There are concerns that the rest of the world could again reap the lion’s share of the benefits from Scotland’s renewables boom.

A senior trade union figure says “no one should have optimism” that the next generation of offshore wind farms in Scottish waters will deliver thousands of desperately sought green jobs.

Crown Estate Scotland has published supply chain development statement (SCDS) outlooks for each of the 17 projects that emerged as winners in the recent ScotWind leasing round.

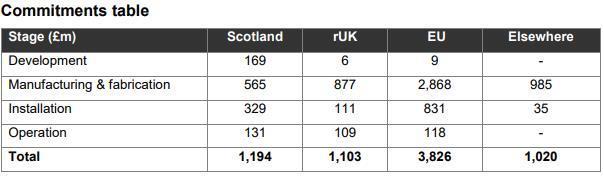

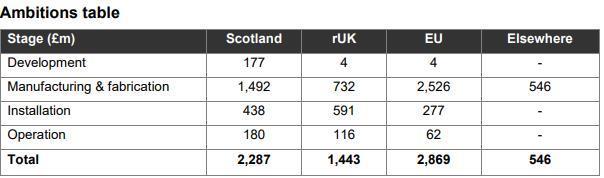

Developers, including Shell, SSE Renewables and ScottishPower Renewables, have made a host of spending pledges that, if delivered upon, will mean billions of pounds for Scotland.

On average, each scheme will spend just shy of £1.5bn north of the border – the rest of the UK is also in line for a significant windfall.

There are some developers though that could end up spending more overseas than in the UK.

Based on their commitments, the likes of BP, TotalEnergies, Vattenfall, Deme Group and Northland Power have all committed to investing larger sums in Europe and the rest of the world than domestically.

Local content

To date the vast majority of work for the offshore wind farms operating off the coast of Scotland has gone overseas, a long running bugbear for unions.

It is hoped that ScotWind will deliver a step change in that regard, providing decades of work for the local supply chain.

The SCDS outlooks are expected to go a long way towards delivering that as companies set out where they intend to splash the cash.

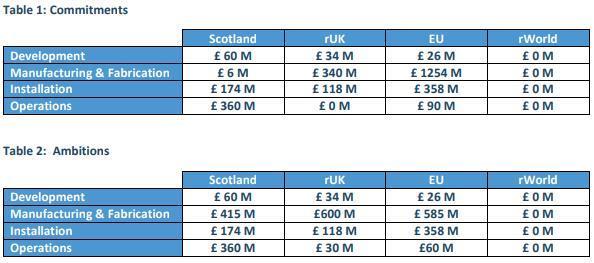

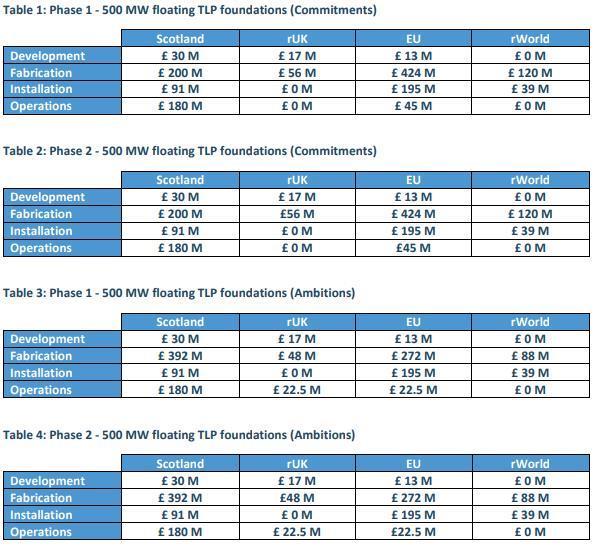

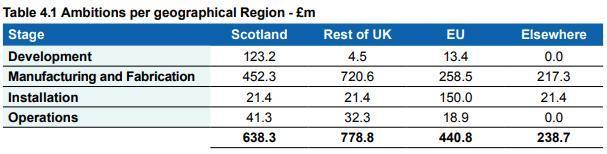

Pledges are split into commitments, the minimum that developers have earmarked to fork out, and ambitions, what they will spend in the best-case scenario.

For most projects, the majority of the committed spend will be in the UK, as is the case for all of the scheme’s ambition statements.

‘Scotland for sale’

But with some notable exceptions to the rule, it has reignited union fears that history could be away to repeat itself.

GMB Scotland senior organiser Gary Cook said: “No one should have optimism that the next generation of Scotland’s renewables manufacturing story will be any different to the broken promises of the last decade.

“A scan of the successful ScotWind bidders and their plans shows familiar international players from the spaghetti bowl of renewables and marine construction firms that have profited handsomely from our bill-payer subsidised offshore wind industry, while exporting tens of thousands of green jobs to the rest of the world at the expense of Scottish working-class communities.

“It’s business as usual for our offshore wind sector, “Scotland for sale” – and government ministers know it.”

Fabrication constraints

In each case, the majority of the cash that is going overseas is wrapped up in fabrication and manufacturing.

A lot of the success of ScotWind is being pinned on Scotland’s supply chains ability to get up to speed in the next few years.

As it stands a lack of suitable yards and manufacturing capabilities means there is only limited scope for assembling of fabricating wind turbines in Scotland.

There are several initiatives hoping to change that though, and ports around Scotland’s coastline are working to make themselves ready for the upcoming boom.

And many developers will be hoping to use the new facilities to help deliver the spending levels they have set an ambition to hit.

Alix Thom, workforce engagement and skills manager at Offshore Energies UK, said: “Scotwind and future offshore energy projects must secure jobs for local people, as well as supporting the UK’s net zero objective and energy security.

“The North Sea Transition Deal we signed with the UK Government last year sets a target of at least 50% local content and this year we’ll be publishing a roadmap which will give UK supply chain companies visibility of upcoming projects they can potentially benefit from.

“We also need governments to work together to ensure that this new investment into domestic energy creates domestic jobs and supports the local economy, rather than seeing the benefits go overseas.”

BP & EnBW

BP & EnBW – a 2,907 megawatt (MW) fixed bottom offshore wind farm.

UK spending commitments – £2,297bn

Overseas spending commitments – £4,846bn

UK Spending ambitions – £3,730bn

Overseas spending ambitions – £3,415bn

Richard Haydock, project director, offshore wind, BP, said: “BP has a long track record of investing in Scotland and building successful supply chains. With our partner EnBW, our ScotWind supply chain development statement affirms our continued commitment to Scotland with at least £1.2bn of spend, investing in Scottish ports, shipbuilding and skills, creating an estimated 1,000 direct and indirect jobs. Our ambition is to go further than this and that’s why we’re engaging with the Scottish supply chain, education providers and the community to support Scotland’s just transition.”

In their SCDS outlook, the pair also said: “Our project will trigger combined investment of up to £10bn into offshore wind– directed to the safe delivery of our project, boosting the supply chain and infrastructure, plus additional benefits for people and communities, enhancing skills and education, driving research and innovation, and promoting sustainability initiatives.”

Vattenfall & Fred. Olsen Renewables

Vattenfall and Fred. Olsen Renewables – Mara Mhór – a 798MW floating offshore wind farm

UK spending commitments – £667 million

Overseas spending commitments – £1,429bn

UK spending ambitions- £1,416bn

Overseas spending ambitions – £680m

A spokesperson for the Mara Mhór offshore wind farm project said: “Renewable energy will make a huge contribution to Scotland’s economy and it’s absolutely right that offshore wind projects are one of the catalysts to build up the supply chain here.

“With the substantial pipeline of projects in Scotland, ensuring the right investment and a coordinated effort from developers, government and industry is vital. This will support the Scottish supply chain to go from strength to strength.

“Vattenfall and Fred. Olsen have the track record in Scotland to understand what is needed to drive forward their Scottish supply chain ambitions for the Mara Mhór project. Our experience will help to enable the development of a world class floating wind supply chain which supports long term, sustainable job creation.”

DEME Group, Qair & Aspiravi

DEME Group, Qair & Aspiravi – a 1,008MW fixed bottom wind farm and a 1,008 floating offshore wind farm.

Cluaran Deas Ear – Fixed

UK spending commitment – £1,092bn

Overseas spending commitment – £1,728bn

UK spending ambition – £1,791bn

Overseas spending ambition – £1,029bn

Cluaran Ear Thuath – Floating

UK spending commitment – £1,148bn

Overseas spending commitment – £1,672bn

UK spending ambition – £1,561bn

Overseas spending ambition – £1,259bn

DEME Group has been contacted for comment

Offshore Wind Power

Offshore Wind Power (TotalEnergies, Green Investment Group, Renewable Infrastructure Development Group) – the West of Orkney Wind Farm – a 2,000MW fixed offshore wind farm.

UK spending commitment – £1,661bn

Overseas spending commitment – £2,368bn

UK spending ambition – £2,318bn

Overseas spending ambition – £1,711bn

Stephen Kerr, project director of the West of Orkney Windfarm said: “The West of Orkney Windfarm has committed to 60% UK content over the 30-year lifetime of the project, with 40% in Scotland. This would represent a step change in UK supply chain involvement and is significantly more than any offshore wind farm has delivered to date. To achieve this in the timeframe available we have launched a £140 supply chain investment plan to drive activity in Scotland and throughout the UK. With this level of support, combined with increased collaboration across industry, we would hope to exceed our commitments and move towards our supply chain ambitions for the West of Orkney Windfarm.”

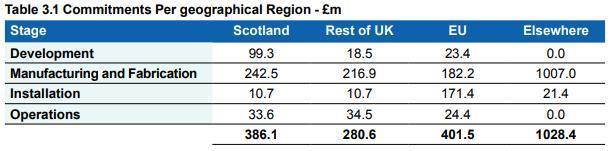

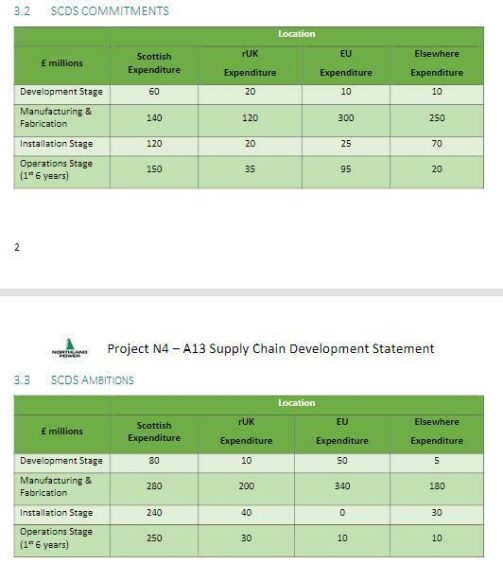

Northland Power

Northland Power will build a pair of offshore wind farms in Scotland after bagging seabed rights for two zones.

Just one of the Canadian company’s developments – a 840MW fixed bottom project – commits to investing more overseas than in the UK, something that is reversed in the ambitions.

UK spending commitment – £665m

Overseas spending commitment – £780m

UK spending ambition – £1,130bn

Overseas spending commitment – £625m

Northland Power has been contacted for comment.

The full picture

Listed below are details of each ScotWind project’s SCDS outlooks, ranked in order of the size of their ambition and commitment – click to zoom in.

Recommended for you

© Image: Peter Macdiarmid/Getty Images

© Image: Peter Macdiarmid/Getty Images © Supplied by Ardersier Port

© Supplied by Ardersier Port

© Supplied by Crown Estate Scotlan

© Supplied by Crown Estate Scotlan © Supplied by Crown Estate Scotlan

© Supplied by Crown Estate Scotlan