Static wind turbines in the Highlands cost consumers nearly £68 million in 2023.

They accounted for more than one-quarter of all Scottish wind farms receiving “constraint” payments for zero energy output, new figures show.

According to the Renewable Energy Foundation (REF), a lion’s share of such payments to UK wind energy suppliers found its way north of the border last year.

Of the £307.2m total for the whole of Britain, the National Grid Electricity System Operator (National Grid ESO) paid a record £275.3m to a total of 86 Scottish generators.

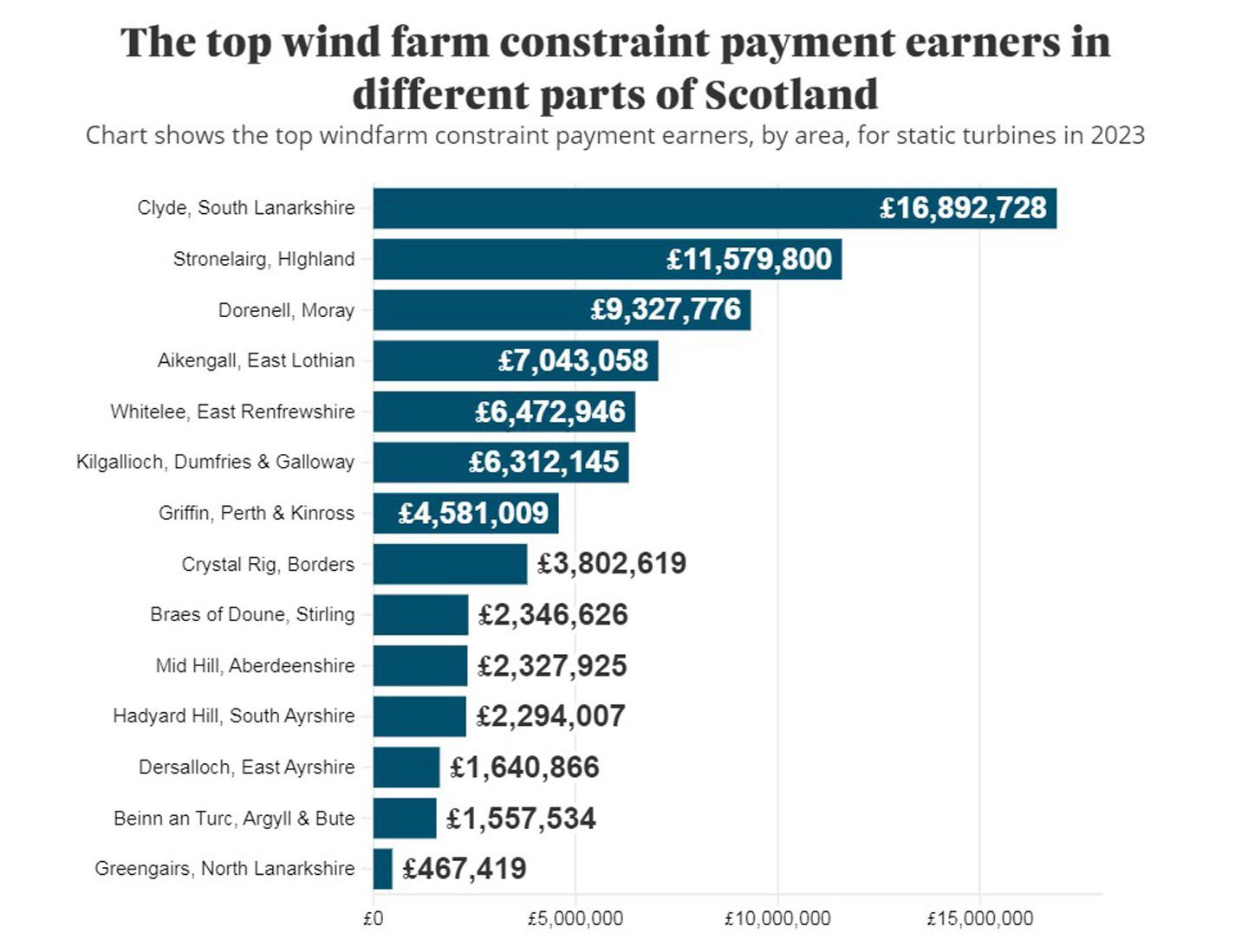

The Highlands led the pay-out league in terms of wind farm numbers, with 22 sites across the region getting payments totalling £67.8m.

Top of the constraint payments league table in the area is SSE Renewables’ 66-turbine Stronelairg wind farm, near Fort Augustus, which received nearly £11.6m.

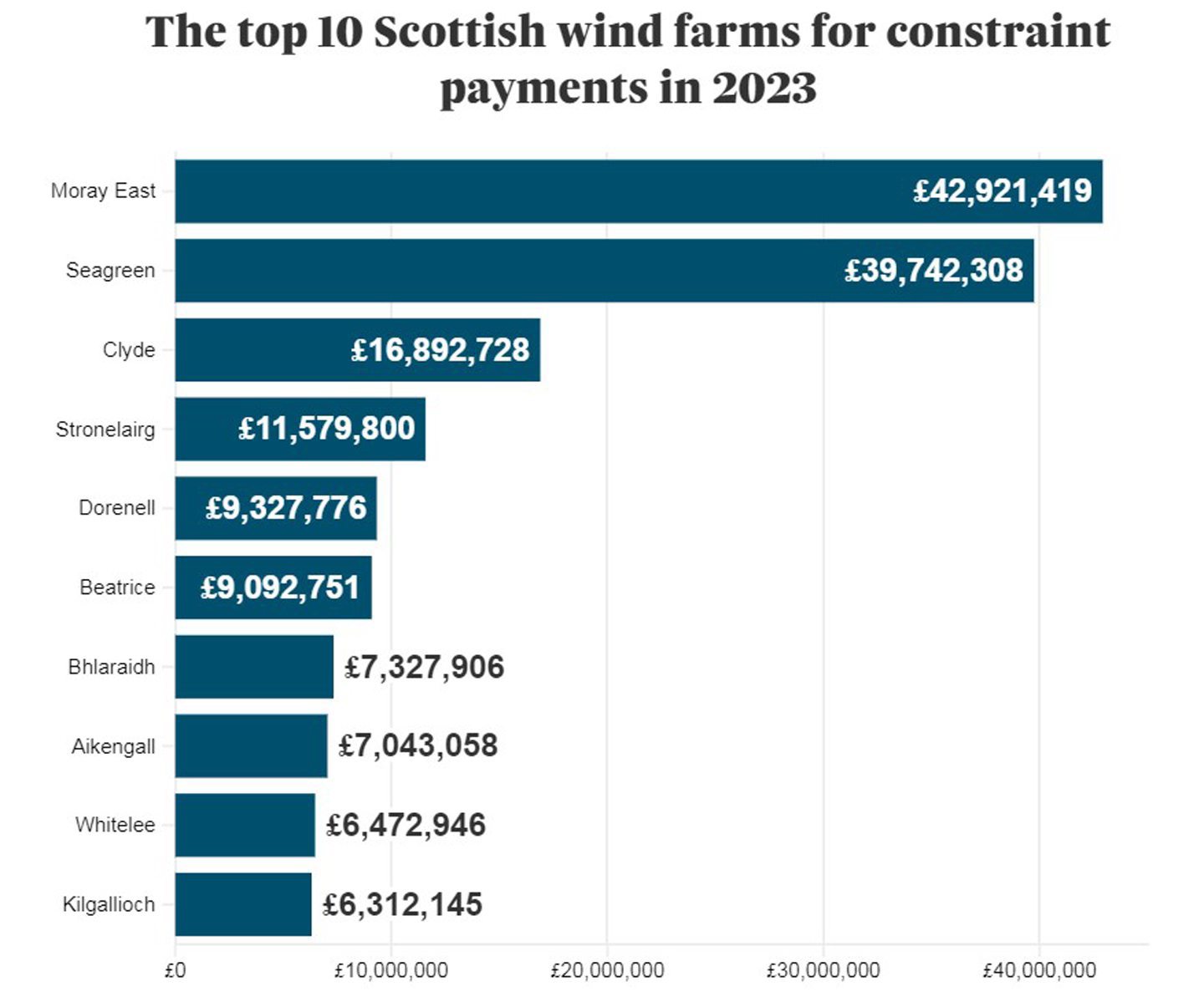

But the two biggest earners in Scotland were both offshore.

Moray East wind farm, a 100-turbine development in the Cromarty Firth, received nearly £43m for machines delivering no energy.

And the 114-turbine Seagreen scheme off the coast of Angus earned constraint payments totalling nearly £40m.

An onshore wind farm, Clyde, near Abington in South Lanarkshire, comes in third at nearly £16.9m.

Stronelairg raked in the fourth highest total last year.

Meanwhile, Dorenell, in Moray, and offshore development Beatrice earned £9.3m and £9.1m respectively.

Other multi-million-pound earners include Griffin, near Aberfeldy, Perthshire, which received nearly £4.6m.

Mid Hill, a 33-turbine development in Fetteresso Forest south-west of Aberdeen, was paid £2.3m.

Argyll and Bute wind farms Beinn an Turc and Carraig Gheal earned nearly £1.6m and about £1.3m respectively.

Wind farms are entitled to constraint payments whenever they are asked to reduce output due to electricity grid congestion or high winds.

The electricity cannot be stored and demand for it fluctuates.

Ultimately, households end up paying for constraint payments though “network costs”.

‘Scandal’

REF has called the system a “national scandal”.

More than a year ago the sustainable development-focused charity estimated the cost to UK consumers since constraint payments started in 2010 to be “well over” £1 billion.

And with many new wind farms planned onshore and in the North Sea, network bottlenecks are likely to get worse.

Unsurprisingly, anti-wind farm campaigners are aghast about the huge sums of money being paid for turbines deliberately left idle.

Graham Lang, of pressure group Scotland Against Spin, said: “It has been known for some years that the Scottish Government has been consenting onshore wind farms far beyond local demand for electricity.

“The latest data shows Scotland has 15.3 gigawatts (GW) of operational, under construction and consented wind farms. There’s another 7.5GW currently seeking consent – total 22.8GW – yet Scotland only consumes on average 3.6GW of electricity.”

Excess power is sent to other parts of the UK but the transmission network lacks capacity.

Mr Lang added: “Wind farms have to be turned off, resulting in constraint payments.

“More than a quarter of wind farms in receipt of those payments are in the Highlands. Areas with low demand and weak grid connectivity can encourage operators to take advantage of constraint payments by constructing more wind farms.

“It is the consumer who is paying for constraint payments via higher electricity prices.

“The latest estimate is that it is costing every homeowner £40 per year to turn off wind farms in Scotland.

“It is a ridiculous waste of money. It makes no sense at all for the Scottish Government to keep awarding consent for more wind farms.”

According to Mr Lang, wind farm operators can also save cash by hitting the off switch.

He continued: “They need less maintenance and repair if they’re not turning and idle.

“Maintenance is very costly. Better to get paid for doing nothing.”

“Constrained” wind farm operators may also continue to sell energy to the National Grid via battery energy storage systems, Mr Lang said.

He added: “It is a bloated subsidy system, being farmed by developers and operators.”

‘We can fix this’, says SSE

SSE Renewables is one of the partners behind the giant Seagreen development, Scotland’s largest offshore wind farm.

A spokesman for its parent company, Perth-based SSE, said: “Constraint payments are made when the energy being produced in one part of the country can’t get to another because there simply isn’t the capacity to carry it.

“We can fix this with policies that speed up investment in electricity networks and energy storage technologies, such as pumped hydro storage, so we can get the most out of our enviable renewable resources.

“SSE has one of the biggest investment programmes this country has ever seen, building the electricity infrastructure the country needs to boost energy security, tackle climate change and create good sustainable jobs.

“The key now is to ensure this investment is brought forward as quickly as possible.”

Moray East offshore wind farm operator Ocean Winds, a joint venture between Spanish firm EDP Renewables and France’s Engie, did not respond to our requests for comment.

Electricity system operator insists it is ‘keeping costs as low as possible’

A spokesman for National Grid ESO said the UK’s electricity system operator keeps power flowing to homes and businesses “in the most cost-effective way for the consumer, keeping costs as low as possible”.

He added: “Like many system operators across the world, we make constraint payments when it is more cost-effective to temporarily reduce wind output, for example, than build expensive new network infrastructure that would add more money to everyone’s energy bills.

“We are exploring a range of options both at a national and regional level to reduce network constraints.”

Recommended for you

© Supplied by Renewable Energy Fou

© Supplied by Renewable Energy Fou © Supplied by -

© Supplied by - © Image: SSE Renewables

© Image: SSE Renewables © Supplied by -

© Supplied by - © Supplied by -

© Supplied by -