Xinjiang Goldwind Science & Technology Co., the largest wind-turbine maker, said profit plunged as a price war continues to offset some of the benefits of China’s surge in clean energy investment.

The producer’s net income fell 98% to 9.4 million yuan ($1.29 million) in the three months ended Sept. 30 from a year earlier, the company said Thursday in a statement.

Sales volumes in the first nine months were 8.9 gigawatts, up more than a quarter on the same period in 2022. Goldwind’s shares fell as much as 5% intraday in Shenzhen on Friday.

Asia’s largest economy is accelerating deployment of renewable energy as it works to curb emissions and meet rising electricity demand.

Though installations are rising, competition is intensifying among China’s wind turbine producers and pushing prices lower.

The sharp quarterly profit drop is due to higher selling expenses and research-and-development costs, Citigroup analyst Pierre Lau wrote in a note.

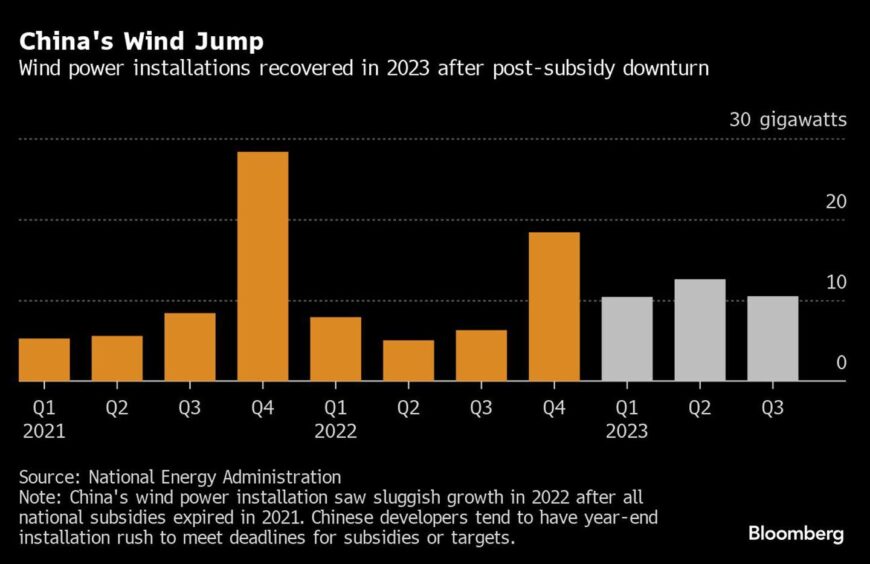

Wind developers are facing higher project costs since all national subsidies expired in 2021 and regional governments require more local-economy contributions, Bloomberg NEF analyst Xiangyu Chen wrote last month.

Clean energy technology manufacturers globally are struggling with rising costs and delays to some projects.

Vattenfall AB and Iberdrola SA have already scrapped some developments this year, and the bleak outlook threatens to hamper efforts by Goldwind and other Chinese producers to expand outside their home market.

China’s wind industry is also a potential new target for scrutiny from overseas trade officials.

The European Union warned this month that the sector could merit investigation if producers are regarded as having received too much state aid.

Manufacturers in China are selling turbines about 20% cheaper than western peers, according to BloombergNEF.

© Supplied by Bloomberg

© Supplied by Bloomberg