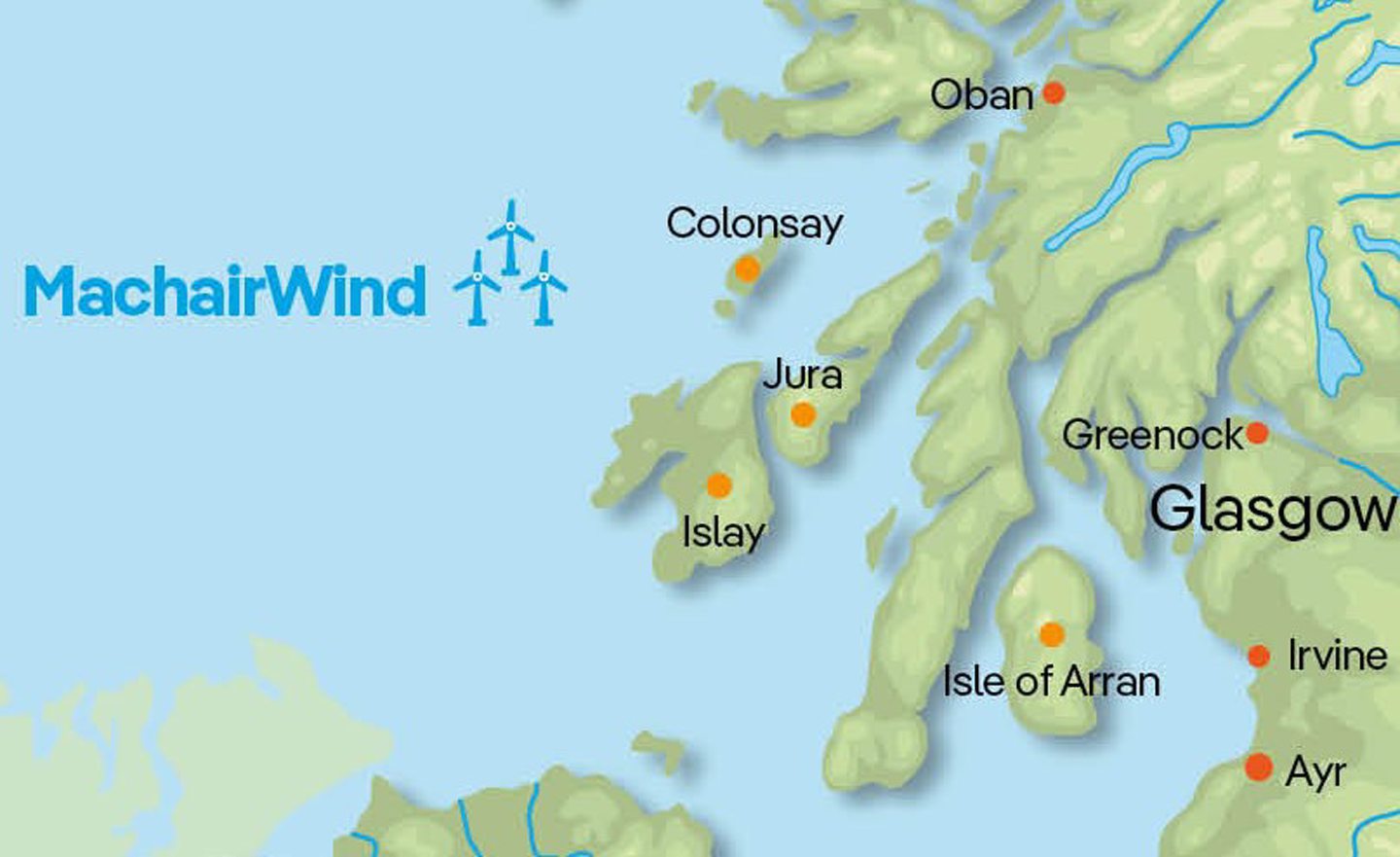

Scottish Power has set out its candidate ports for some big-money spending on its Machair ScotWind project off the west coast.

Nigg in the Cromarty Firth, Arnish on the isle of Lewis and Kishorn, which sits geographically closest to the development, are among eight locations set out in a new economic study for the two giga-watt project across construction and operations and maintenance.

No decision has yet been taken on the facilities, but the potential spend outlined in the BiGGAR Economics study is into tens of millions of pounds.

Nigg, Kishorn, Arnish and Belfast are in the running for the construction port-only.

However other options are being considered – such as a joint construction port and operations and maintenance base, in which case other sites are being looked at.

The report breaks the figures down into spend going locally and jobs being “supported”, as well as other items including costs for port investment and transient workers and the jobs which will be “generated”.

Major ambition for supply chain spend in Scotland

Scottish Power Renewables was awarded rights to the MachairWind project when Crown Estate Scotland granted initial awards in 2022 from the ScotWind auction.

A key pillar to those awards was supply chain and spending commitments from developers.

Scottish Power, which is also partnered with Shell on ScotWind projects in other parts of the county, set out ambitions of nearly £3bn to be spent specifically in Scotland for Machair Wind.

On that basis, Nigg or Clyde Coast offer the most potential for spend and job creation in Scotland for the construction port of those options – though other factors will likely weigh in, such as its relative distance from the project site.

At 2GW MachairWind will generate enough power to cover two million homes across the UK, said Scottish Power.

Construction Port only

In descending order:

-Should Belfast be selected, the equivalent of £116.5m would be spent over the three-year construction phase with potential to support the equivalent of 446 jobs each year of that construction.

Another £1m would be spent on port investment, all going to local contractors which could bring 16 jobs in the area.

A cost of £7.3m is also set out for a required 65 transient workers – estimated to generate 41 jobs in Belfast.

Benefits would include a wide labour market, available housing and being aligned with the region’s economic growth vision and its aim to contribute to reducing emissions.

-For Nigg, the equivalent of more than £105.1m would be spent over three years, which could support 317 jobs each year of construction.

Another £1m would be spent on port investment supporting 11 jobs, of which £0.9m would go to local contractors.

A cost of £12.7m is set out for an estimated 92 transient workers required in port construction, and another £51,000 for two work in port expansion activities. It’s estimated this would create 41 construction jobs in Nigg, and less than one job in the expansion phase.

The report notes that a large travel to work area means the base could draw on a widely populated area for employment and housing needs, with collaboration opportunities with the HIA university and Skills Development Scotland.

-In the case of Arnish, it’s £86.1m, supporting 267 jobs each year of construction.

Another £1m of investment could be made on port investment creating four jobs, £700,000 of which going to local contractors.

Arnish would also have a provision for an estimated 138 transient workers needed, with costs of £18.7m for the construction phase. Another £200,000 of costs will be covered for seven transient workers in port expansion activities.

Overall this is expected to create 61 jobs in development and construction and one job in port expansion.

Jobs would be welcomed locally, the report notes, but availability of the skilled workforce, the capacity for local contractor Harland and Wolff to take on business, and investment in infrastructure such as a deep-water port and housing are all important factors.

-Should Kishorn be selected, it’s £67.2m over three years supporting 158 jobs each year of construction.

Another £1m would be spent on port investment, which could support three jobs in the area and £700,000 would go to local contactors.

A cost of £25.2m is set out for 188 transient workers required for construction, and another £200,000 for seven more needed in port expansion. Overall, this is expected to create one job in port expansion and 80 in development and construction.

The report sets out a housing construction cost for transient workers to live locally at £5.3m- £10m, which in itself could generate 28-54 jobs in Kishorn.

It notes that a “lack of affordable options” for housing in the region generates challenges, but the community is seeking opportunities to attract residents and support housing and infrastructure growth which this could accelerate.

Joint construction port and operations & maintenance base

Scottish Power Renewables is also considering an option for a port responsible for construction as well as operations and maintenance – and other sites are being considered for that case.

-Clyde Coast (Hunterston to Inverkip) has also been considered as a joint construction and O&M site.

For development and construction, £112.6m would go to the local region over a three-year period, supporting 385 jobs.

As an O&M base, £600,000 would be spent per year, whose impacts could generate 71 jobs in the region.

Another £1m is needed for port investment (£0.9m to go locally) which could support 12 jobs.

Meanwhile some 73 transient workers would be needed in development and construction with £10.1m staff costs over thee years, one additional in operation activities needing one transient worker with staff costs of £62,300 and two transient workers with staff costs £51,000.

The report estimates development and construction of transient workers could generate 50 Clyde Coast jobs, while less than one O&M and less than one port expansion transient worker could be created.

The document highlights potential for transferable skills from the closed Hunterston Terminal in 2016, particularly as new port and resource centre is seen as an opportunity for economic growth.

-Campbeltown and Machrihanish is also on the list, in which case £13.6m would be spent on the local supply chain supporting 36 jobs each year on construction.

Meanwhile, in O&M, 62 direct jobs would be generated on the base, with contract spending of £182,000 going to companies in the area each year.

Another £1m would be spent on port investment but just 10% (£100,000) would go to contractors locally. The £1m would support one job in the area.

A cost for transient workers of £42.5m has been set out for an estimated 310 transient workers required. Using “appropriate ratios and multipliers” the impact of this could generate 134 jobs in Campbeltown and Machrihanish in development and construction, less than one job in O&M and one job in port expansion.

Housing for these workers would require £1m to refit the RAF Machrihanish base, while £300,000 of that would go to local suppliers. The spend could support two jobs.

There is “enthusiasm and capacity” among local people to take up job opportunities, the BiGGAR report notes, though “various housing-related issues” have been raised over the location.

Other ports in the running for Scottish Power’s Machair ScotWind project – operations and maintenance base-only

Outside of the construction side, Oban and Islay are in the running for the operations and maintenance base.

-In Oban’s case, £500,000 would be spent per year which could generate 68 jobs in the west coast town.

A further £1m would be spent on port investment, which could support seven jobs, with £600,000 of that to be spent on local contractors.

It estimates two transient workers with costs of £88,000 would be needed for operations, and another four costing £100,000 for port expansion.

This has potential for significant economic potential on Oban, but concerns have been raised around housing, labour market conditions and infrastructure constraints.

-If Islay was selected then the report states £300,000 would be spent each year which could generate 64 jobs.

Another £1m would be spent on port investment which could support two jobs in the area.

It’s estimated three transient workers would be needed for operations, costing £200,000 and generating fewer than one job on Islay each year, and another nine would be needed in port expansion costing £300,000 and generating one job on Islay.

Housing, labour market, infrastructure and visual impacts are among the concerns raised, though this would contribute to long-term community sustainability and job opportunities on Islay.

Making the right call

Responding to the report, ScottishPower Renewables’ Kiera Wilson, MachairWind development lead, said: “While no preferred port locations have been selected for MachairWind’s construction and operations at this very early stage – and there’s a lot more work to be done around this – the BiGGAR Economics study provides valuable insight and analysis that will inform our next steps and help ensure we ultimately make the right decision not just for the project, but for local people and places too.”

Recommended for you

© Supplied by Scottish Power Renew

© Supplied by Scottish Power Renew © Supplied by Harland & Wolff

© Supplied by Harland & Wolff © Supplied by Kishorn Port

© Supplied by Kishorn Port © Supplied by https://ayrshireanda

© Supplied by https://ayrshireanda