] work going on there and the FEED work will be rolling out into next year.

“All of the other packages are being pulled together at the moment as well, so pulling this together is quite a logistics play in every sense, so we’ll have more details on that later but at the moment we’re in a procurement process so I can’t comment too much.”

These comments related primarily to the electrical package of the Green Volt project, the first of eight the team is “pulling together” in order to take a final investment decision (FID) on the project.

The eight packages include wind turbine generator (WTG), substructures, electrical system, inter-array cables export cables, civils, ports and harbours and operations and maintenance.

Overseas input on UK floating wind projects

As floating offshore wind scales up in the UK and the sector looks to deliver on the government’s 5GW by 2030 target, overseas manufacturing will be necessary, Bull explained.

He said: “About 40% of the wind turbine supply chain comes from China, so while that isn’t branded to offshore wind turbines in Europe with a Chinese brand on them, a lot of it does come from there.

“Permanent magnets, for example, is one of the key elements that come from there. All of the precious metals and rare earth minerals are generally refined in China and developed across the world for all turbines.”

Bull explained that Chinese supply chain firms are commonplace in areas such as “the car industry or industrial manufacturing”.

“I think what you find now is the debate around Chinese turbines, is that because, obviously, there’s a major shortage of turbine manufacturing capacity, in Europe in particular,” he added.

“This issue is something that the industry needs to look into and try to accept that where you have a level playing field and fair world trade rules, as long as that applies in every sense and you have the right innovation, the right investments – maybe from Chinese companies in Europe- then I think we should be welcoming this.”

UK manufacturing and how it plays a part in floating wind

Despite the input from Chinese firms, the UK is also looking to retain its supply chain and manufacture components for the offshore wind sector domestically.

During the first panel of the Aberdeen conference, Bull said that “industrial policy is back in fashion”, adding that it should have never fallen out of favour.

He told Energy Voice: “This government in particular, from the Labour government, is embracing that particular philosophy and we should welcome it as much as possible because that is the way to really get this business moving.”

Bull explained that “public-private partnership has taken a stronger form now” as he pointed to the USA’s inflation reduction act as well as moves made across Europe.

With the UK budget looming, Bull called for Chancellor Rachel Reeves to turn her attention to “the decarbonisation of oil and gas.”

GreenVolt is set to provide power to oil and gas installations within UK water to slash emissions associated with hydrocarbon production.

“If there is a nod towards that in the budget to make that work and to make that technology work and also reduce carbon at the same time, I think that would be a pretty exciting opportunity.”

© Supplied by Green Volt

© Supplied by Green Volt © Supplied by Green Volt

© Supplied by Green Volt © Supplied by Mingyang

© Supplied by Mingyang © Supplied by Flotation Energy

© Supplied by Flotation Energy