Offshore wind developer Cerulean Winds has unveiled its £20 billion blueprint for decarbonising vast swathes of the North Sea.

Hailed as a major step on the route to net zero oil and gas production, the North Sea Renewables Grid (NSRG) is among the UK’s largest infrastructure investment projects.

As many as 10,000 jobs are expected to be created as a result of the integrated green power and transmission system, first power from which is slated for 2028.

The bulk of those positions will come in the construction phases, while a portion will be involved in the ongoing maintenance of the project – the majority of these will be based in Scotland.

Local content to deliver North Sea Renewables Grid

Crucially, Cerulean intends to maximise the use of local content, with plans to build scores of floating foundations in the UK – engagement with the supply chain has already taken place.

The firm also aims to deliver the project ahead of the offshore wind farms secured in ScotWind in a bid to help domestic companies ready for future renewables work.

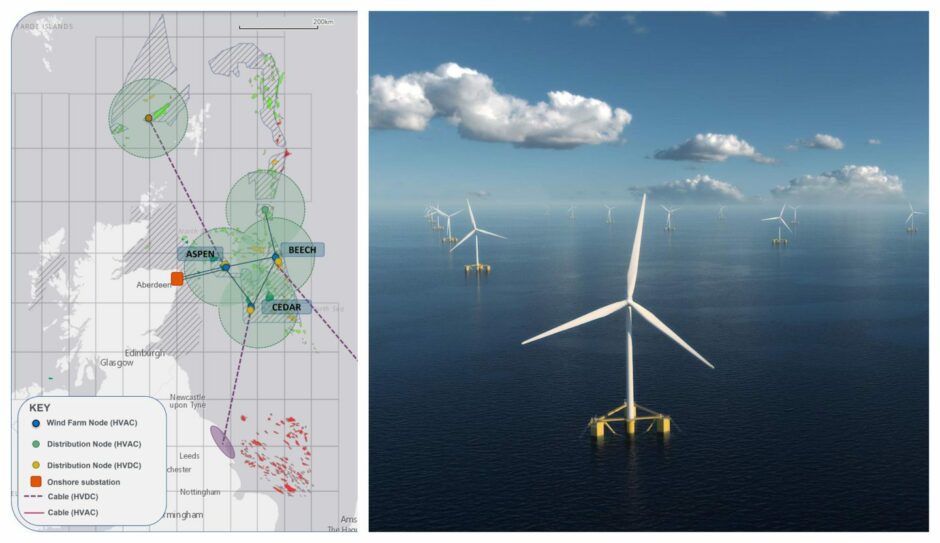

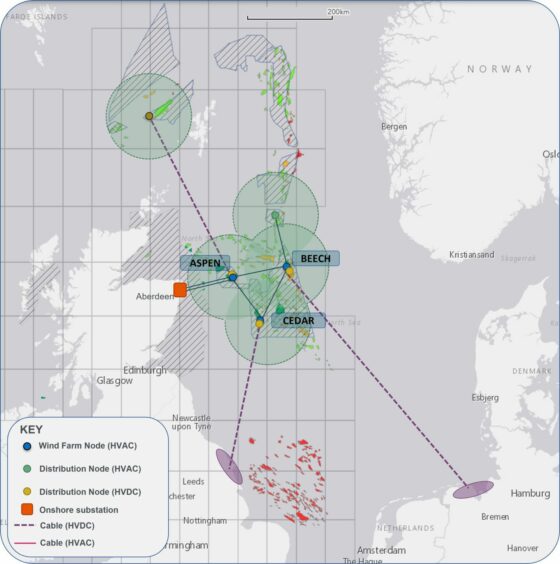

The NSRG will be comprised of three 130 square mile sites, each containing hundreds of floating wind turbines producing multiple gigawatts (GW) of green energy.

Once operational, oil and gas platforms will be able to hook into the system, giving them access to the clean power needed to hit the North Sea Transition Deal target for a net zero basin by 2050.

Dan Jackson, founding director of Cerulean, said: “The oil and gas sector is wrestling with the challenges of meeting the North Sea Transition Deal emissions reduction targets whilst supporting UK energy security. We recognise that to achieve meaningful reductions at the pace required, a reliable basin-wide approach is needed that they can plug into when they are ready to for affordable power.

“Early oil and gas electrification supports the country’s energy security, net zero action and delivers huge benefits to the supply chain and economy, creating 10,000 jobs. With our partners we will accelerate access to green power and provide the infrastructure for the next phase of the North Sea’s life.”

INTOG bearing fruit

Proposals for the NSRG come just weeks after the results of the Innovation and Targeted Oil and Gas (INTOG) offshore wind leasing round were announced.

Orchestrated by Crown Estate Scotland and similar in design to ScotWind, the process attracted bids from 19 companies and raised £261 million.

Cerulean, alongside partner Frontier Power International, bagged the lion’s share of the INTOG seabed leases, while there were also successes for Harbour Energy (LON: HBR), TotalEnergies (PARIS: TTE) and Flotation Energy.

Net zero barrels of North Sea oil

Phase one of the NSRG will focus on oil and gas firms to support their brownfield modifications, with future phases exporting green power to the grids in England and Europe.

It is understood that as part of the bid process, the London-headquartered company secured several letters of intent from operators.

Now the work begins in earnest to get oil and gas firms locked in, with plans to offer flexible, standardised power purchase agreements (PPAs).

With the system spanning across the Central North Sea, operators will then be able to plug platforms into the renewables grid as and when they are ready.

In doing so they will be able to remove millions of tonnes of production emissions by trading gas and diesel generation for clean power.

Cerulean has drafted in a number of heavy hitters to help deliver the NSRG, including NOV, Siemens Gamesa, Siemens Energy, DEME and Worley.

Mr Jackson added: “We are targeting a build out before ScotWind developments, allowing the supply chain to respond, creating crucial partnering opportunities for the ports and getting the market ready to deliver floating wind at scale. It will make a material impact on Scotland’s emissions, removing millions of tonnes of CO2 a year to support a just transition. Basin-wide scale gives greater flexibility, lower pricing and supply robustness. Work with end users has begun in earnest so that we can aim for first power availability in 2028.”

Stumping up the cash

Mark Dixon, Cerulean’s other co-founder, said previously that each of the three sites will be funded via a special purpose vehicle (SPV), owned by Cerulean Winds and institutional investors, covering 30% of the capital needed.

The rest of the cash would come from the infrastructure debt market, and there has been engagement with investment banks Societe Generale and Piper Sandler.

Cerulean says it has already agreed an approach with industrial partners to de-risk the project, “in the same way other large scale infrastructure developments are initiated”.

In total, the company claims the North Sea Renewables Grid will add over £12bn to the UK economy.

Humza Malik, founding partner of Frontier Power, said: “Each windfarm site is located within 100km of the others and will be connected together to form the offshore ring main around the Central North Sea. A High Voltage Alternating Current (HVAC) transmission will provide availability and redundancy for maximising generation uptime. The scale allows for offtake to other parts of the North Sea through a new High Voltage Direct Current (HDVC) network. For the oil and gas companies, this diversity of offtake provides robustness to the scheme and added flexibility. For Scotland, the HVDC transmission not only provides clean energy to the National Grid, but provides export of power directly to continental Europe.”

Recommended for you

© Supplied by Cerulean Winds

© Supplied by Cerulean Winds © Supplied by NOV

© Supplied by NOV © Supplied by Cerulean Winds

© Supplied by Cerulean Winds