There is “quite a lot of scepticism in the developer community” for the UK’s plans around the Contracts for Difference (CfD) auction, a leading firm has warned.

RWE, the largest electricity generator in the UK and a growing offshore wind player, said companies are still to be sold on UK Government plans to change the auction in 2025 with the introduction of “Sustainable Industry Awards”.

The “SIRs”, to be introduced in Allocation Round 7 (AR7), are to be a “top-up fund” over and above the CfD, rewarding supply chain considerations like carbon footprint and investment in manufacturing in deprived areas.

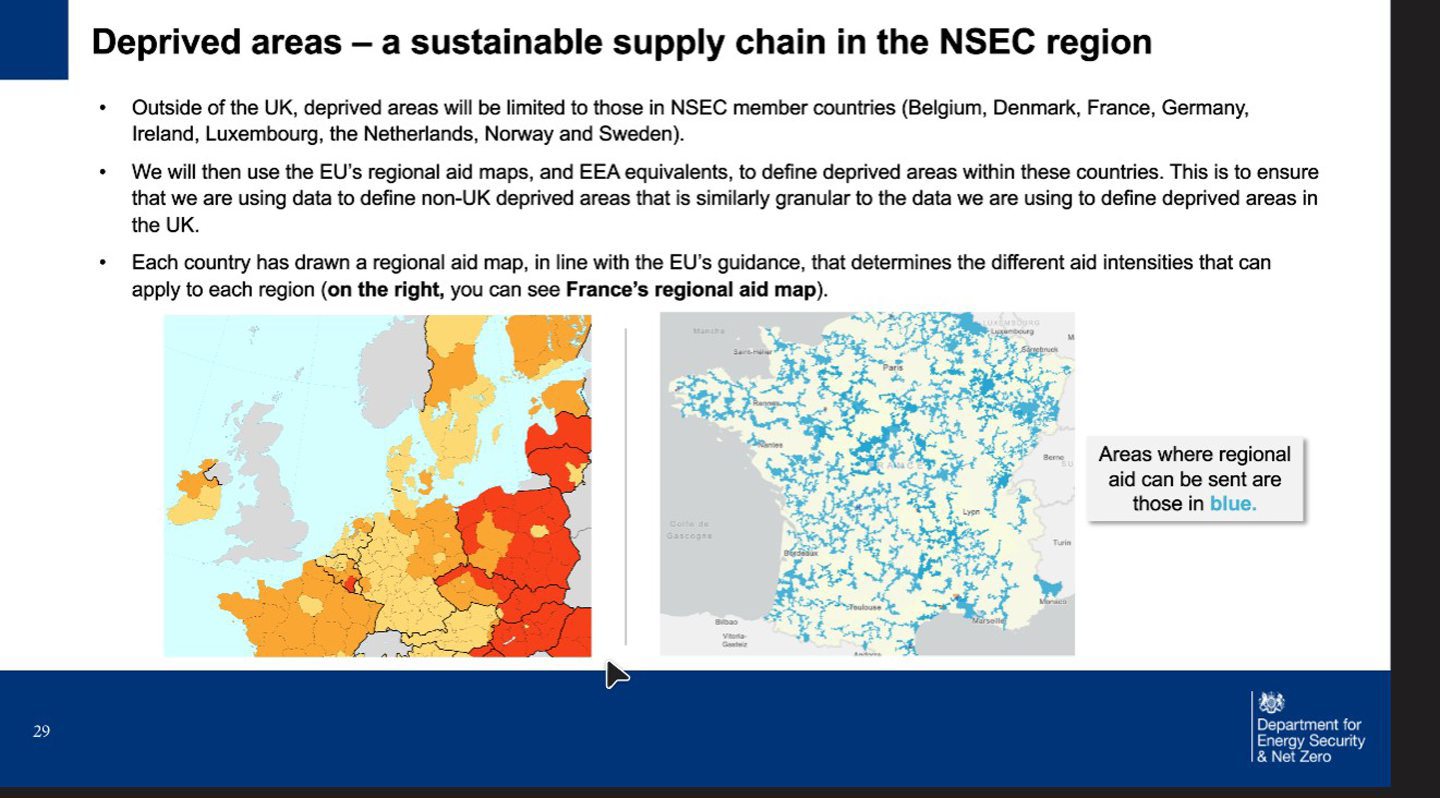

These will not only focus on the UK but North Seas Energy Cooperation countries in the European Union like Belgium, Denmark and Germany.

RWE, a German firm with 2,600 UK employees, told an industry event last month it supports moves to help the supply chain but SIRs could introduce “unwelcome complexity and risk”.

Senior regulatory affairs manager James Brabben said: “I think it’s fair to say there is quite a lot of scepticism in the developer community about these rewards at the moment, mainly because we’re still in a period of heightened supply chain volatility and constraints globally, not just in the UK. And introducing a measure like this, which hasn’t been done in other markets, does come with risks.”

‘Individual CfD projects are not going to catalyse new factories’

Mr Brabben said the “patchwork” nature of support could be more coherent outside of the CfD scheme.

“We’re also wanting to see a bit more detail on the wider strategic support. So we’re all for supporting the supply chain in the UK, and we have done in the past with many of our projects – the key for us is turning the patchwork, as it is at the moment, of different initiative schemes and grant programmes into something which is more of a strategic supply chain support programme alongside the CfD.

“(The CfD) is the key tool to get developers building and then integrating with the supply chain. However there has to be I think a realisation that ultimately individual CfD projects are not going to catalyse new factories and new manufacturing facilities – we need a joined-up approach to do that.”

Earlier on, the Westminster Energy Forum event heard from the Department for Energy Security and Net Zero (DESNZ) which set out the many and various renewable electricity announcements in the Autumn Budget.

That included issues like the £960m green industries growth accelerator, the Electricity Generators Levy, permanent full expensing for plant and machinery, reforms to the grid connection process, investment powers for the Crown Estate and further planning reforms for energy infrastructure.

SIRs to avoid ‘race to the bottom’

Helena Charlton, who leads the CfD auction at DESNZ, told the event that the SIRs in the auction aim to address criticisms that price-only considerations can cause a “race to the bottom and make it hard to secure a sustainable supply chain”.

These will support supply chains “across Europe” rather than just in the UK; the scale of UK ambitions means neighbouring countries and their capabilities will be required.

“As many of you will know, we’re not allowed to promote local content through the CfD, that’s against our international trading rules and the rules of trading with the European Union, and it’s in our interest to have a sustainable supply chain across the European region.

“Therefore in our consultation, we’ve looked at those rewards for investment being across the North Sea energy cooperation region in deprived areas. We think it will be beneficial to having a resilient supply chain.”

Future of the CfD

Mr Brabben of RWE, also criticised a lack of long-term clarity on the CfD going forward as developers are “auctioning in the dark”.

He pointed out that the full parameters of the next round, AR6 this year, are not yet known – never mind AR7, AR8 or AR9.

“The UK is a bit of an outlier in that regard of not having a long-term schedule – certainly from RWE’s point of view and the markets we work in.

“We think it would be for the benefit of the sector to have a long-term auction schedule for the CfD that outlines how much could be procured each round, what the maximum prices might be for each round, and what the ambitions are for each round.

“Really aligned, hopefully, to our 2030 ambitions and/ or carbon budgets to make it more aligned, which sets out a pathway for the sector to 2030 – I would say to 2035 and beyond.

“We know that offshore wind is in the consumer interest, so setting out a pathway to get us to maximising that build, we think, would be very very helpful.”

Earlier in the session DESNZ set out some detail on the future direction of the CfD round in broad terms.

- Ms Charlton said AR6 – this year – will focus on investibility and securing investor confidence in the wake of 2023’s dismal AR5 which secured no offshore wind bids.

- AR7 with the Sustainable Industry Awards (SIRs) “will be about the wider integrated system benefits that we need to be thinking of, so facilitating co-location of flexibility services such as battery storage or hydrogen electrolysers on the CfD sites”.

- This round will also include consulting on expanding the eligibility of the scheme for projects seeking to “repower” older, used sites, and supporting projects which coordinate their offshore infrastructure to reduce the onshore impact on local communities.

- AR8+ “moves us into the Review of Electricity Market Arrangements (REMA) type horizon,” said Ms Charlton, referring to the government’s major overhaul of the British electricity market.

As far as CfDs go, that’s more likely to impact AR9 than AR8, she added.

Some key challenges DESNZ is looking at include the “highly correlated nature of renewables” which will push prices very low in windy periods, and how to ensure CfD generators “behave in ways that are best for the overall system”.

Recommended for you