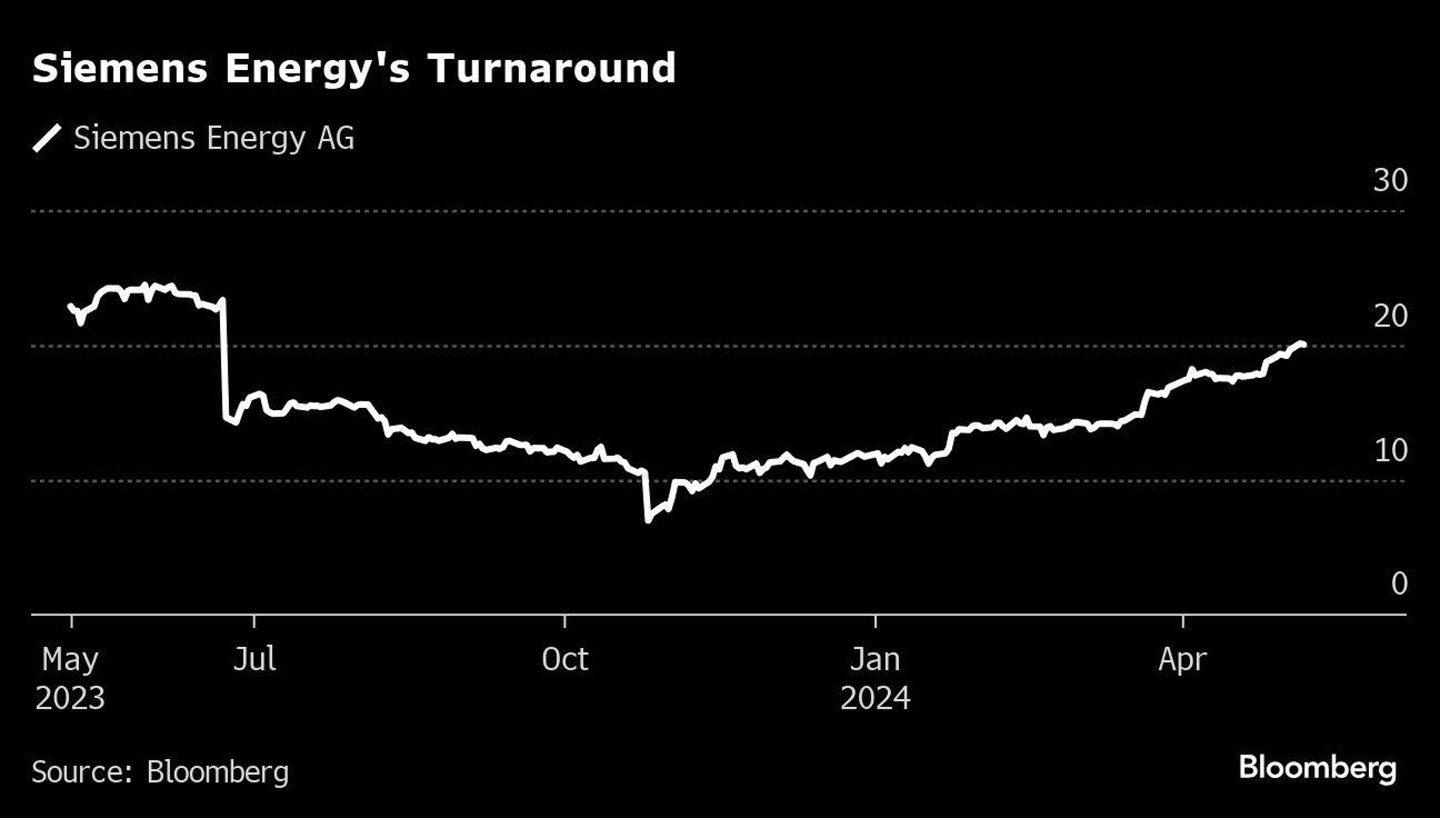

Siemens Energy AG (FWB:ENR) shares jumped 14% after the company signaled its lucrative gas and electric grid businesses were no longer burdened by ongoing losses at its struggling wind-turbine unit.

The German company now sees comparable revenue growing by as much as 12% this fiscal year, up from a potential high of 7%, it said Wednesday.

Orders for the company’s electric-grid technologies have surged since it reached a €15 billion ($16.1 billion) deal with the German government and former parent Siemens AG to shore up its finances after years of losses at the Gamesa wind unit. Siemens Energy had said it needed the guarantees for its other businesses to finance large projects.

Now, the company has a record €119 billion order backlog, Chief Executive Officer Christian Bruch said on a call with reporters.

“We see a significant increase in demand for electricity generation and grid services that surpasses our outlook from November,” Bruch added.

The company also announced structural changes including job cuts and output reduction at the onshore wind business, where problems with defective turbines have been the most severe. Siemens Energy didn’t specify the number of potential job cuts at Gamesa, which employs roughly 26,000 people. The company is eventually targeting double-digit returns at the unit.

The manufacturer also plans to retrench to primarily focus on European and US markets.

“We will not defend each and every market, in particular onshore, where we do not see the midterm profit,” Bruch said in a Bloomberg TV interview. “It is about focus and selectivity.”

Gamesa will resume sales of revised 4.X onshore turbines by the end of this fiscal year ending September, Bruch said, with sales of 5.X onshore turbines restarting early next fiscal year.

Gamesa will also swap out its chief executive officer, the fourth such move since 2017. Vinod Philip, 50, who currently heads Siemens Energy’s IT, purchasing and innovation unit, will replace Jochen Eickholt, who has headed the Spanish wind power division since March 2022. Eickholt, 62, will step down in July.

Siemens Energy also reported earnings for its fiscal second quarter that met analyst expectations and said it expects pretax free cash flow of as much as €1 billion ($1.1 billion), up from a negative €1 billion previously.

What Bloomberg Intelligence Says:

Siemens Energy’s raised guidance for fiscal 2024 organic-sales growth of 10-12% (from 3-7%) — driven by strength in its Grid Tech and Transformation of Industry segments — along with a solid 1H margin suggest profit expectations could increase by the mid-to-high single digits. Increased free-cash-flow guidance to €1 billion is underpinned by strength across all segments excluding the Siemens Gamesa unit (where sales are expected to increase significantly in 2H, driven by offshore turbines).

— Omid Vaziri, BI industrials analyst

There is “continued strong demand for technology to power the energy transition,” Bruch said in a statement. “The turnaround of our wind business is still our focus.”

Problems with defective wind turbines at Siemens Energy’s Gamesa unit have weighed on the company for years, overshadowing strong results in other units.

Making matters worse, the debacle has coincided with a period of soaring raw material costs and supply-chain disruptions across the industry. Rival Vestas Wind Systems A/S said last week that turbine sales slumped in the first three months of the year after price increases.

Siemens Energy has said it will take years to fix the problems, expecting it to take until 2026 to break even. In February, Bruch indicated that Siemens Energy might divest its troubled onshore wind business if it can’t meet midterm profit targets.

Recommended for you

© Supplied by Bloomberg

© Supplied by Bloomberg