Plans for investment in offshore wind have been dealt a number of blows but this offers a “silver lining” to the industry, an analyst has highlighted at a conference in Aberdeen.

Petra Manuel, senior analyst and product manager for offshore wind at research firm Rystad provided the firm’s latest analysis on the sector at the opening session at Subsea Expo.

“We are going through uncertain times, both in oil and gas but also in renewables and power, especially in the offshore wind sector,” he said.

However delays in offshore wind projects could be a “silver lining” for the industry as the market will act as a form of “natural selection”.

“This will push out some projects that are not ready yet and that will help the supply bottleneck for components in the market.”

In a presentation focused on the synergies between offshore wind and the oil gas industry, particularly the supply chain, he highlighted positive investment trends.

“We are seeing the tally of total installed capacity can reach more that 430 GW by 2035. Yes, we have heard some negative news that a couple of companies, developers, are scaling back their investment – they want to focus on oil and gas.

“That is quite understandable because at the moment we are still seeing a high inflationary impact on the overall market and this increases the cost of components including turbines, foundations, and cables where we saw copper surging in price.”

But he added the offshore wind industry was still on track for a “huge increase in the years to come”.

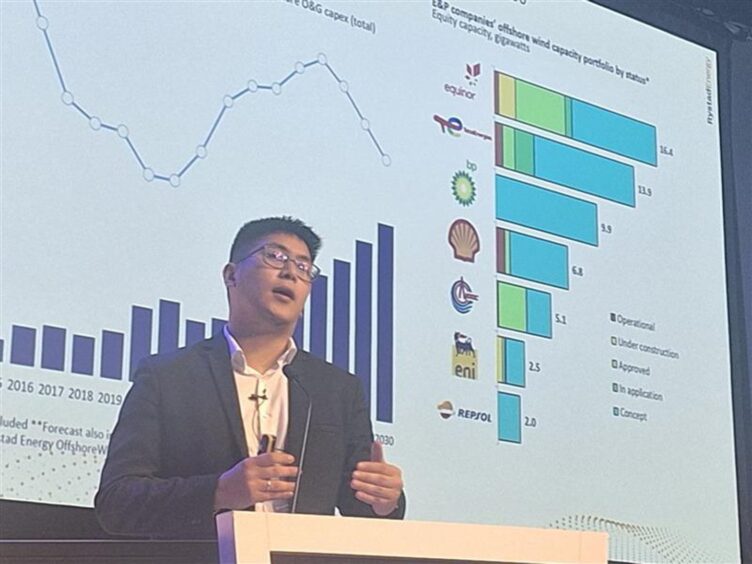

He said Rystad predicts capital expenditure (capex) on the sector will rise from $16 billion (£12.7bn) in 2024 to $74bn in by 2030.

Rystad, whose clients include a range of energy providers, investors, lenders and other customers, said oil and gas firms would still have “sizeable” offshore wind capacity despite “shifting a little bit”.

Firms including Norway’s Equinor have confirmed plans to scale back investment in offshore wind although Rystad expects it will remain the front runner, with 16.4 GW in its current portfolio of offshore wind production capacity.

French firm TotalEnergies is second, with an estimated 13.9 GW portfolio.

BP is third with 9.9 GW after the firm announced plans to carve out its offshore wind assets as part of a joint venture with Japan’s largest power generation company Jera. The venture, JERA Nex bp, is expected to be one of the top five offshore wind developers in the world by capacity.

“Equinor, BP, Shell are shifting a little bit their strategies from offshore wind – or renewables in general – to oil and gas to boost production concerning a reduction in profits.

“This is still a sizeable portfolio and we do expect they will still continue to invest where there is a clear path to profit.”

The firm said installed global offshore wind capacity reached almost 79 GW in 2024 and that it expects this to grow to 220 GW by 2030.

China will be the leader in this race with 47 GW, with UK coming in second at 16 GW, with Germany third at 8 GW.

However this falls far short of current UK targets which aims to deliver 50 GW of wind, including 5 GW from floating wind.

Recommended for you

© Erikka Askeland/DCT Media

© Erikka Askeland/DCT Media